New Zealand radiata pine is responsible for 85% of logs “jammed” at Chinese ports, with PF Olsen reporting that more than 3.4 million cubic metres of NZ logs now lie awaiting delivery at China’s mega ports.

Published on Sunday, PF Olsen’s Director of Sales and Marketing, Scott Downs, said that the daily off-take is 60,000 cubic metres per day, a slight increase from China’s Lunar New Year, “which means there are over two months of inventory in China.”

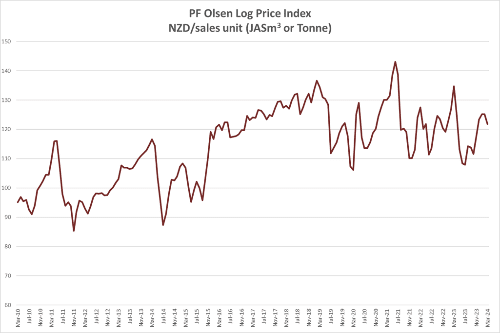

However, Mr Downs said log exporters still don’t understand the relationship between price and the supply curve, confirming that “the sale price for A grade pine logs in China remained stable in February in the 128-132 USD range.”

“But even as supply exceeded demand and inventory was building through March, one exporter was still trying to price A grade at 136 per JASm3 but had to settle for 116 USD per JASm3. Even worse, forest owners didn’t slow supply down.”

The uptake is that given log demand in China is constant, “the only correction to the current situation will be a reduction in log supply.”

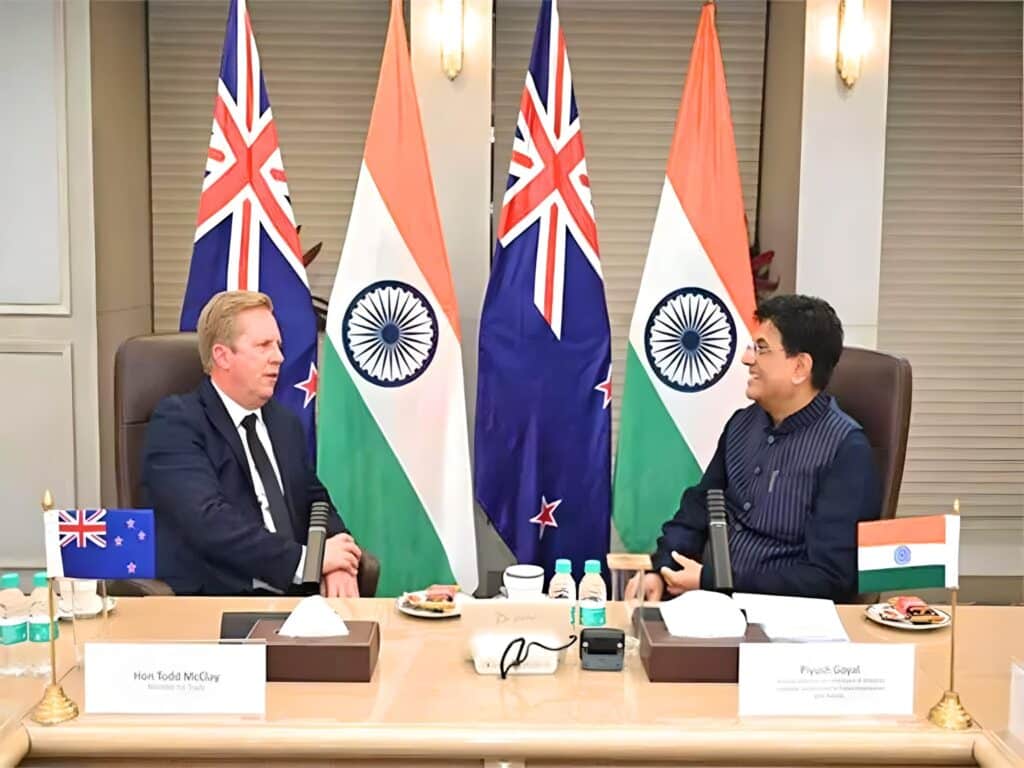

As reported by Wood Central last year, China remains the single most important market for New Zealand’s logs – with more than 89% of raw logs leaving New Zealand for Chinese ports.

Despite New Zealand’s push to reopen trade with India and boost supply to South Korea, China dominates the export market for raw logs, sawn wood, sleeper, and pulp.

Speaking to Wood Central last month, Rudolf van Rensburg, the co-author of China – Forest, Log & Lumber Outlook,” a 197-page report produced by Russ Taylor Global and Margules Groome Consulting, expects that raw logs to China will slowdown in the coming years thanks, amongst many things, to “an anticipated slowdown in NZ harvesting.”

“It’s important to note that China is coming off a softwood lumber demand peak, pre-Covid, that will likely not be matched for a very long time,” according to Mr van Rensburg, who added that “we expect that Chinese lumber exports will grow, offsetting the decline in log exports amid a ban on log exports from Ukraine and Russia, bark beetle infestations in Europe, and an anticipated slowdown in NZ harvesting.”

The latest PF Olsen report also reports worrisome news for the local industry, with a drop in timber demand fuelled by a 28% drop in building covenants over the 12 months to February 2024.

- For more information about the PF Olsen “Log Market” report, visit the PF Olsen website.