Suiters for Altus Renewables will be given until September 15 to prepare bids after one of Australia’s largest timber waste recycling companies entered voluntary administration earlier this month.

The Queensland-based Altus Renewables used pine sawdust from forest plantations to make pellets, supplying the product as a complementary fuel source for power stations.

On Wednesday, the Australian Financial Review reported that debt recoverers FTI Consulting mailed a flyer to prospective buyers. It is inviting offers for the entire company or its assets.

Due diligence is expected to begin on August 30, following the close of expressions of interest on August 29.

After receiving non-binding indicative offers on September 15, FTI Consulting will assess the proposals before setting a timeline for final bids.

FTI Consulting said that its client, the Japanese conglomerate Mitsu & Co, showed no preference for a deed of company arrangement, asset sale or a combination of the two structures.

Wood Central understands Atlus Renewable appointed administrators from McGrathNicol over two weeks ago, leading to Mitsu & Co. calling in the loan.

Atlus Renewables cost squeeze

Last year, Atlus Renewables went to market looking for investment to drive its expansion.

Now, its administrations are looking into why the business fell into trouble.

Despite rising revenues, raw material costs allegedly ate into its profitability creating an input squeeze.

According to the Australian Financial Review, its accounts indicate a raw costs squeeze, showing the company lost $3.48 million in 2022 compared with a profit of $582,000 a year earlier.

Whilst revenues increased by 24% to $14.14 million in the year, its raw materials rose substantially by 43.8% to $5.2 million.

Atlus Renewables accounts blamed “losses and delays in upgrade works at its plant” and “investment spending to expand its Green Triangle Project.”

Foreign exchange rate fluctuation has also been blamed for poor financial performance.

“The upgrade was implemented in stages,” the accounts said, “intended to allow the plant to operate at increasingly higher production levels using the newly installed equipment.”

However, it notes that global shipping delays caused by the pandemic delayed the installation of the fourth pellet press.

This led to the pellet press being delayed several months over the 2021/22 period.

The accounts also noted a net asset deficiency of $1.4 million, and the company auditors flagged in their note “a material uncertainty about the operation continuing to run.”

It said the “continuing support of lenders and increased production to establish sustainable, profitable operations”.

These lenders included Mitus – which provided Atlus Renewables with a $14.5 million loan, $2.1m from Export Finance Australia and National Australia Bank, which the Australian Review reports had a leased facility tapped for $118,000.

Complete U-turn from 2022

Last year, RBC Capital Markets and Gresham talked up its experience, green potential, offtake agreements and proximity to port infrastructure in hopes of bringing in an investor.

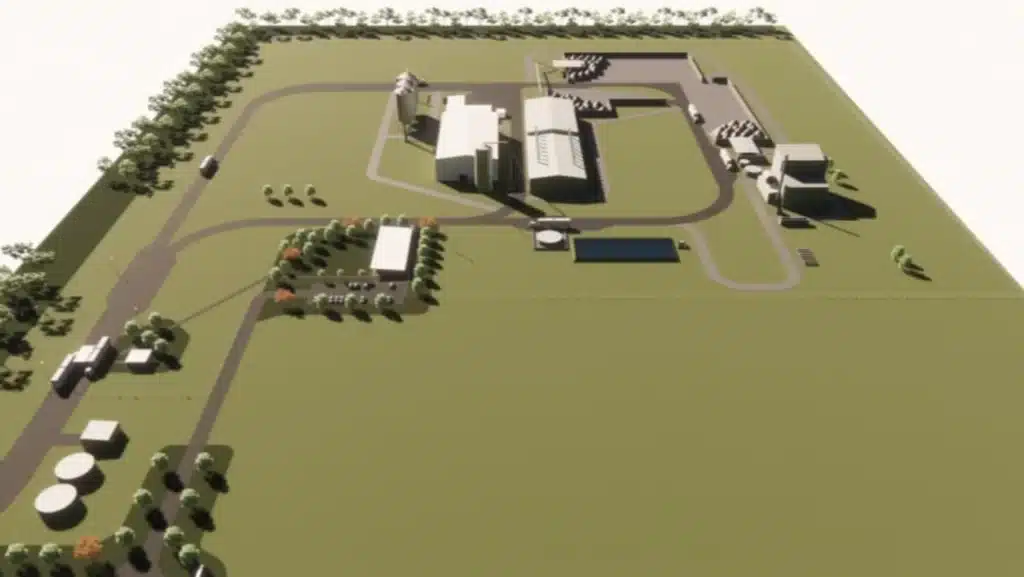

Altus has production facilities close to forestry areas and has strong access to port infrastructure.

Its Tuan Facility has a 125,000 tonnes annual capacity and is running at 90,000 tonnes.

FTI Consulting is confident that it can find a new buyer for the company, noting that the “company is in the third year of a 10-year offtake and has a development site, the Green Triangle Project, near Portland.”