China is ramping up particleboard production, with the world’s engine room churning out huge volumes of wooden panels, leading Chinese manufacturers to commission new plants at rapid speed.

That is, according to Rudolf van Rensburg, the co-author of “China – Forest, Log & Lumber Outlook,” a 197-page report produced by Russ Taylor Global and Margules Groome Consulting, who said that “there is now an increasing risk that the particleboard could overheat.”

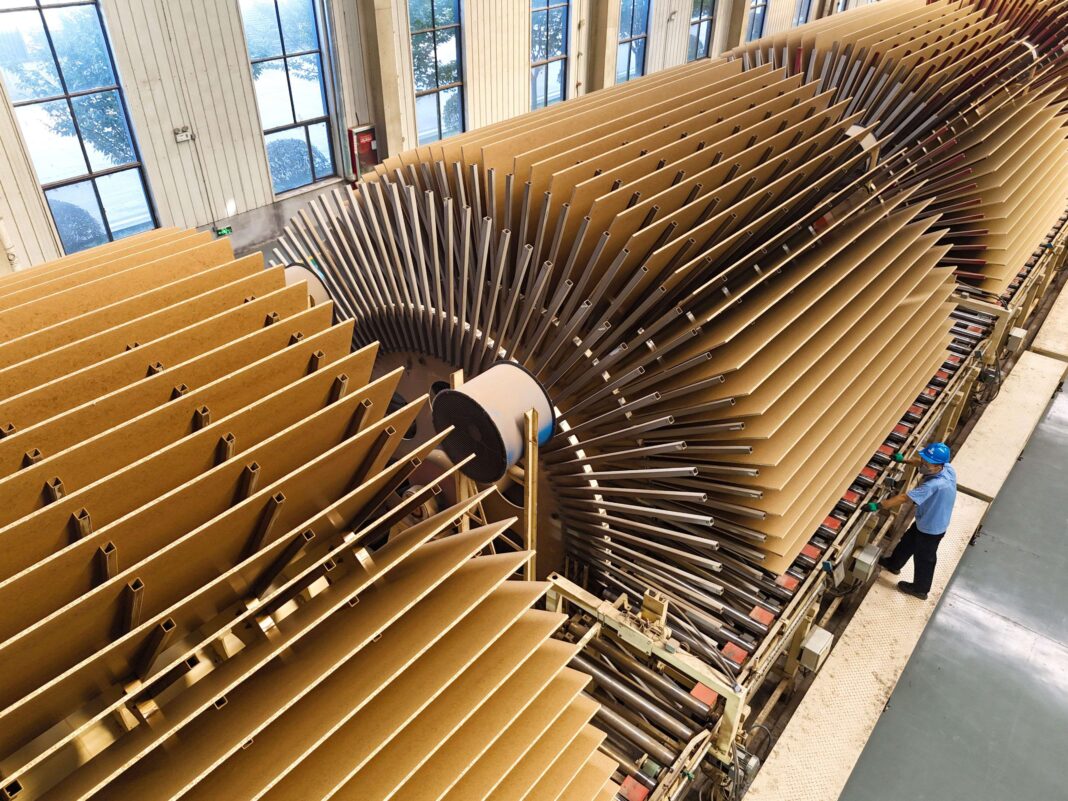

It comes as German-based Siempelkamp, one of the world’s top mass timber equipment companies, is now working with Chinese manufacturers to supply newly commissioned plants with super-strength particleboard lines that can produce up to 600,000 cubic metres per year “to develop the Chinese particleboard industry.”

What is Particleboard?

Particleboard, or chipboard, is a manufactured wood made from compressed wood particles – including wood residues, forest thinnings and wood waste from processing. It is a low-cost and strongly bonded general-purpose board used in various applications, including furniture, cabinetry, flooring and construction, and 50% of all IKEA products.

“From 2022 to 2023, production grew more than 20% year-on-year,” Mr Rensburg told Wood Central, adding that “particleboard supply and consumption is booming across China,” with a significant shift in demand, supply, growth and production of panel-based products in the world’s most important forest economy.

“Particleboard capacity is actually maxed out and has been since Covid,” Mr Rensburg said, “with China quickly adding new plants to keep up with domestic consumption.”

The capacity crunch comes as the Chinese government looks to curb the surge in unsold housing. Officials are moving to bar construction as it looks to shrink a mountain of unsold homes weighing on prices.

Wood Central understands that the restrictions prevent local authorities from selling land usage rights to developers in cities with unsold housing inventories that would take three years or more to clear—a criterion that more than 40% of major cities meet.

Assuming all planned particleboard plants are actually built, China will have enormous additional capacity—but will they have the demand to keep pace with production?

“I guess you’ll need to purchase the report,” Mr van Rensburg said.

The report is available for order for US $5,000.00, with report data tables additionally available for US $700,00. Corporate subscriptions and presentations are also available upon request. See the Margules Groome website for details.