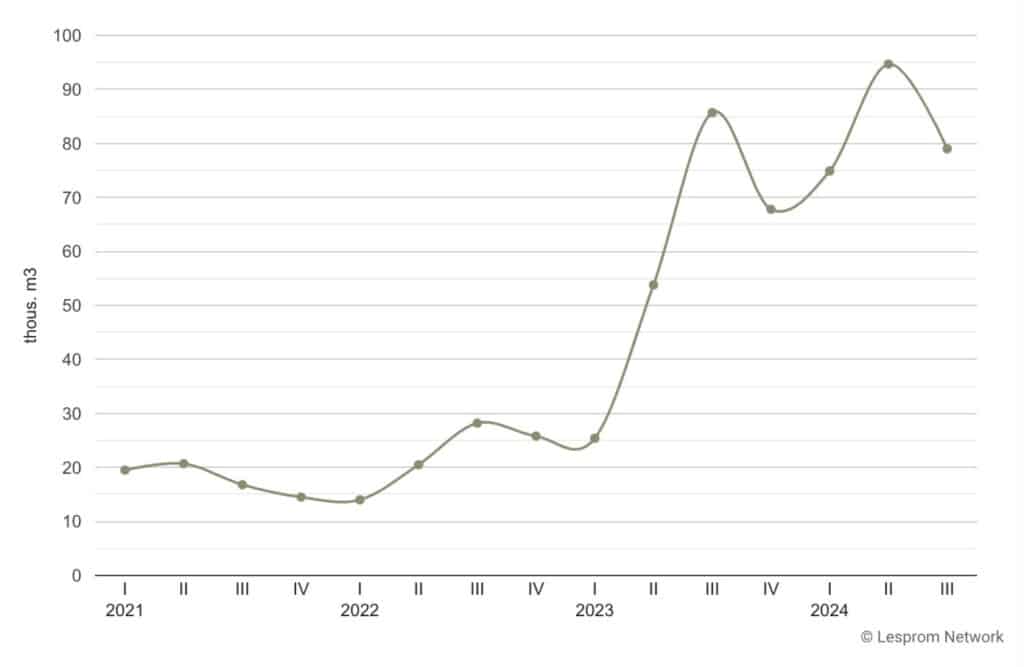

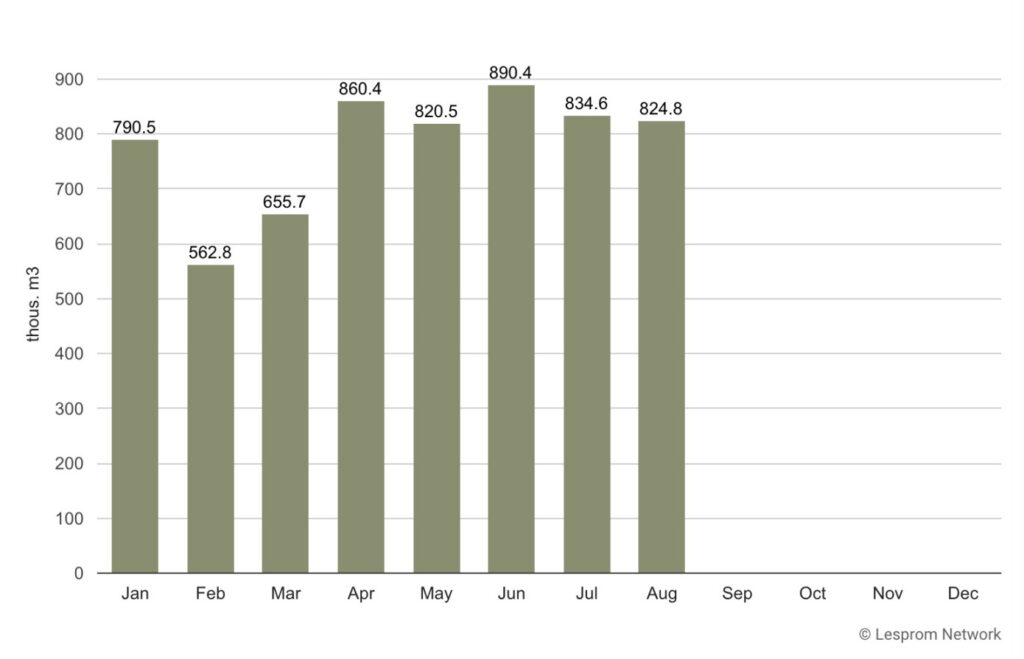

The European Union is cracking down on the sharp increase in Chinese plywood flooding local ports—already up 23% this year for the first eight months of 2024—launching a 14-month anti-dumping investigation into Chinese manufacturers amid growing concerns that Russia is now using China—which has seen trade surge 74% — to circumvent sanctions.

It comes after the European Commission acted on concerns from the Greenwood Consortium—a lobby representing hardwood plywood producers in Poland, Finland, France and the Baltics —alleging that “Chinese imports are sold at artificially low prices, undercutting European producers and violating fair trade rules.”

Wood Central understands that the investigation includes wooden sheets—excluding bamboo and okoumé —with a ply thickness of no more than 6 mm, classified under HS codes 4412 31, 4412 33, and 4412 34. According to the complaint, these contain wood sourced from Russian forests despite the EU embargo on Russian imports.

The complaint alleges that Chinese products are sold far below production costs, thus undercutting producers and distorting the European market. In addition, they argue that Chinese manufacturers benefit from “substantial market distortions,” including state subsidies and interventions that artificially lower production costs: “Distortions include lower prices for raw materials (such as wood), capital, labour, and energy, providing exporters with an unfair advantage,” they said.

Chinese manufacturers are struggling amid rising competition.

As it stands, China is responsible for producing more than 70% of the world’s plywood—including more than 50% of plywood traded into the European common market. However, its global share of production is now in decline amid growing competition, with the United States, Morocco, Turkey, and South Korea leading the world in slapping trade sanctions on Chinese plywood imports.

“From the perspective of international trade, anti-dumping investigations often tend to trigger trade frictions and tensions,” according to Wang Peng, an associate research fellow at the Beijing Academy of Social Sciences. “The EU’s move not only concerns the interests of relevant industries within the bloc but may also impact trade relations between China and Europe,” Mr Peng told the Global Times yesterday.

The era of EU and Chinese engagement is over.

The crackdown comes amid growing tensions over competition between the EU and China. Earlier this year, Wood Central revealed that China was amongst the most vocal opponents of the European Union’s deforestation regulation. A recent 45% tariff imposed on Chinese electric vehicles was met with a retaliatory tariff by China on European whisky.

Speaking to the Financial Times, Alicia García Herrero, a senior fellow at the Bruegel think tank, said the time of “engagement between China and the EU was over, as the two sides now compete in several industries.”

The final decision on whether to impose definitive duties will depend on the outcome of the investigation, which will consider whether these measures serve the overall interests of the EU economy. Interested parties, including importers, EU producers, and trade unions, have been invited to submit evidence to support their positions during the investigation.

- To learn more about the investigation, click here for the updated documentation provided by the European Commission.