At a time when timber demand is surging worldwide, several European countries now face a shortage of timber. New data from the European Forest Industry Database (EUFID) reveals that Germany, Norway, and the Czech Republic all face a shortage in softwood availability crucial for timber production and bioenergy.

That is according to a new study, “Preliminary Evidence of Softwood Shortage and Hardwood Availability in EU Regions,” published by researchers from Wageningen University and the European Commission’s Joint Research Centre. For the first time, the study reveals a major mismatch between wood resources and processing capacity across major European forest producers.

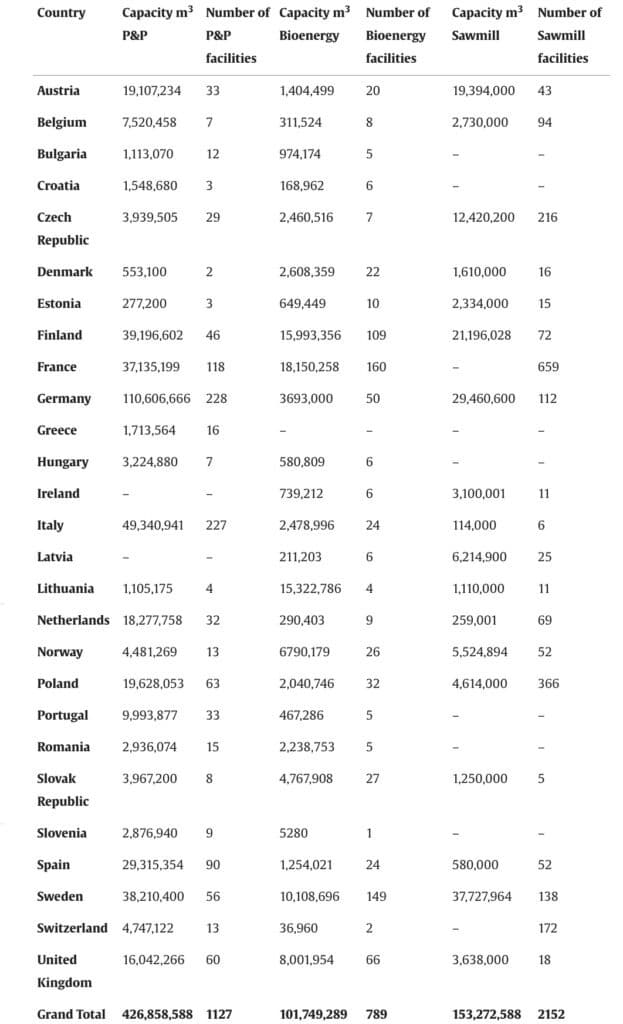

The study, published in the Forest Policy and Economics journal, suggests that while Europe’s pulp and paper, bioenergy, and sawmill plants have enormous capacity (currently 427 million cubic metres for pulp and paper, 102 cubic metres for bioenergy, and 153 cubic metres for sawmilling), the EU lacks the wood supply to process through the actual mills.

“Specifically, the Czech Republic is experiencing a softwood shortage of 3.4 million cubic metres, Norway 1.5 million cubic metres, and Germany 3.8 million cubic metres. Conversely, Germany shows an oversupply of hardwood, estimated at 3 million m3, which researchers suggest could support an expansion in hardwood processing operations.”

Regional wood supply gaps

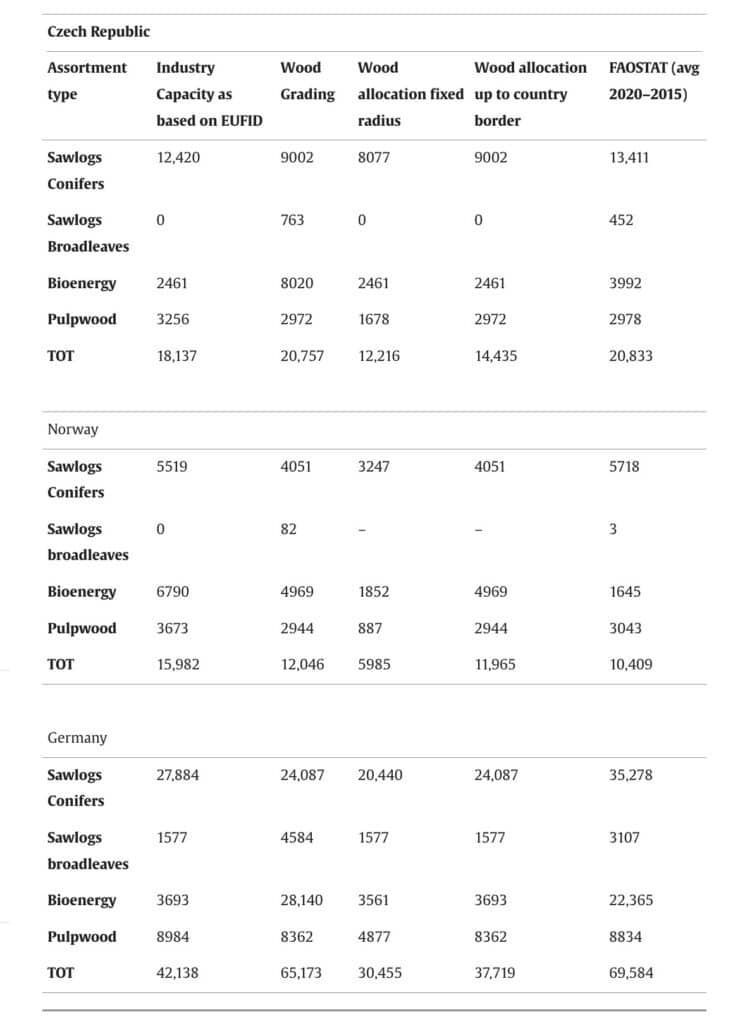

The researchers claim that German sawmills and bioenergy plants, in particular, face an acute crisis. With a processing capacity of 42.1 million cubic metres, Germany has a surplus of graded wood available (65.2 million cubic metres).

“However, the breakdown shows a softwood deficit in the sawmill sector, offset by a hardwood surplus,” they said. “The bioenergy industry recorded a nominal capacity of 3.7 million cubic metres, in contrast with a total graded wood capacity of 28 million cubic metres, which includes a significant volume of biomass designated for household fuelwood.”

For Norway, they said softwood supplies fall short of demand in the sawmill and pulpwood sectors. “And despite a total industry capacity of 16 million cubic metres, just 12.1 million cubic metres of graded wood is available, which in turn meets just 75% of industry needs.”

They said, “Pulp and bioenergy, in particular, use a model that leaves around half of Norway’s bioenergy capacity unmet – this has led to logistical challenges due to the distribution of facilities, especially in remote northern areas.”

In the Czech Republic, while sawmills have a capacity of 12.4 million cubic metres, just 9 million cubic metres of graded logs are available, which in turn results in a 3.4 million cubic metre softwood deficit: “In addition, the bioenergy sector shows a disparity, with a 2.5 million cubic metre capacity compared to 8 million cubic metres of graded wood supply.”

“This situation, compounded by forest disturbances like the bark beetle infestation, suggests that Czech sawmills may struggle to secure raw materials as spruce tree availability continues to drop.”

Wood procurement challenges highlight the need for expanded sourcing areas.

According to the researchers, the solution could lie in extending the procurement radius beyond a mandated 100km radius. This would help boost supplies for pulp and bioenergy, which often require larger sourcing areas due to higher demand.

The researchers observed that material shortages would decrease if facilities procured wood across national boundaries.

“In Germany, for instance, expanding the radius to country borders would raise sawmill utilisation to 90%, compared to only 72% within a 100 km range,” they said. “Germany and the Czech Republic also exhibited higher wood use in central regions, particularly in areas surrounding economic hubs like Berlin and Prague. By contrast, Norway’s wood consumption remained concentrated around Oslo, with minimal use in more remote regions.”

The report also supports more efficient regional wood distribution models and broader sourcing strategies. The bioeconomy-driven rise in wood demand could exacerbate shortages if current capacities remain unchanged. Bioenergy, which now competes with traditional wood product sectors for raw materials, may face intensified competition without expanded sourcing basins.

“Industries may need to consider more extensive procurement logistics, incorporating transportation infrastructure beyond road networks, such as rail and river routes, to optimise raw wood distribution.”

The authors also call for policies that balance bioeconomic growth with forest conservation, noting the long-term impact of forest degradation.

“These findings highlight the critical need to align wood resources with industry capacities, especially as Europe transitions towards a bioeconomy that emphasizes renewable and locally sourced materials,” the authors note that accurate resource projections are essential for sustainable industry growth.