Australia will pour almost $500m into the development projects across the Asia-Pacific region, with the Albanese government flexing muscle and influence in a region now targeted by China’s Belt and Road Initiative.

The new commitment is part of a suite of policies, soon to be released, to boost Australia’s presence in the region.

Last night, Australia’s Minister for International Development and the Pacific, Pat Conroy, and Foreign Minister Penny Wong announced a $492 million, four-year funding contribution with the Asian Development Bank.

The commitment comes after the Bank agreed to reform the way it delivers projects and concerns from security officials that Chinese-owned enterprises were using the Bank to advance Beijing’s geopolitical agenda.

According to Minister Conroy, the Asian Development Bank is one of several regional banks “unwittingly caught in a contest” for influence in the South Pacific and the broader ASEAN region.

In November, Wood Central revealed that Beijing used these banks to secure $5.6 billion in ASEAN forest contracts, bamboo and timber products, biomass, forest carbon, and forestry finance.

“I am happy to say they are responding to that, and it is their role to be a trusted regional institution rather than unwittingly servicing the needs of any country,” Minister Conroy said in an interview with Nine Media.

The Asian Development Bank—which counts Australia and Japan as its two largest funders—and the World Bank have vowed to ensure that multilateral development bank-funded projects focus on delivering quality outcomes in the Pacific rather than being handed to the lowest bidder.

Asked why Chinese state-owned enterprises have won so many development projects in the region, Minister Conroy said:

“Often, they are the cheapest, and until the MDBs (the multilateral development banks) develop sophisticated procurement systems, they will pick the cheapest options. And if you are the cheapest option, often they are the lowest quality, and you bring in your workforce.”

While Nauru, PNG, and the Solomon Islands have fully embraced China’s support, other Pacific Island countries have been reluctant to accept aid from Beijing. Last month, Sitiveni Rabuka, Fiji’s Prime Minister, told Nine Media’s 60 Minutes programme that Chinese-supported projects “were not up to standard.”

Beyond airports, ports, and “legacy” construction, the Pacific Islands are a major forest market – not only for forest products but also increasingly in carbon markets.

Last year, Wood Central exclusively revealed that the region is looking to establish a Pan-Pacific Standard for Sustainable Forest Management – which could see the region protect more than 2 million hectares of forest and unlock more than AU $1 billion in certified forest products.

The new standard—which PEFC International could endorse—was discussed at the Asia Pacific Forest Commissioners meeting last year and is a vital part of the region’s commitment to reducing deforestation and promoting sustainable forest management.

According to Richard Laitly, the PEFC International Southeast Asia Manager and Linh Bui, also from PEFC International, who travelled to Sydney from Vietnam for the meeting, the Pan-Pacific Standard has been in the works for several years.

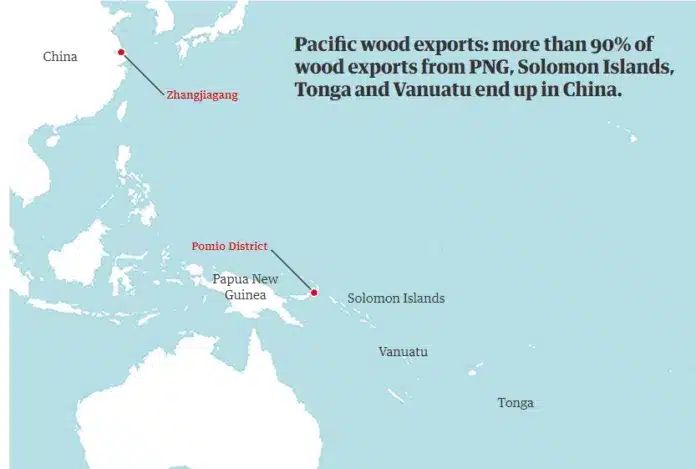

The new standard could include Fiji, Papua New Guinea, the Solomon Islands, Tonga and Vanuatu – with up to 90% of timber exported to China and allegedly tied up in “unsustainable and illegal logging.”

Wood Central understands that the new standard would greatly assist Trans-Tasman importers, provide a “green lane” for tropical timbers, and, most importantly, demonstrate sustainable forest management.

The new standard would allow regional governments to address the trade of illegal timbers and provide greater transparency to supply chains. It would also help enhance sovereign capabilities, including certification body capabilities, and reduce cost barriers typical of certification systems managed from Europe or North America.

That includes Fiji, where Minister for Forestry Kalaveti Ravu said the government is working with industry to improve harvesting practices.

“Harvesting timber over and above the forest’s sustainable level of harvest has resulted in degradation and reductions of biological diversity, such that the quality of the range of ecosystem services and products provided impacts negatively,” the minister said at a tree-planting event in Labasa.

According to Minister Ray, forestry is crucial to the nation’s post-COVID recovery, with Fiji pushing to get its Mahogany products certified to access international markets.

In July 2022, the government launched the Forest Certification Gap Analysis and Roadmap Report – emphasising the importance of certification in growing its global trading partners, especially Australia and New Zealand. Valued at Fijian $213 million, the report argues that its value could be substantially higher if certified by PEFC or FSC, according to Fiji Hardwood General Manager Sami Dranibaka.

“The certification of forests will raise the market value of logs and its timber products to meet international markets.”

Whereas in PNG, the late Bob Tate, the former PNG Forest Industries Association CEO, exclusively revealed to Wood Central that the country’s AU $407m “was an absolute basketcase” and in dire need of reform to compete with Chinese plywood traders in global markets.

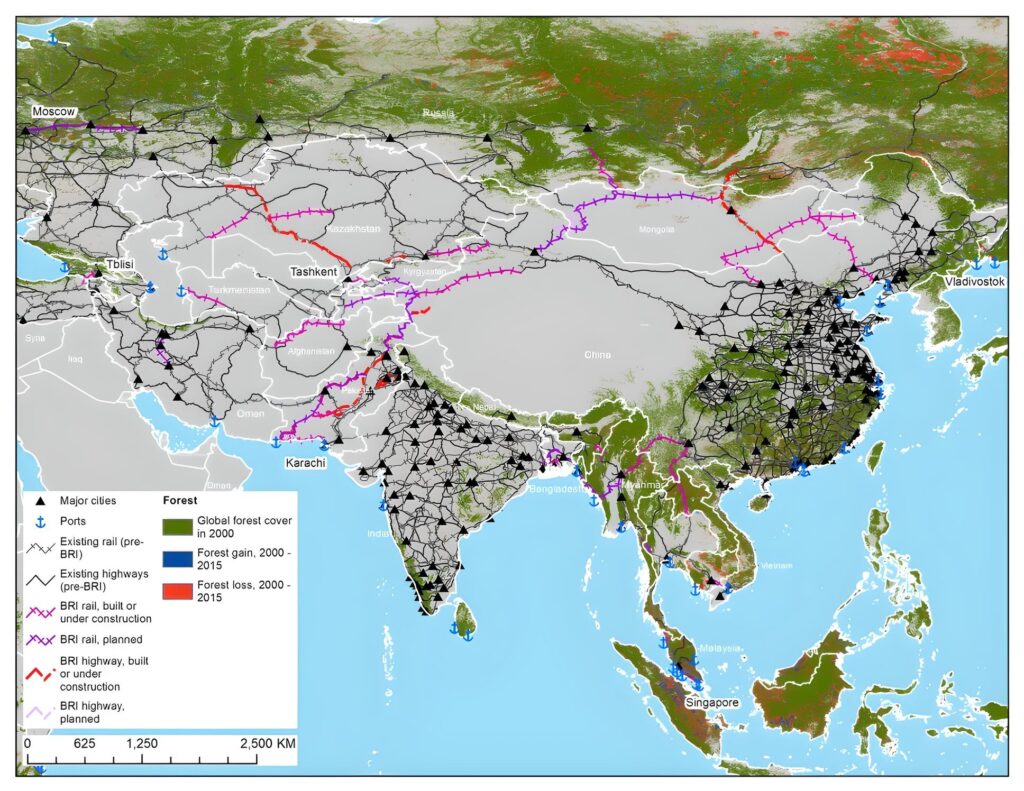

As it stands, China controls more than 30% of the world’s forest products industry, using Belt and Road Initiative investments to grow its footprint in Asia, Africa, South America, Eastern and Southern Europe, and the Asia-Pacific region.

Described as “the World’s Factory”,” China produced 71% of the world’s manufactured plywood in 2020. While that number has dropped, Wood Central understands that Chinese companies are investing in Malaysian and Indonesian plywood manufacturing.

As the world’s largest consumption market, it swallowed 18% of global demand and 71% of Asian demand for forest products. It has the highest reliance on imports – with the share of imported wood at 55%, including sawn timber, logs, pulp and paper.