The European Union’s EUDR—slated to come into effect later this year—is under siege, with the Biden Administration ramping up pressure on the EU to delay the rollout of its “impossible standards.”

It comes after twenty (out of 27) European Agricultural Ministers called for rules to be delayed amid concerns over global supply chains, echoing warnings from government officials in Australia, New Zealand, Brazil, Indonesia and Malaysia.

In a joint letter co-signed by two of Biden’s top officials—including the US Secretary of Commerce, Gina Raimondo, and the US Secretary of Agriculture, Thomas Vilsack, as well as the US Trade Representative, Katherine Tai—the officials claim that the law “posed critical challenges” to US producers of timber, paper, and pulp.

The concerns come just months after Wood Central revealed that 27 senators, a cross-section of Republicans, Democrats and Independents—from timber, paper, and pulp-producing swing states in the American South—pressured Ms Tai to fight back against the new rules – claiming that the traceability rules would be “nearly impossible for a significant segment of the US paper and pulp industry to comply with.”

“We urge the European Commission to delay the implementation of this regulation and subsequent enforcement of penalties until these substantial challenges have been addressed.”

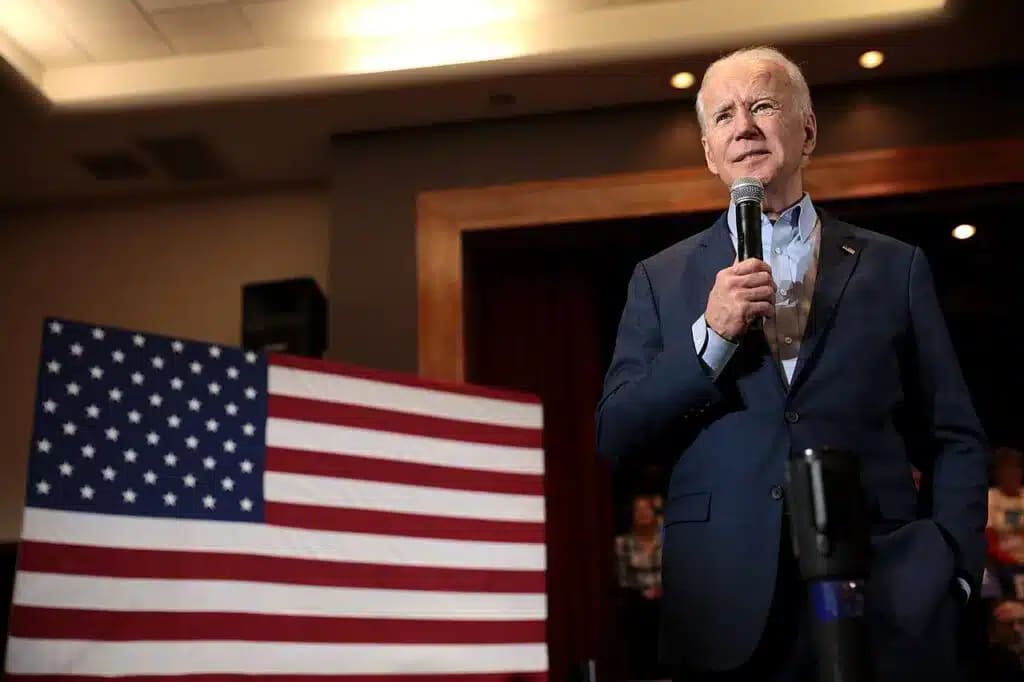

The three trade officials addressing the European Commisson

According to the American Forest and Paper Association (or the AF&PA), the laws, in their current form, “impose unachievable requirements” and “significant technical barriers” on producers and, if enforced, will risk the Euro-American US $1.3 trillion trade – including more than US $3.5 billion in forest products directly impacted by the new rules.

What is the United States’ beef with the EUDR?

As the world’s largest pulp, paper, and lumber producer, producers are concerned with the EU’s requirements for full traceability and new definitions for deforestation – which will “impose costly requirements on US exporters” and limit market access.

“The EUDR imposes a geolocation traceability requirement that mandates sourcing to the individual plot of land for every shipment of timber product to the EU,” the 27 senators warned in a letter to Ms Tai. “In the United States, 42% of the wood fibre used by pulp and paper mills comes from wood chips, forest residuals, and sawmill manufacturing residues, wood sources that cannot be traced back to an individual forest plot.”

Described as a “non-tariff trade barrier,” lawmakers are concerned that the European’s “expansive” definition of deforestation would consider typical agricultural practices like roadbuilding and clearing dead trees as “acts of deforestation.”

How the EUDR will work

- The regulation will assign regions within countries inside and outside the EU a low, standard, or high-risk level associated with deforestation and forest degradation.

- This risk classification will guide the obligations of various operators and the authorities in member states to perform inspections and controls. Consequently, this will streamline monitoring for high-risk regions and simplify due diligence processes for low-risk regions.

- Authorities responsible for these areas must inspect 9% of operators and traders dealing with products from high-risk regions, 3% from standard-risk areas, and 1% from low-risk regions. This inspection aims to confirm whether they are effectively meeting the obligations stipulated by the regulation.

- Further, these competent authorities will inspect 9% of relevant goods and products either placed on their market, made available, or exported by high-risk regions.

- Lastly, the EU plans to enhance its cooperation with partner countries, focusing primarily on high-risk areas.

For more information, visit Wood Central’s special feature on EUDR and its implications for the global supply chain of forest products from July 2023.