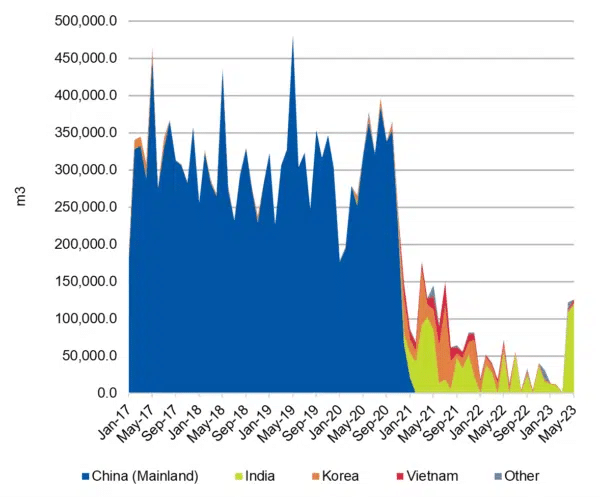

Australia’s timber trade with China—once worth $1.6 billion a year—is slowly returning, with Lesprom Analytics reporting that just under 70,000 cubic metres of logs left Australian ports last month.

However, it is a steep decline from the pre-COVID peak, with China taking 500,000 cubic metres of softwood (or 99% of total exports) in May 2019.

It comes as China, in May 2023, resumed its trade with Australia after resolving concerns about bark beetle infestation – which saw trade drop from 3.5 million cubic metres (per year) in the five years leading up to Covid to just 400,000 cubic metres in 2022.

At the time, Joel Fitzgibbon, Australia’s former Agriculture and Forestry Minister and ex-CEO of the Australia Forest Products Association, said, “When the ban came into effect more than two years ago, it caused a great deal of upheaval and uncertainty for many timber exporters and the broader forest sector.”

Whilst Port of Portland CEO Greg Burgoyne reported that the port, which exported 1 million tonnes of logs to China leading up to the bans, “were aiming to get back to that tonnage.”

Yesterday, Wood Central spoke to Rudolf van Rensburg, the co-author of China – Forest, Log & Lumber Outlook,” a 197-page report produced by Russ Taylor Global and Margules Groome Consulting, who said it’s unlikely that the volume of Australian log exports will return to past levels, “once bitten and twice shy,” “according to our consultants in China.”

“It’s important to note that China is coming off a softwood lumber demand peak, pre-Covid, that will likely not be matched for a very long time,” Mr van Rensburg revealed to Wood Central ahead of the report release.

“Instead, we expect that Chinese lumber exports will grow, offsetting the decline in log exports amid a ban on log exports from Ukraine and Russia, bark beetle infestations in Europe, and an anticipated slowdown in NZ harvesting.”

The report, the first of its type, accessed all areas of the Chinese wood and forest industry, including China’s extensive land and ocean port network, with “no area is off limits” according to Mr van Rensburg.

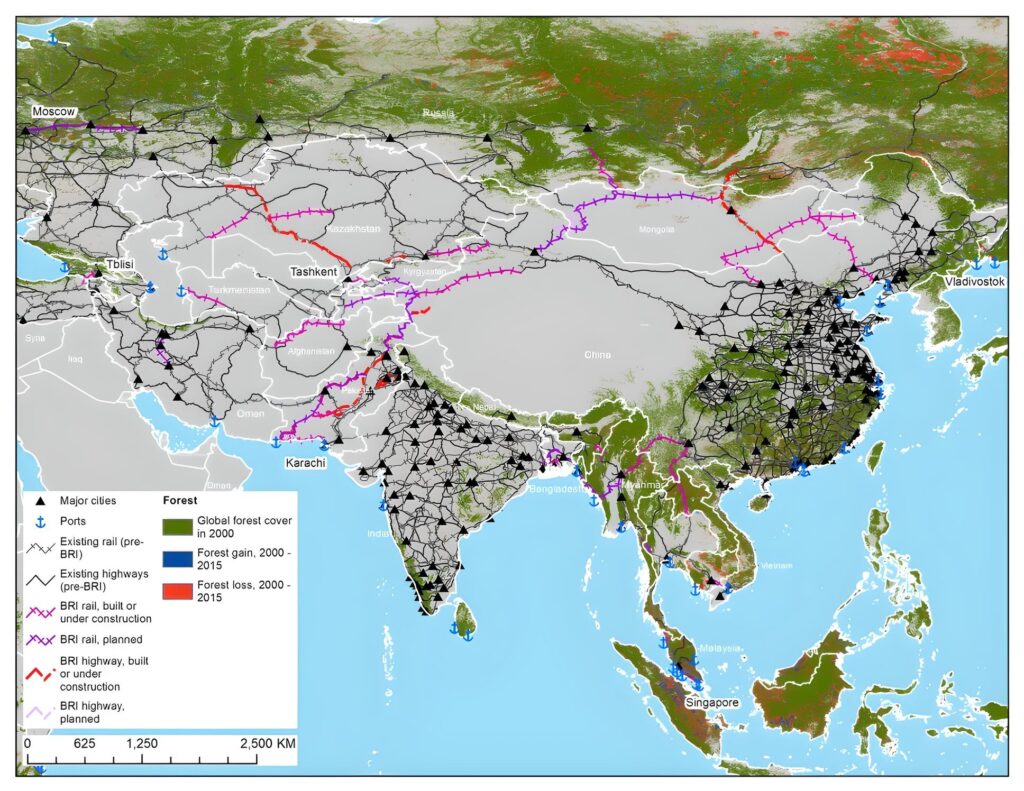

“Our consultants have mapped China’s extensive industrial parks, which are grouped with logistics sites, production facilities and raw materials, together creating the world’s more efficient industrial clusters,” which Mr van Rensburg said are “strategically located along China’s extensive port network.”

Wood Central reported earlier this month that China is now addressing its “supply gap” in hardwoods and, thanks to more than 40 years of policy development, is rapidly boosting plantation establishment to attain its long-term goal of “wood product self-sufficiency.”

At the same time, it is investing in Oriented Strand Board (OSB) production. It aims to develop OSB from timber scraps, recycled wood, and bamboo to fuel development in the Global South along its extensive belt and road network.

What opportunities exist for businesses to capitalise on China’s pivot from log to lumber imports? What opportunities exist for timber processors and manufacturers looking to enter the world’s most important forest market?

“Well, I guess you’ll need to purchase the report,” Mr van Rensburg said.

The report is now available for order for US $5,000.00, with report data tables additionally available for US $700,00. Corporate subscriptions and presentations are also available upon request. See the Margules Groome website for details.

- Wood Central will have exclusive interviews with the report’s authors in the coming weeks, including behind-the-scenes video and audio.