The Malaysian government is now in talks with the Chinese developers of Forest City, dubbed the world’s Ghost City, to develop the Muslim majority’s second casino licence.

It comes as Anwar Ibrahim, Malaysia’s Prime Minister, last week met with Berjaya Corp founder Vincent Tan and Genting Group’s Lim Kok Thay to have preliminary discussions about the site’s future development.

Malaysian ruling monarch Sultan Ibrahim Iskandar of Johor – who ascended to the crown in January – is understood to have a 20% stake in “Forest City” – arguably China’s most famous Belt and Road project.

It comes as China is now looking to smaller projects and “greater use of the yuan” to reinvent its flagship Belt and Road Initiative after one of its most heavily liquidated real estate companies, Evergrande, was ordered to liquidate by a Hong Kong court earlier this year.

According to a document published in February, it will now prioritise “small and beautiful projects with a focus on those with small investments, quick impact, as well as sound economic, social and environmental benefits.”

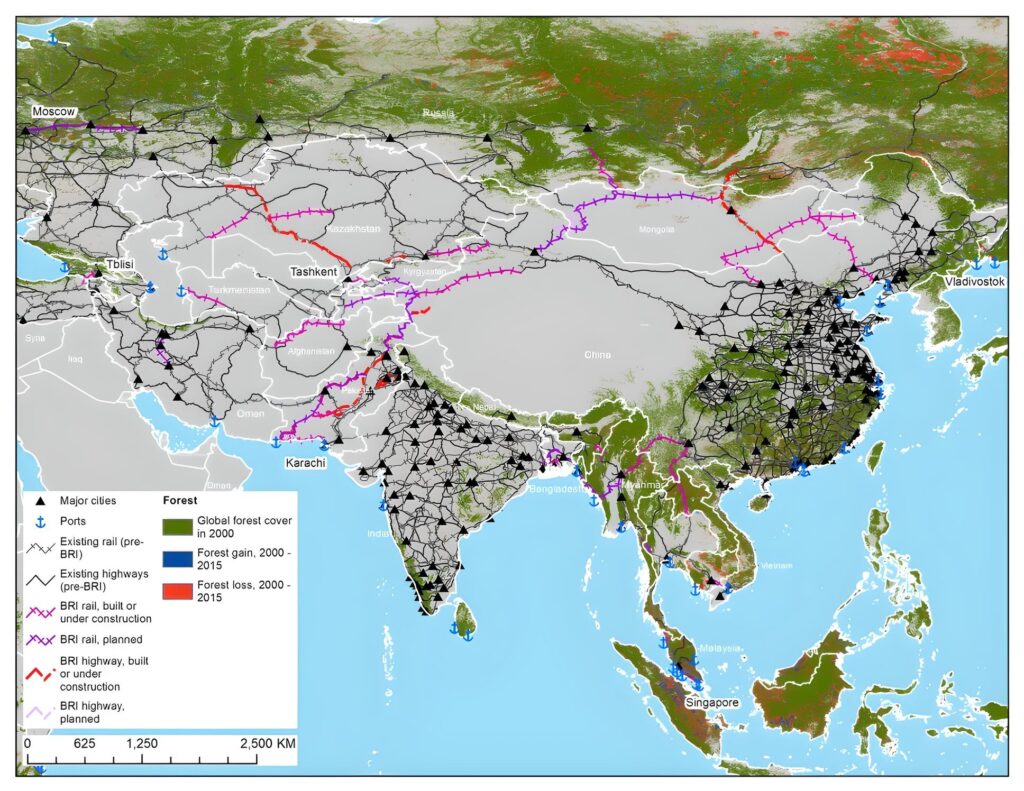

The Belt and Road Initiative, which controls upwards of 30% of the world’s timber supply chain, has spent more than $1 trillion since its launch in 2013.

However, momentum has tapered off in recent years as the pandemic and China’s slowdown disrupted the global economy.

The average Belt and Road deal fell to $392 million in the first half of this year, 48% smaller than its 2018 peak, according to the think tank Green Finance & Development Center.

In a forum marking the initiative’s 10th anniversary last month, Chinese officials emphasised sustainable debt and greener, more cost-effective projects.

The policy U-Turn, outlined in President Xi’s new 10-year “project of the century,” is to avoid the mistakes of projects like Malaysia’s US $100 billion Forest City.

As reported by the BBC, Forest City, developed by China’s largest real estate company, Country Garden, is one of the country’s highest-profile Belt and Road projects unveiled to much fanfare in 2016.

The Chinese property boom was in full swing then, with China’s “Shadow Banks” borrowing colossal sums of money to develop real estate at home and abroad for China’s surging middle class.

The plan was to build a new age sustainable metropolis featuring a golf course, waterpark, offices, bars and restaurants. At the time, the company said Forest City would eventually be home to nearly one million people.

But eight years on, it stands as a stark reminder that you don’t need to be in China or a timber exporter selling into China to feel the effects of its property crisis.

According to estimates from the BBC, just 15% of the project has developed, and according to recent estimates, just 1% is occupied by residents.

Despite facing debts of nearly US $200 billion, Country Garden said it was “optimistic” the plan would be eventually finalised.

However, locals have their doubts; billed as “a dream paradise for all mankind”, the reality is that it is aimed at the Chinese market, offering residents the chance to own a second home abroad.

Forest City’s isolated location – built on reclaimed islands far from the nearest major city, Johor Bahru – has put off potential tenants and earned it its local nickname, “Ghost City”.

“To be honest, it’s creepy,” a local Malaysian resident, Nazmi Hanafiah, told the BBC. “I had high expectations for this place, but it was a bad experience. There is nothing to do here.”

This frustration is also felt across China, where the property market is in disarray. After years of rampant developer borrowing, the government feared a bubble was forming and imposed strict limits in 2021.

“Houses are for living in, not speculation” was the mantra of China’s leader Xi Jinping.

Now, the real estate companies and “shadow banks” fuelling the Belt and Road Initiative projects have run out of cash to finish massive projects.

In addition, the COVID-19 travel restrictions and controls on how much money Chinese citizens could spend abroad have also hampered overseas projects.

“I think they probably pushed it a bit too far, too fast,” according to Tan Wee Tiam from KGV International Property Consultants. “Before launching a hugely ambitious project like this, the critical lesson to learn is ensuring you have sufficient cash flow.”

Country Garden insists the current situation in the Chinese property market is just “noise” and its Malaysian operation “runs its business as usual”. It also said plans to include Forest City in a new special economic zone between Malaysia and neighbouring Singapore showed the project was “safe and stable”.

However, without access to cash, it is hard to see if it will ever be finalised or attract people to live in the communities. Currently, Chinese-built property is a tough sell, to put it mildly.

“It’s a chicken and egg situation,” says Eveline Danubrata from REDD Intelligence Asia. “A developer typically relies on pre-sales to help fund construction. But buyers won’t put their money in if they’re unsure whether they’ll get their apartment keys.”