The European Deforestation Regulation (EUDR) (otherwise known as Regulation (EU) 2023/1115) is the European Union’s (EU) attempt to combat global deforestation and forest degradation. The regulation is scheduled to come into force for large companies on 30 December 2024 and for small and medium enterprises on 30 June 2025.

Under this regulation, companies must verify that certain products, such as timber and other forest-related commodities, including cocoa, coffee, and palm oil, do not originate from deforested land. Strict due diligence obligations are imposed, and detailed geolocation data for supply chains must be provided to demonstrate that products are not linked to deforestation activities after 31 December 2020.

The EUDR is seen as a crucial step in the EU’s efforts to protect global forests and biodiversity, positioning the EU as a leader in sustainable trade practices.

The EUDR will assign a country or region a risk level (low, standard, or high) based on its deforestation risk. This classification will dictate the intensity of the due diligence process required from companies operating or importing from the country or region. For example, operators dealing with products from high-risk areas are expected to undergo more rigorous inspections, with up to 9% of their operations being subject to control.

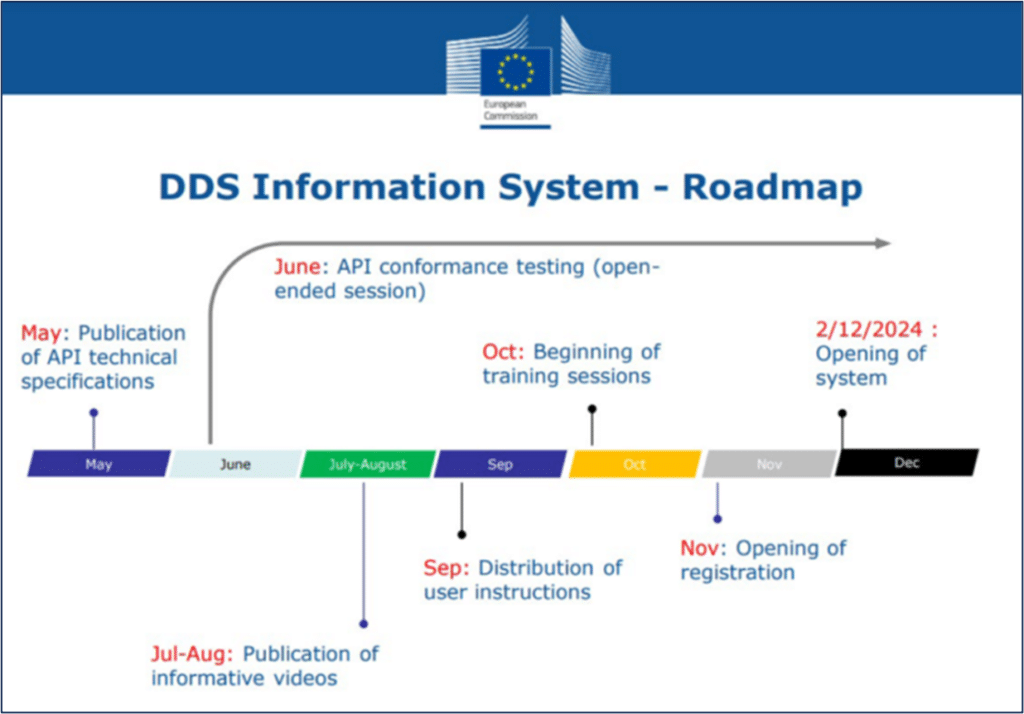

To aid the implementation of the EUDR, the EU is developing important technological and logistical support systems. These efforts include a Data Distribution Service (DDS) Information System (see Figure 1), which is intended to assist companies in managing and modifying due diligence declarations more efficiently, notably through the Deforestation Due Diligence Registry (DDDR).

Additionally, collaboration with various technology partners is ongoing to improve the accuracy and reliability of geolocation data. The EU conducts risk assessments, with third-party organisations classifying countries based on their risk of deforestation. However, feedback from the industry and organisations indicates that these tools are still in the early stages and require significant IT resources, raising concerns about their accessibility, particularly for smaller businesses.

Moreover, international suppliers have raised concerns regarding data privacy and the feasibility of providing precise geolocation data, which is critical for compliance.

Figure 1: DDS Information System Roadmap

Despite the EU’s commitment to enforcing the EUDR, it faces considerable international opposition. Major players in the global forest product markets, such as China and the United States, have expressed serious concerns. For instance, China has refused to share geolocation data due to security concerns, leading to a stalemate in discussions with the EU. Similarly, the US has criticised the regulation as a “non-tariff trade barrier,” arguing that it could disrupt the USD 3.5 billion forest product trade between the two regions. In response to these challenges, calls have been made by several industry groups and international governments for the regulation’s implementation to be delayed, allowing more time for compliance and mitigating potential disruptions to global supply chains.

Similarly, several Asian countries, including Indonesia and Malaysia, have expressed concerns about the regulation’s impact on agricultural exports. They argue that the EUDR unfairly burdens developing nations and could hinder their economic growth.

To summarise, exporters of wood products, particularly from the Americas and Southeast Asia, will likely encounter significant challenges under the EUDR. The requirement for precise geolocation data and adherence to EU and local environmental laws may pose difficulties for exporters reliant on small-scale or informal supply chains. For instance, tracing wood products to their exact plot of origin could lead to increased costs and operational delays, especially in regions where such data is challenging to obtain. Smaller exporters who may lack the technological resources to meet these stringent requirements risk being marginalised. This could result in some exporters withdrawing from the EU market altogether and instead focusing on regions with less stringent environmental regulations.

As the EUDR’s implementation deadline approaches, stakeholders are placing increasing pressure on the EU to provide clearer guidance and more robust digital infrastructure to support the regulation’s implementation. Concerns about the feasibility of complying with the regulation’s stringent requirements have been voiced by stakeholders from various sectors, including the timber, coffee, and cocoa industries. Additionally, developing countries, particularly those in the Global South, have highlighted the potential economic impacts on small-scale farmers and exporters who may struggle to meet the EUDR’s demands.

On the other hand, preparations for the EUDR have already begun by many businesses worldwide, with supply chains being reassessed to ensure compliance. This preparation involves mapping supply chains to trace products back to their origin, conducting risk assessments, and forming partnerships with certified suppliers who can guarantee deforestation-free products. For instance, the Indonesian government is developing a supply chain traceability dashboard to assist its producers in meeting the EUDR’s requirements. Similarly, Africa’s cocoa sector companies are enhancing their traceability systems to align with the regulation. The Dutch Ministry of Agriculture, Fisheries, Food Security and Nature’s June 2024 Agrospecials Edition 11 reports on deforestation-free practices and initiatives in seventeen countries:

Moreover, the EU remains committed to enforcing the regulation, emphasising its long-term environmental benefits while collaborating with partner countries to address challenges and ensure fair implementation.

Looking ahead, the EUDR is expected to impact global trade and environmental governance significantly. Although the regulation aims to reduce deforestation and promote sustainable supply chains, its success will depend on the ability of both the EU and its trading partners to navigate the complex web of regulatory requirements, geopolitical tensions, and market dynamics.

Companies involved in the affected commodities should begin preparing now by conducting thorough risk assessments, mapping their supply chains, and investing in the necessary technology to ensure compliance. While the EUDR’s long-term outlook remains positive, with the potential to drive meaningful change in global trade practices and environmental conservation, its implementation will undoubtedly require ongoing collaboration and adaptation from all stakeholders involved.

Please note: This is an extract from Margules Groome’s website – a global consultant specialising in forestry, wood products, bio solutions, pulp & paper, and agricultural tree crop sectors. For more information, visit Wood Central’s special feature on EUDR and its implications for the global supply chain of forest products from July 2023.