Twelve months after the Red Sea crisis – which has seen global shipping divert billions of freight containers around the Cape of Good Hope, Donald Trump’s quest to Make America Great Again is set to be the biggest shake-up to global timber for several decades. Wood Central understands that Trump’s new policy, a throwback to the 1880s and 1890s, could potentially kick off a trade war of unprecedented scale, with the $520 billion trade in forest products caught in the crosshairs.

Speaking to the Joe Rogan Experience podcast on Friday – which has been downloaded 42 million times on YouTube, the former president, now ahead in the polls after current President Biden labelled Trump supporters ‘garbage, has doubled down on his pledge to impose a universal baseline 10% tariff on all US imports and a 60% tariff on all US imports from China.

While discussing tariffs, Trump was asked by Rogan, “Did you just float out the idea of getting rid of income taxes and replacing them with tariffs?”

Rogan asked, “Were you serious about that?”

“Yeah, sure. Why not?” the former president responded. “Because, we, really, our country was the richest in the world, relatively, in the 1880s and 1890s. A president named McKinley, who was assassinated, was the tariff king. He spoke beautifully of tariffs.”

“And then around in the early 1900s, they switched over stupidly to frankly an income tax. And you know why? Because countries were putting a lot of pressure on America: ‘We don’t want to pay tariffs, please don’t.’ You know they, believe me, they control our politicians.”

Former President Trump on his plans to introduce a blanket tariff on 10% of all imports into the United States – and 60% on goods imported from China.

As it stands, the US is the world’s largest producer of forest products, has the highest per capita consumption of industrial wood, and is the second-largest consumer market (behind China) for lumber, engineered wood products, paper, and wood energy. In addition, it has the largest stake in the USMCA – the world’s largest free trade zone, which includes Canada (the world’s fourth-largest lumber and pulp producer) and Mexico (one of the world’s fastest-growing lumber consumption markets.)

According to the Tax Foundation, America’s top think tank on economic policy, if implemented and met with retaliation from trading partners, the tariffs “would more than offset the entire benefit of the major tax cuts for economic output and jobs, resulting in a net loss for the US economy.”

The new policy comes after the New York Times reported that former President Trump told House Republicans that he would “love to raise tariffs” and cut income taxes on Americans, potentially to zero. “Everyone was clapping in the room,” said Georgia Republican representative Marjorie Taylor Greene. “He said, ‘If you guys are going to go vote on something today, vote to lower taxes on Americans.'”

In July, Wood Central revealed that President Trump believes that mixing tariffs with tax cuts can revitalise American businesses and manufacturing, boost jobs, and benefit working-class Americans. They see tariffs on foreign products as a lucrative source of revenue, one that could offset a drop in tax receipts—with the cost borne by the foreign manufacturers and importers.

Robert Lighthizer, President Trump’s chief trade negotiator during his presidency, who continues to advise the campaign on trade, said the tariff hike hit the supply chain instead of the consumer hip pocket. Mr Lighthizer said studies showed that tariffs paid by American consumers were “fundamentally wrong,” maintaining that foreign producers and importers very often pay tariffs.

“A tax-and-tariff regime can be progressive,” he said. “What it will do is change the relationship between importers and American manufacturers,” Mr Lightnizer affirms, “it will create jobs.”

Trump’s tariffs and the flow through to global forest products

As it stands, more than US $10 billion worth of timber is traded between the United States and China annually – with the volume of trade rocking from US $7 billion a year over the past decade.

“The Chinese and the US forest markets are closely linked, according to a Chinese study looking at the impact of a trade war on the global supply chain of forest products. “The main forest products imported by the US from China are plywood, fiberboard, and wooden furniture, accounting for 46.68%, 33.31%, and 50.33% of US total imports.”

“On the other hand, China’s main imports of forest products are industrial roundwood, sawn wood, and waste paper, accounting for 42.93%, 42.27%, and 71.12% of the total US exports of these products,” they said, adding that “these imported products also amounted for 10.25%, 18.09%, and 46.01% of the total Chinese imports.”

Looking at two scenarios in which the US and China impose a 25% and 30% tariff on goods between the countries, “we found that China’s imports of sawn wood and waste paper from the US and the US imports of plywood and other paper from China decreased significantly.”

“Meanwhile, some trade flows between China and the US shifted to other parts of the world,” it said, arguing that Vietnam and New Zealand were the biggest winners, “whilst Thailand suffered heavy losses.”

“Product substitution occurred mainly in Asia and Europe, where price changes were within 10%,” it said, arguing that “China benefited slightly, but the US experienced a major loss from a potential trade war.”

Days before the election, Trump is the favourite to take back the White House.

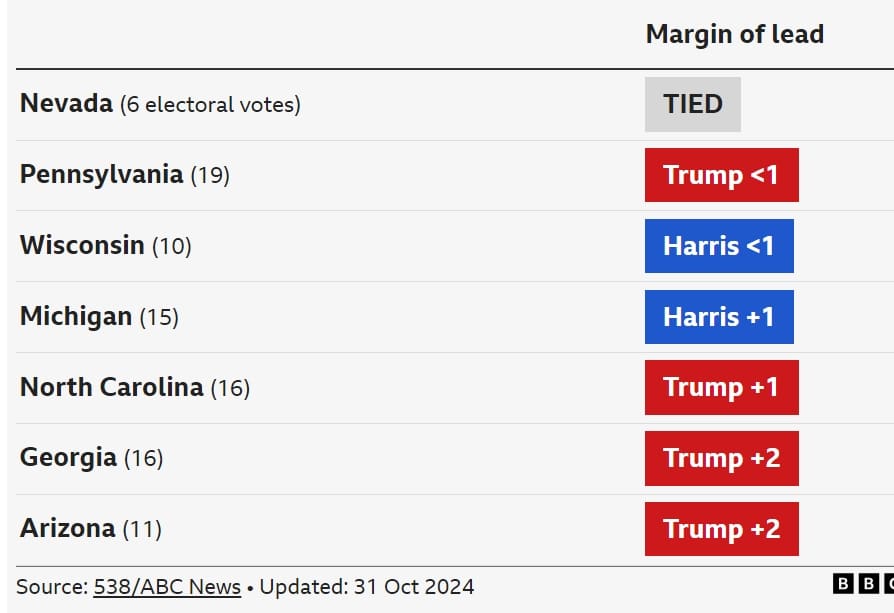

Less than one week before the election, Trump has taken a key lead in four of seven battleground states – with Vice President Kamala Harris struggling to hold her lead in Michigan and Wisconsin.

According to election aggregator Five-Thirty-Eight, Trump now leads Harris 51/49 across all major polling, whilst Polymaker, an online betting platform backed by Peter Thiel, a high profile Trump supporter, now has Trump favoured to prevail in Arizona (68%), Georgia (64%), Pennsylvania (54%), Michigan (52%), North Carolina (63%), and Wisconsin (52%). The only swing state where Harris maintains a slim lead is Nevada, where she holds a 51% chance of victory compared to Trump’s 49%.

- To learn more about Trump’s plans for old-growth forests, click here for Wood Central’s special feature.