New housing data from the United States show a rebound from the slow-down of mid-2022 when lending rates started to rise.

The data supports improved optimism in the Australian market, where Wood Central reported that the country’s largest residential builder is predicting the return of the housing boom.

Total housing starts in the US for May 2023 shot up by 22% from the previous month to 1.631 million, compared to the 1.340 million reported for April, and are up 6% from the May 2022 rate of 1.543 million.

The figures have been provided by Madison’s Lumber Prices Index, which monitors US Housing Starts overnight.

According to Madison’s Lumber, an indicator of the growing activity to come is building permits which are up by more than 5%, at 1.491 million for the month from 1.417 million in April.

Apartments under construction also remained high compared to historical averages, with 1.689 million apartments constructed for the month.

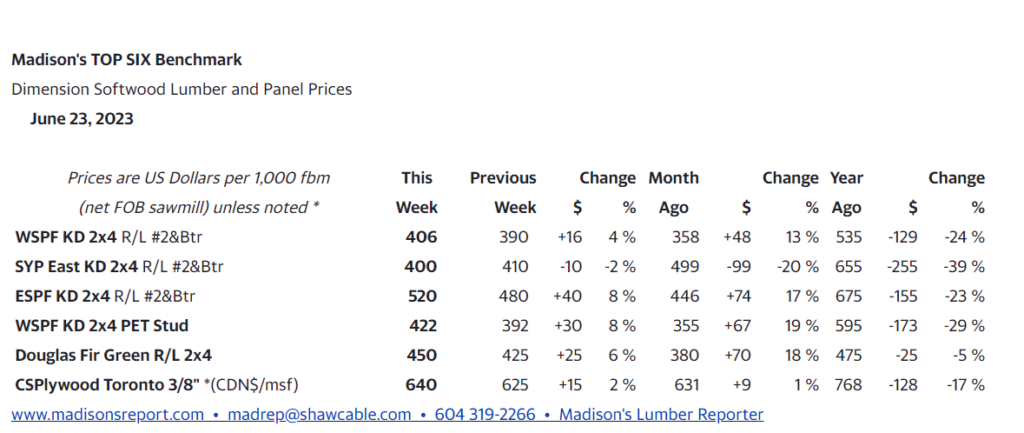

In the week ending June 23, 2023, the cost of a key softwood lumber product, Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL), rose to $406 per thousand board feet (mfbm). This represents a 4% increase from the previous week’s price of $390.

SPF is an acronym for spruce, pine, and fir.

SPF lumber typically refers to dimensional lumber or engineered wood derived from coniferous trees in North America. SPF lumber is further divided into two categories: Eastern (ESPR) and Western (WSPR) species.

That week’s price was up by 14% from one month ago when it was $358.

As June passed its mid-way point and questions swirled about overall supply given ongoing wildfires, demand was strong for lumber, studs, and panels.

Other concerns included recent curtailments and production adjustments, as well as upcoming summer shutdowns in Eastern Canada.

Demand for Western S-P-F (WSPF) commodities grew rapidly

Many buyers were caught short with their inventory, resulting in a surge of short-covering that fed the rally.

Sawmill offerings got slimmer, and inventory that was available for quick shipment through the distribution network vanished.

Madison’s Lumber reports that US-based WSPF sawmills took advantage of this rush in demand and extended their order files into mid or late July.

Meanwhile, for the second week in a row, suppliers of Western S-P-F lumber in Canada showed optimism that an upswing was around the corner.

There is a perception growing amongst buyers that whoever didn’t at least cover short-term needs would miss out, as the market appeared to be entering a sustained rally.

After moderating for a year since lending rates started rising, sales of new single-family homes in the US jumped sharply in May, at 763,000, which is up 12% from April’s 680,000 and is a 20% increase compared to May 2022 when it was 636,000.

Correcting downward after a recent surge, the median sales price of a new home in May fell by almost -15%, to US$416,300, from US$487,300 in April, and is down -7.6% from one year ago.

As for lumber prices, compared to the same week last year, when it was US$535 mfbm, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending June 23, 2023, was down by -$129, or -24%. Compared to two years ago when it was $1,040, that week’s price is down by -$642, or -61%.

- Articles use extracts from Madison’s Lumber Report overnight.