The mass timber market in Canada could hit US $1.3 billion by 2030 – and even top out at $2.4 billion in 2045. However, the industry must rapidly expand production capacity and overcome logistical challenges. That is according to Tim Buhler, technical manager for WoodWorks, who moderated a panel session, “Accelerating Mass Timber in Canada,” at the WoodWorks Summit in Toronto this week:

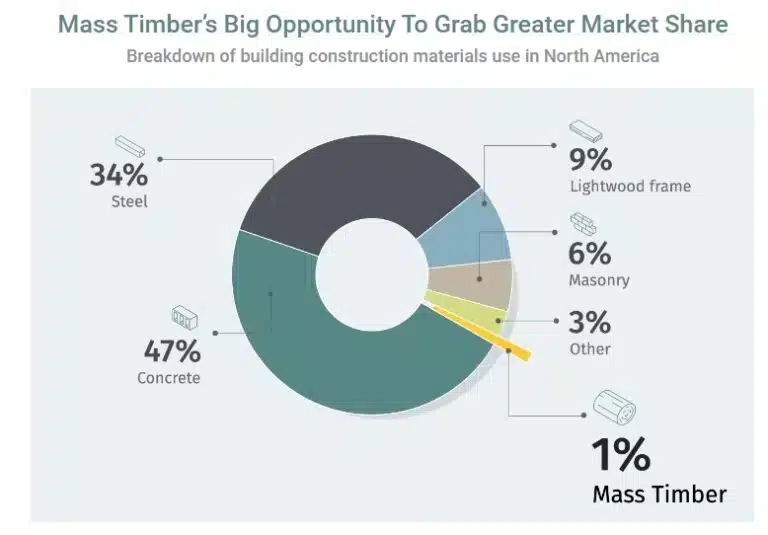

“Mass timber is still in its infancy, a US $400 million market representing only about 1% of all construction in Canada.”

Tim Buhler, technical manager for WoodWorks.

He said the team at WoodWorks would define success by achieving a market share of 5% of all construction and a 25% share of the multi-family residential sector.

Panellist Steven Street, executive director at WoodWorks, said producers needed to look at more circularity in their operations: “They need to do more with their fibre, especially now that the (building) code is with us.”

“New code provisions that permit 12-storey mass timber housing provide opportunities for high-rise builders to think about eight-storey unencapsulated residential designs. It’s the game changer as far as we are concerned because these builders already have the know-how and resources to construct these buildings.”

Mr Steel said that Element5, now in expansion mode, proves that manufacturing can be successful. “We need five more of them.”

[Element5 is a mass timber manufacturer specialising in the design, fabrication and assembly of contemporary timber structures, including CLT and glulam]

In Alberta, where concrete and steel dominate construction, mass timber is primarily used for decking or roofing: “We see it as part of the building solution, not the only solution,” said Rory Koska, program director for WoodWorks in Alberta.

He said a public-private sector alliance would be a big step toward the industry’s growth, adding that product standardisation (billets) would further advance mass timber.

Mr Koska said the Alberta Government recently announced a US $8.6 billion program to construct 90 new public schools by 2031, and it has shown interest in evaluating mass timber for schools. “It could be a foot in the door where we would start to see buy-in,” he said.

Mass timber is growing in the institutional sector in Quebec largely because the provincial government requires that partly or wholly financed public institutional projects evaluate mass timber design options, according to Simon Bellavance, technical adviser with Quebec-based building contractor Cecobois.

“It leads to a lot of schools and sports facilities in wood.”

There has also been “a lot of pickup” in mass timber in the institutional sector in British Columbia, says Shawn Keyes, executive director at WoodWorks. This is partly because projects under an ESG framework pursuing provincial funding must include a mass timber option.

Mr Keyes added: “The City of Vancouver recently created density bonuses for mass timber in the private sector, offering two additional storeys for buildings eight to 12 storeys and three extra floors for projects over 12 storeys. “It helps offset potential high costs,” he said, noting government support of mass timber and wood construction is “extremely strong” in the province.

David Porter, program coordinator with WoodWorks Atlantic, said. At the same time, nail-laminated timber projects have been the standard in New Brunswick and Nova Scotia; that will change because construction will start next spring on a $250 million plant to produce 50,000 cubic meters of CLT annually. Another plant is planning to roll out panels by 2026.

Steven Street said that while many municipal governments in Ontario didn’t promote mass timber, the sector could grow there because it meets net-zero targets set by many municipalities. “If you set the right policy, wood will meet it,” he said.

Scott Jackson, director of conservation biology at the Forest Products Association of Canada, said the three main reasons for promoting mass timber construction were that it fit well with net-zero targets, helped address the housing shortage, and created jobs in rural and Indigenous communities.

Developed by members of the association with the Canadian Wood Council and a wide variety of other stakeholders, the ‘Mass Timber Road Map’ outlines goals to increase mass timber to a market valued roughly at US $2.4 billion by 2035.