Australia’s second-largest hardware chain wants to expand its retail footprint and is now looking to independent hardware stores to gain market share from retail giant Bunnings.

As reported in the Australian, Metcash, which operates 1500 brick-and-mortar stores across Australia, is now targeting HBT and its 940 “proudly independent” retail stores nationwide.

HBT is a buying group for independent hardware, building supplies, industrial, pain, rural, garden and timber retailers.

According to HBT, “it has been helping local independent hardware, building & industrial businesses across all states of Australia for over two decades, ensuring they have the tools and daily support to operate a successful retail store.”

The move comes as more Australian businesses are looking to open physical brick-and-mortar outlets after the Covid pandemic.

Wood Central understands that Metcash is looking to add high-performing stores to its stable of “unbanned independent operators”, supporting its existing portfolio of branded retail outlets, including Mite 10, Home Timber & Hardware, Hardings Hardware and, from September 2020, Total Tools.

Metcash operates the assets through the Independent Hardware Group (IHG), “considered a leader in servicing the Trade market” and the country’s largest home improvement wholesaler.

Its stores cater to a broad range of trade and DIY customers, from large format warehouses to convenience operations and trade centres, and it has frame and truss sites in two states.

Hardware is the area of opportunity for Metcash, with the conglomerate heavily invested in food (through IGA and Foodland) and liquor (including Celebrations, IGA liquor and Bottle-O).

The push comes as Bunnings, which has a more than 50% total market share of the Australian hardware and DIY market, invests heavily in frame and truss to capture an even greater share of the commercial “wholesale” market.

Bunnings make up 50% of Wesfarmers’ AU $45.6 billion revenue, with a new 5-year plan implemented earlier this year as part of a push to grow its commercial business to offset fluctuations in the retail market.

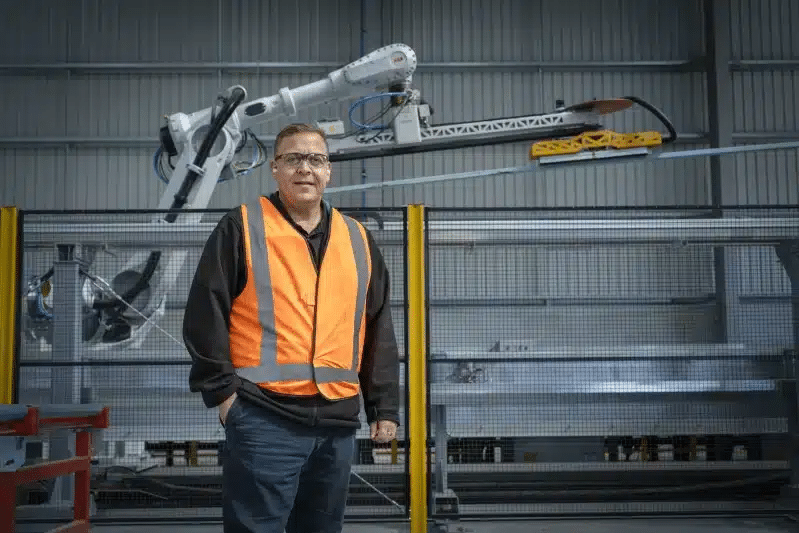

In September, Wood Central reported investing up to $75 million in developing “mega” timber fabrication facilities in Victoria, NSW and QLD, which could see it become Australia’s largest truss manufacturer.

The new facilities will use robots to assemble and nail-plate the A-frame trusses, which IndustryEdge Managing Director Tim Woods said represents a “massive rationalisation” in the residential construction industry.

“The largest participants in the market are making the next logical step, and it could be that some of their thinking is getting ahead of a global trend toward entire houses being built inside factories,” Mr Woods said.

Meanwhile, the latest Australian Retail Report, conducted for financial technology company Ayden by KPMG, reveals Australians prefer in-store shopping compared to their US and UK counterparts – 65 per cent and 49 per cent, respectively.

Two-thirds of Australian consumers believe a physical store is an essential touchpoint between a business and its customers. At the same time, 48 per cent of respondents said they attend physical stores to get help they cannot get online when selecting a product.

Australian Retail Association chief executive Paul Zahra says traditional bricks-and-mortar retailers have bounced back with force after the lockdowns, with consumers returning to the stores in droves, relishing a face-to-face community experience.

As a result, more than 39% of businesses plan to open new stores in the coming year, while 45% expect the proportion of annual revenue that comes from their physical stores to increase.