Russian plywood manufacturers are drowning under war sanctions and have nowhere to hide. That is according to the Russian-based Lesprom, which reports that Russia—until 2022, among the top 3 markets for global plywood production —is now flooding Asia, Latin America, and Africa with an oversupply of cheap wood in response to ‘crippling’ EU sanctions.

“As it stands, (Russian) capacity stands at 5,669 thousand cubic metres, with demand (into these secondary markets) just 3,192 thousand cubic metres,” Lesproom said. “This (77%) imbalance has created a fiercely competitive landscape among lean exporters, crunching profit margins.”

The problem is that manufacturers have relied on a “growth at all costs” strategy for years, hell-bent on increasing capacity to achieve economies of scale. For example, in 2021, Russia’s birch plywood capacity stood at 4,615 thousand cubic metres, projected to grow to 5,225 thousand cubic metres by the end of this year and 5,315 thousand cubic metres next year.

However, despite capacity growth, “actual production has been progressively decreasing, from 4,124 thousand cubic metres in 2021 to just 3,255 thousand cubic metres in 2024,” Lesprom said and could dump again to just 3,274 thousand cubic metres in 2025. According to Sveza – one of Russia’s largest plywood producers, the increase in capacity has not translated to growth, with limited market access coming alongside labour shortages, cross-border payment issues, high raw material costs, and elevated interest rates.

Russia’s New Belt and Road: Trade Key to Save Russian Plywood

In May, Wood Central revealed that Russia was ramping up birch plywood exports to China, surging more than 344% for the first three months of 2024, according to data provided by Roslesinforg – the Russian state-owned customs agency. Though still small, the Chinese market for birch imports has grown 20-fold since Covid, with Russia hopeful that the market could reach 1 million cubic metres within the next decade (a four-fold increase on last year).

“India is another market,” according to Nikolai Ivanov, the Vice President of External Relations for Segezha – one of Russia’s largest timber companies – who said the push into the market was “part of a long-term strategy” that would see Russia exporting 50 million cubic metres of timber into India every year: “This would represent 25% of Russia’s entire timber harvest, all the while helping India meet its surging demand for plywood, lumber and logs.”

And then there is Africa and the Middle East, with producers looking to undercut China and Vietnam to meet Saudi Arabia’s and United Arab Emirates’ twin construction booms. “Egypt—Africa’s largest consumer of plywood—South Africa, Nigeria, Algeria and Kenya also provide opportunities,” Lesrprom said. “In 2023, Africa’s total plywood consumption was 2,449 thousand cubic metres, with birch plywood making up 382 thousand cubic metres.”

It’s not just Plywood: Lumber production stagnates across Russia.

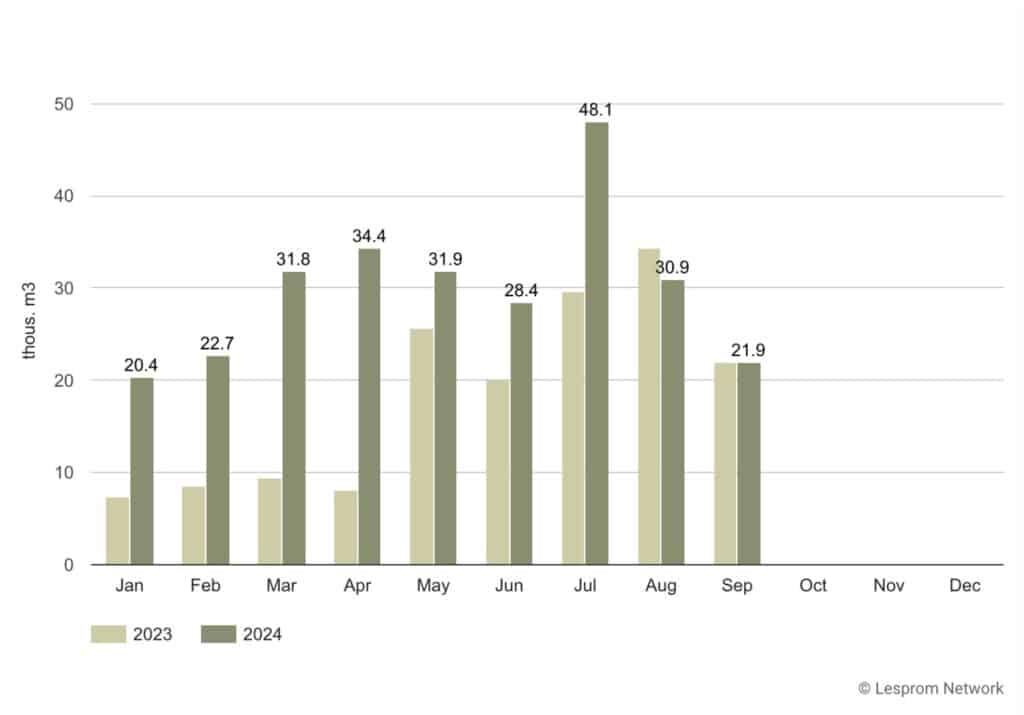

The challenges faced in plywood mirror Russia’s total lumber market, which has stagnated for the first three quarters of this year, according to new data obtained by Rosstat. “This stagnation mirrors broader trends in Russia’s wood sector, where some segments saw growth while others experienced declines,” Rosstat said, confirming that production reached 21.9 million cubic metres – a 0.03% increase from last year. “Wood pellet production (for example) experienced a sharp decrease, falling 21.9% to 758 thousand tonnes, indicating weaker demand or other operational challenges,” whilst plywood, particleboard, fibreboard and pulp remained relatively stable.

- To learn about the impact of the Ukraine War on Russian trade sanctions on the global timber market, click here for Wood Central’s special feature.