One of Australia’s furniture outlets is the latest to be heavily impacted by conflict in the Red Sea, which, combined with ongoing industrial action at local ports, is causing supply shortages and soaring freight costs.

It comes as Wood Central reported that inbound cross-laminated timber panels and glue-laminated timber beams, imported from Central Europe, were now arriving at Australian ports via the Cape of Good Hope rather than through the Suez Canal.

Now, The Australian reports that Greenlit Brands, the owner of two of Australia’s highest-profile retail brands (Fantastic Furniture and Freedom), is the first major retailer to acknowledge that disruptions caused by industrial actions and terrorist attacks in the Red Sea could result in product delays and cost blowouts as retailers look to recover costs.

“Compared to prior years, the business has not faced the same level of supply-chain disruption; however, (the DP World ports dispute has caused) delays and some shortages in stock availability,” a spokesman for Greenlit Brands told The Australian.

“Ocean freight rates are also increasing due to the Red Sea conflict,” they added. Wood Central reports that shipping costs have risen 243% since December, with further increases expected later this month.

Greenlit Brands has 146 outlets across Australia between both brands, accounting for more than AU $1.3 billion in gross sales. And whilst its Australian-made sofas are manufactured locally, Wood Central understands that the raw timber used in its fixtures and fittings comes from Southeast Asia – specifically, Vietnam (one of the ports impacted by the Red Sea conflict).

The industrial action on the ports flared up over pay and rostering, with the Australian also reporting that 50,000 containers are stranded at port. DP World, Australia’s second-biggest port container operator, has already estimated the delays have cost the Australian economy $84m every day since the industrial brawl began in October.

But that peace deal came at a price, with wharfies set to get a 25% pay rise over four years and a $2000 sign-on bonus – expected to flow through to higher charges for containers and port services.

At the same time that prices will increase at the port, terrorist attacks in the Red Sea have forced more than 100 different vessels to seek alternate routes, which has added at least ten days, more than 15% in additional shipping costs, effectively clogged the global supply chain of materials and products.

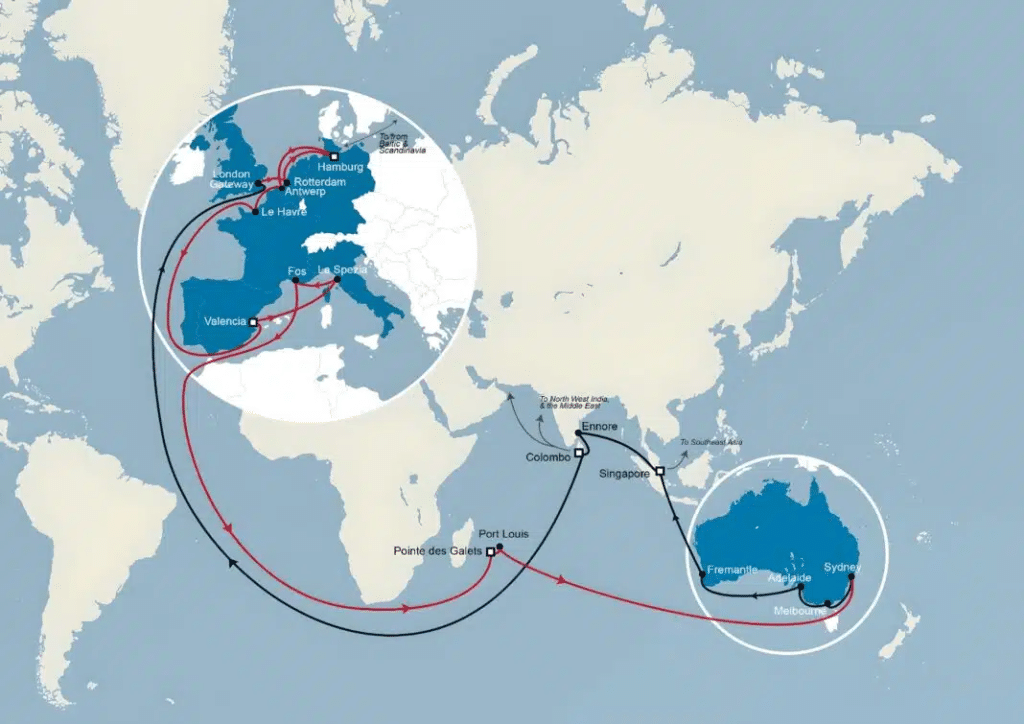

This has led the world’s largest freight companies, including CMA CGM, the world’s second-largest commercial vessel, to connect Australia and New Zealand to the global supply chain via the Indian Ocean.

Already, supply-chain shocks experienced through 2023 have impacted Greenlit Brands’ performance. According to the latest accounts, Greenlit Brand’s net losses on revenue have risen fourfold to $9m, driven by higher raw material input costs and increased supply-chain expenses.

Greenlit Brands, the local offshoot of Steinhoff International, has long been rumoured to seek a sharemarket float on the ASX. A spokesman for Greenlit Brands signalled there were no plans to take the company public yet: “Whilst Greenlit Brands remains committed to the shareholder’s direction and ultimately further divestments, there is no specific deadline for transacting the remaining businesses.”

“Greenlit Brands continues to focus on investing in its businesses, operations and people whilst continuing to assess and evaluate future potential strategic opportunities that are in the best interests of our shareholders.”

Greenlit Brands has shed a number of its businesses since the scandal erupted around its parent company, including the bedding business sale to Mr Kestelman, selling Plush-Think Sofas to rival furniture chain Nick Scali for $103m in 2021 and disposing of discount department stores Harris Scarfe and Best & Less.

The Red Sea disruption comes at a time when Wood Central reported in December that China, India and the ASEAN block are looking to Northern Sea Routes with Russia as a hedge against the ongoing conflict in the Gaza Strip.

Avoiding the Red Sea means abandoning one of the most common global shipping routes from Asia to Europe – with a surge in timber cargo entering European markets via China and the ASEAN region.

Indeed, more than 40% of Asia-Europe trade transits through the passage, with ships shunning the passage adding up to $1 million in fuel and weeks to its round trips.

In Australia and New Zealand, more than 20% of bulk imports and exports connect to Europe, and blockages in the global shipping system are already impacting mass timber, food, clothing, and furniture.

- For more information about the implications of the Red Sea Crisis on Global Timber Supply Chains, read Wood Central’s special feature.