Russia’s invasion of Ukraine—as well as the subsequent western sanctions—could drive up the cost of industrial roundwood and finished wood products by more than 3% over the next decade.

However, the long-term impact of the conflict is unlikely to move the needle, with the vast majority of forest-based products returning to pre-invasion levels over the next 10-30 years.

That is according to new research, Projected Effects of the Russian Invasion of Ukraine on Global Forest Products Markets, just published in Forest Policy and Economics. The study projects the global trade of timber under two scenarios—one in which an invasion did not occur and another in which the sanctions continue over the coming years.

“In the short term, which we define as within ten years of the end of the invasion, our model predicts an increase in price up to 3% for things like industrial roundwood and finished wood products,” according to Rajan Parajuli, the associate professor of forest economics and policy at North Carolina State University.

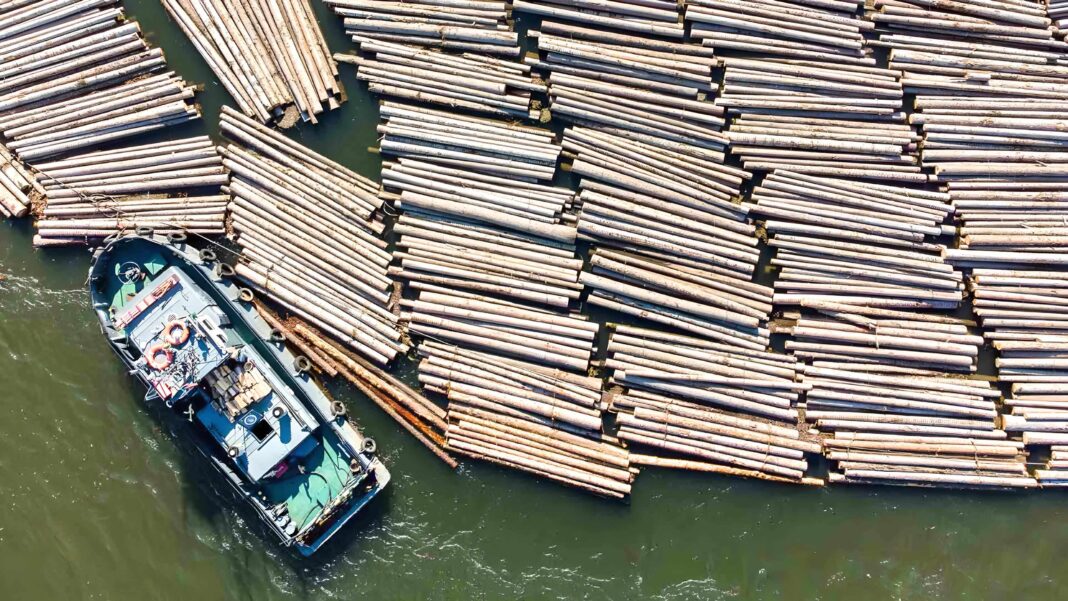

“Russia is a top producer of forest products, and they supply worldwide, so sanctions on them are very impactful. You must also factor in the disruptions in Ukraine, where the military operations will make things like timber harvesting very difficult.”

However, Associate Professor Parajuli said Russia is poised to regain the vast majority of its overall timber market share in the decades to come:

“Looking as far forward as 2050, the model predicts a lower overall disruption level as Russian industrial timber markets recover.”

Associate Professor Parajuli on the long term impact of sanctions on global timber markets.

Parajuli was part of a team of researchers – from both the North Caroline State University and the USDA Forest Service Forest Products Laboratory, which set baseline assumptions that the conflict would end next year and thus predicted that the global markets would begin returning to pre-invasion levels over the next 10-30 years.

Despite the lower overall level of disruption predicted in the long term, researchers do not expect that some smaller product markets will ever return to their exact pre-invasion states. Parajuli said that some effects may last beyond the end of the conflict.

“We found that products like wood-based panels, paper and paper board will not recover in Russia or Ukraine. These are not large markets, and our model predicts that if these countries cannot produce those products for a few years, other countries will move into that space.”

Associate Professor Parajuli on the impact of the conflict on wood-based panels, paper and paper board industries.

“The sanctions will cause higher prices, which we predict would lead resource-rich countries like the United States and Canada, China and some other Asian countries to ramp up production,’ he said, adding that “they will want to sell while the price is high.”

- To learn more about the Ukraine war, its impact on global timber markets, as well as it’s impact on the European Union’s Deforestation Regulation (or the EUDR), visit Wood Central’s special feature.