Foreign trade of Russian timber has plunged over 20% to 4.5 million cubic meters during the first quarter of 2023, according to the latest data provided by Roslesinforg, the Russian forestry regulator, overnight.

The drop is largely attributed to the EU’s sanctions against Russia over the war in Ukraine. The EU had previously been amongst the largest importers of Russian timber.

Before the conflict, Russia’s total share of the global softwood lumber trade stood at 22%. In 2021 exports from Russia to Europe increased by 16% to 5.2 million cubic meters.

In July last year, the EU introduced an embargo on all Russian wood – the USA, Japan, and South Korea also introduced trade restrictions, with Japan’s imports dropping 47.7% and the US and South Korea falling 40.3% and 18.7%, respectively.

The 2022 Data

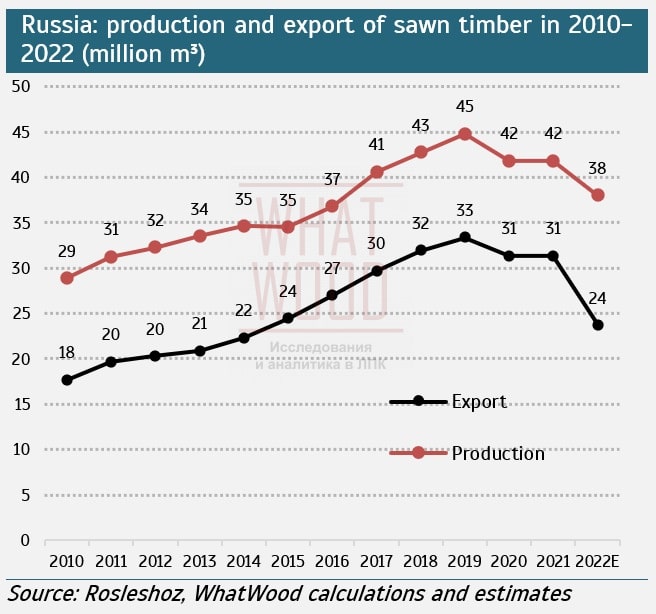

Last year, total Russian exports dropped 20.8% to 23.3 million cubic meters – with more than half of exports going through China.

Despite a Covid-related drop of 7% in Chinese consumption, China imported 13 million cubic metres of Russian timber. Uzbekistan, the second largest buyer of Russian timber, imported 1.9 million cubic meters of sawn timber.

Last year, total Russian exports dropped 20.8% to 23.7 million cubic meters – with more than half of exports going through China.

Despite a Covid-related drop of 7% in Chinese consumption, China imported 13 million cubic metres of Russian timber. Uzbekistan, the second largest buyer of Russian timber, imported 1.9 million cubic meters of sawn timber.

There have been multiple reports of China being used as a destination for Russian timbers successfully circumventing trade restrictions.

In August 2022, the UK Timber Importers Federation warned UK Consumers about the risk of Russian birch plywood using China as a ‘green lane’ to navigate trade sanctions.

And in October 2022, the Washington Post alerted its readers to the threat of Russian birch wood flowing to American customers, disguised as “Asian” products, despite US economic sanctions imposed on Russia over its invasion of Ukraine.

In November 2022, the publishers of Wood Central exclusively reported that China was turning Russian logs into engineered wood products with record shipments to Australia, mainly LVL formwork, which represents 40 percent of the Australian market.

What’s changed in 2023?

China and Uzbekistan remain the largest importer of Russian timber, accounting for more than 74% of exports in total. China purchased 2.88 million cubic meters of wood, an increase of 3.5%.

Its share in Russia’s timber exports increased to 63.6%, up from 48.6% in the same period the previous year.

But Russia is confident it can replace its lost trade by redeploying trade to China and a block of countries that have not introduced heavy trade sanctions.

Pavel Chasshchin, head of Roslesinforg, is expecting increased profitability of export to surge due to the stabilisation of the ruble and a jump in a share of ‘high-margin’ products.

High-margin products include birchwood and other plywood products, which can be manufactured into engineered products.

Reports of Russian ‘conflict timber’ via China, Kazakhstan, Kyrgyzstan, and Turkey

On Friday, Timber Development UK reminded its members to remain on high alert for illegal imports of conflict timber from Russia and Belarus.

New reports suggest that Russian birch plywood and other conflict timbers are being exported into America and other countries, including the UK, disguised as having originated in Vietnam, Asia, and China.

The Environmental Investigation Agency (EIA) says Russian birch plywood is being routed through Asia before being shipped to America. Most birch products exported from Vietnam to the United States originate in Russia.

According to Vietnam customs data, roughly 40,000m3 of birch plywood is transported monthly from Russia and China into Vietnam, where it is assembled into furniture and plywood and repackaged, with these countries listed as the country of origin.

TDUK members have also reported receiving birch plywood offers from the Far East’, and TDUK is urging its members to carry out their due diligence and ensure they know the timber’s country of origin before purchasing from new sources.

There are also concerns that conflict timber is being sold in Australia using false country-of-origin labels.

Unlike the European Union, Australia has not imposed an outright ban on timber from Russia and Belarus but has introduced 35% tariffs on wood products exported from the region.

The Australian Timber Importers Federation (ATIF) has warned its members that Russian beech is being blended into plywood in China before being shipped to Australia.

“Evidence suggests that increasing volumes of logs are currently being exported from Russia into China and then exported to other countries and manufactured into timber products,” ATIF’s statement said.

There have also been reports of some banned Russian and Belarusian timber entering the EU by claiming they have originated from Kazakhstan or Kyrgyzstan.

There have also been reports of some banned Russian and Belarusian timber entering the EU by claiming they have originated from Kazakhstan or Kyrgyzstan.

Nick Boulton, TDUK’s Head of Technical and Trade, says: “We would ask all our members to continue remaining vigilant against any organisations offering to supply Birch Plywood to the UK from the Far East or countries like Turkey, Kazakhstan, or Kyrgyzstan.

“Should Russian timber products be found in the UK/EU market, the importer and all customers who have purchased these products may be subject to legal action, fines, and reputational damage, which would also impact their trading partners in the manufacturing country.

“Always do your due diligence with potential new suppliers, especially when dealing with products that could be considered conflict timber.”