Global hardwood prices are surging, softwood prices are softening, and exports are shrinking, with the Russia-Ukraine conflict and a decade-low demand from China blamed for an increasingly uncertain and volatile market for forest products.

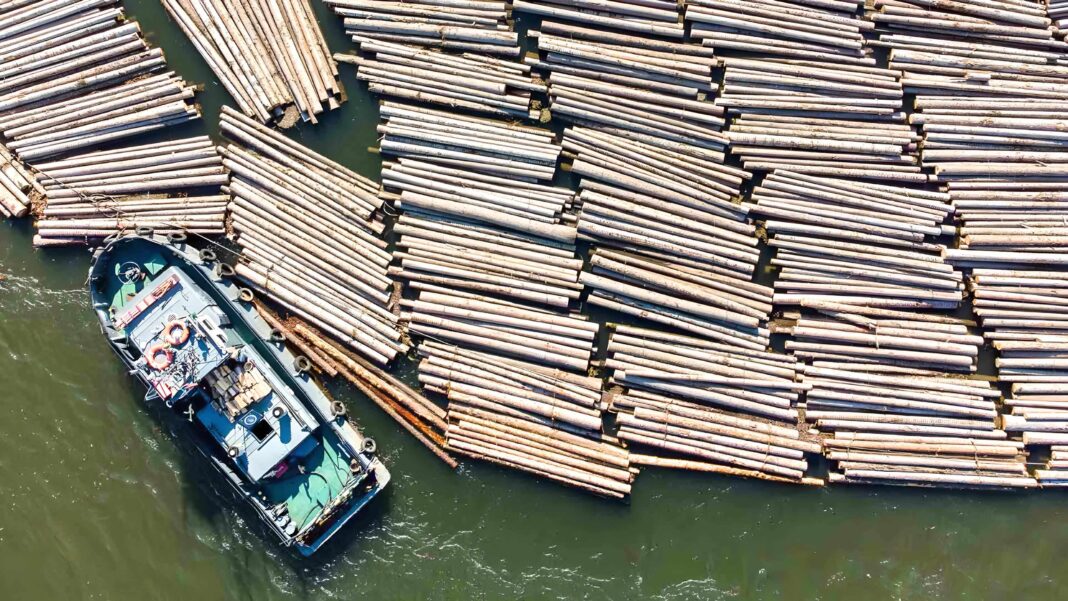

At the same time, the supply of global timber, fuelled by the trade of timber from Russia, Canada and the United States, fell for the first nine months – with Russian export volumes dropping by more than 33%.

That is the latest takeaway from the Wood Resources International (WSI) Global Forest Summary, which reports that the war has slashed prices and shipments for the year to September 2023.

It comes as export prices for Russian timber have almost halved since early 2022, with volumes crashing by more than 25% as sanctions – which have not only seen trade bans but all Western Companies’ exit from Russian assets, a freefall in Chinese demand and a weakening of the ruble against the dollar leading to a perfect storm.

As a result, Finland – which, until the sanctions, was Russia’s third-largest trading partner for imported forest products – has made up some of the shortfall, raising concerns that the increased use of forests for sawlog production is undermining the country’s commitment to carbon neutrality.

Due to sanctions, Russia’s trade is isolated to just ten countries – China, Kazakhstan, Belarus, Uzbekistan, Iran, Kyrgyzstan, the United Arab Emirates, Azerbaijan, and Tajikistan whilst domestic demand remains sluggish, with Wood Central reporting that Russian timber continues to infiltrate global supply chains.

Whilst the drop in softwood prices has seen European and North American producers drop production and consolidate operations, prices for hardwood logs have surged to a decade-high due to the tightening supply of resources.

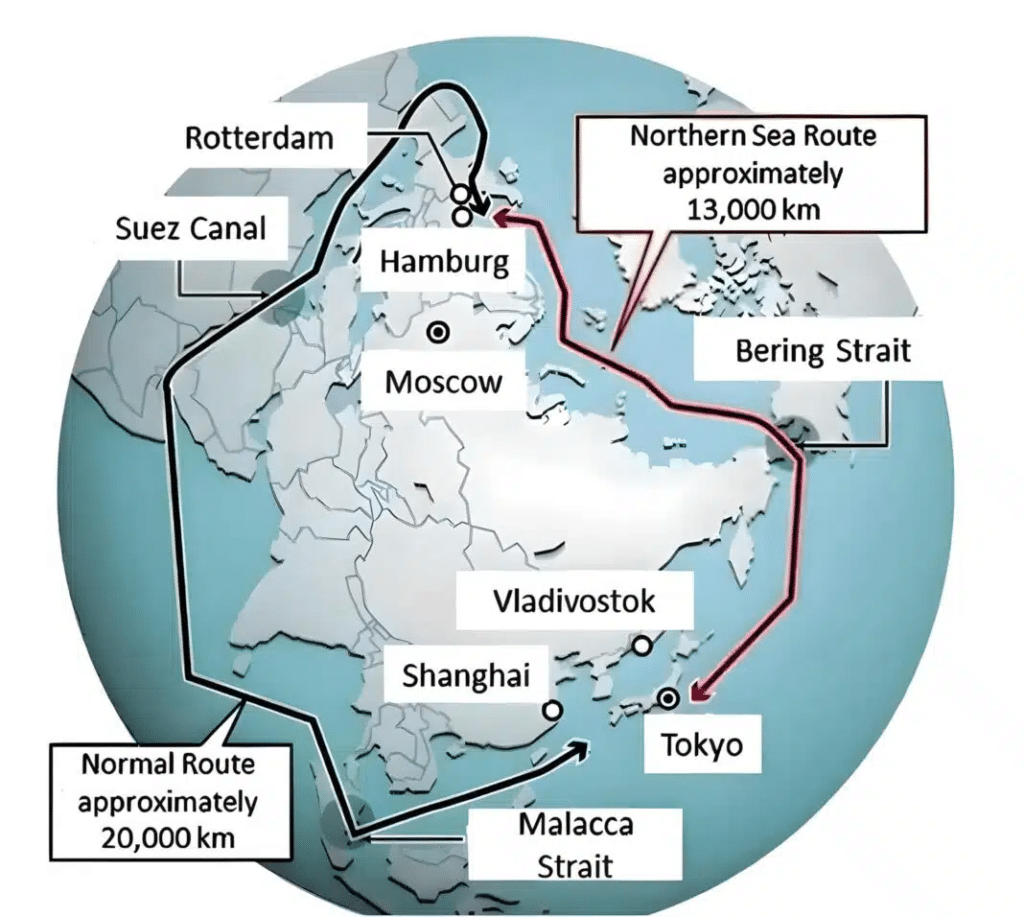

That rise, more than 44% on the Global Hardwood Fiber Price Index (HFPI) since late 2020, could increase further in the final quarter of 2023 due to the Gaza strife and its impact on the Suez Canal.

As identified in the report, producers are increasingly operating in a globalised market – with Sweden, for example, using global markers as a hedge to reduce reliance (from 80% to 55%) on EU markets.

Last year, Wood Central revealed that China, India and the ASEAN block are looking to Northern Sea Routes with Russia as a hedge against the ongoing conflict in the Gaza Strip.

- For more information about timber markets, the wood fibre markets, lumber markets, and the biomass market download the WSI report today.