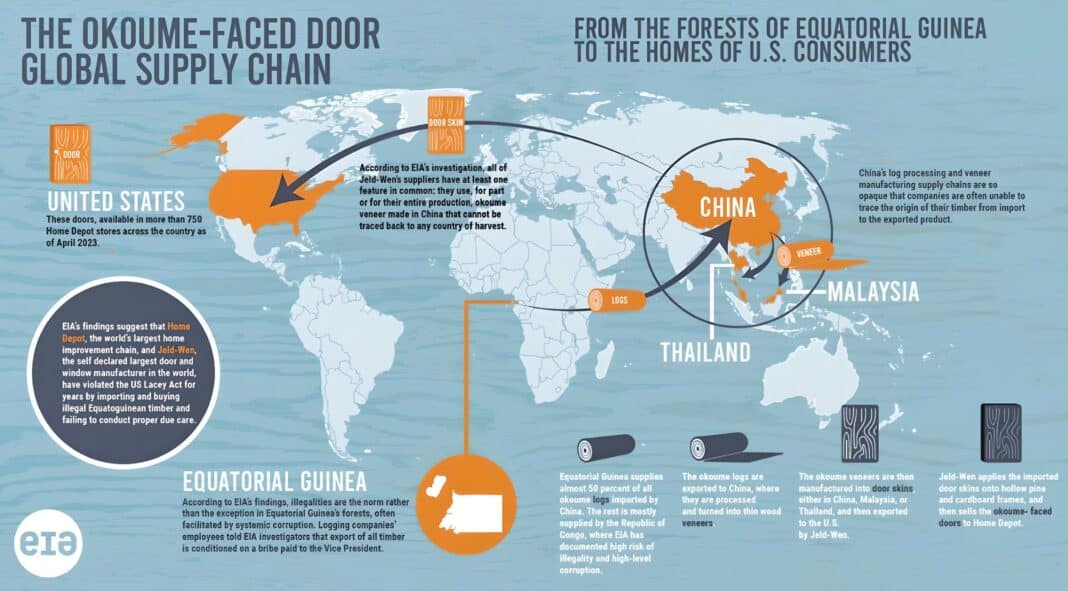

Millions of timber doors sold by the world’s largest door and window manufacturer, stocked in the world’s most famous home improvement chain, are now subject to illegal logging from one of the world’s most oppressive regimes.

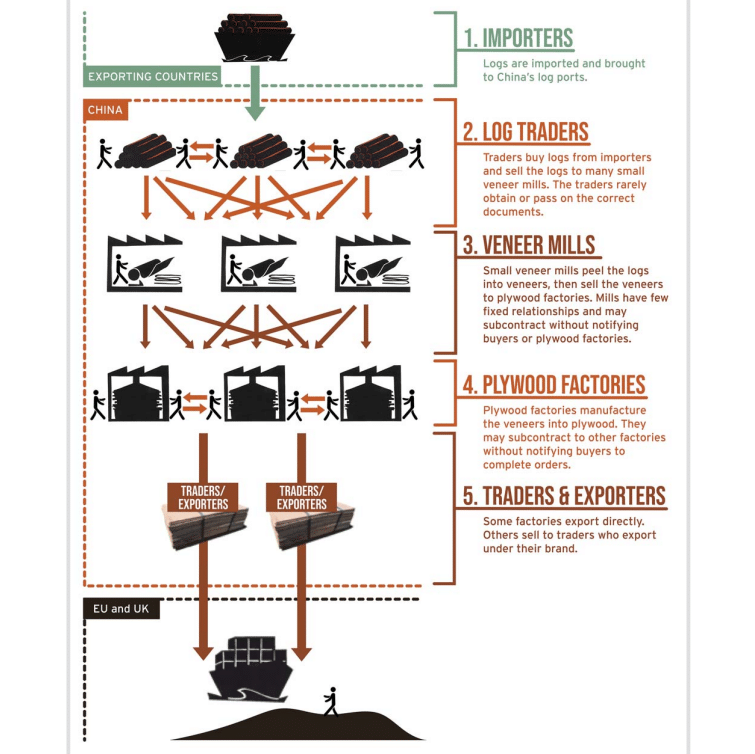

Described as “China’s Manufacturing Black Box”, logs are exported to China from the African basion – including Equatorial Guinea, the Republic of Congo and Gabon, are processed into thin wood veneer at China’s sprawling production mills, are then manufactured into door skins at Chinese-owned plywood factories in China, Malaysia and Thailand before being exported to the US.

Imported by window and door manufacturing giant Jeld-Wen, the Okoume door skins are applied to hollow pine and cardboard frames and sold as Okoume-faced doors in more than 750 Home Depot centres across the US alone.

According to a report by the Environmental Investigation Agency, “at least 1.2 million doors sold to US consumers (between 2017 and 2022) have a very high likelihood of containing illegal Okoume wood harvested in Equatorial Guinea,” with concerns that the US Lacey Act is inefficient in policing the surge of dubious timber coming from Chinese exporters.

Adding to the problem, China does not have a legal mechanism to address imports from deforestation, leaving an enormous loophole for Chinese importers to exploit – and further clarifies China’s business model as outlined in the “Lie Behind the Ply” report published in 2021.

Last week, Wood Central reported that China was reluctant to address deforestation outside its borders, with Beijing-backed timber companies treating the African Basin “like a conquered province.”

However, the implications could go much further with Jeld-Wen operating in 19 countries, including Australia and New Zealand, with the Australasian business recently subject to an AU $686 million buyout by a private equity firm.

That sale includes the leading Australian designer, manufacturer, and distributor of windows and doors, Corinthian® – however, Wood Central can confirm that timber doors from Okoume forests are not sold through the Corinthian range.

Wood Central understands the Jeld-Wen product in question has been incorrectly sold in-store with FSC certification, with EIA’s research reporting “no valid FSC certified Okoume forests exist in either Equatorial Guinea or the Republic of Congo, which provide the vast majority of Okoume logs exported to China for processing into door skins.”

According to Jeld-Wen, “FSC certification is a priority because it responds to increasing customer expectations and competition in the region—but also because it’s the right thing to do.”

Its most recent ESG Report claims, “All Jeld-Wen doors in Europe comply with EU timber regulations, which aim to prevent the trade in illegal harvesting of timber into the European market.”

However, this statement is at odds with what appear to be Jeld-Wen’s practices for sourcing Okoume in the North American market.

“Even with pandemic-related disruptions, EIA’s analysis indicates that Jeld-Wen imported 964 40-foot containers of Okoume-faced door skins from 2018-2022, and 378 that included Okoume door skins mixed with other species,” the report said.

Significantly, more than 50% of the Okoume wood used in the doors is from Equatorial Guinea, “one of the most oppressive and corrupt regimes in the world,” and according to EIA, “ranks close to Afghanistan and North Korea in Transparency International’s Corruption Perception Index.”

By the numbers, the regime provided more than 3.4 million tons of Okoume logs, worth more than AU $1 billion (or US $750 million) from 2014 to 2021, “representing 50% of the Okoume logs imported by China by weight.”

“From 2010 to 2021, 81% of all timber and 95% of all logs exported (by value) from Equatorial Guinea went to China,” the report said.

Consequently, Equatorial Guinea is behind just PNG and the Solomon Islands as China’s third-largest import market for tropical hardwood timbers. According to the report, log exports to China from Equatorial Guinea increased 47% per year between 2010 and 2017.

Wood Central spoke to an importer this afternoon who said the relationship is akin to blood timber – a play on the famous blood diamond trade.

Despite being the fourth most prosperous country in Africa, Equatorial Guinea is among the most corrupt countries on earth, with nearly 80% of the population living under the poverty line.

The scale of the corruption has led EIA investigators to report that Teodorin” Nguema Obiang – the son of the president, former Minister of Forests, and current Vice President – has a commercial agreement with the Chinese-connected Wan Peng and the Rimbunan Hijau groups “where he collects a bribe for each cubic metre of timber exported from the country.”

From 2015 to 2021, that amounts to more than AU $40 million (approximately US $24.6 million) per year from 2015 to 2021 on Okoume exported to China alone.

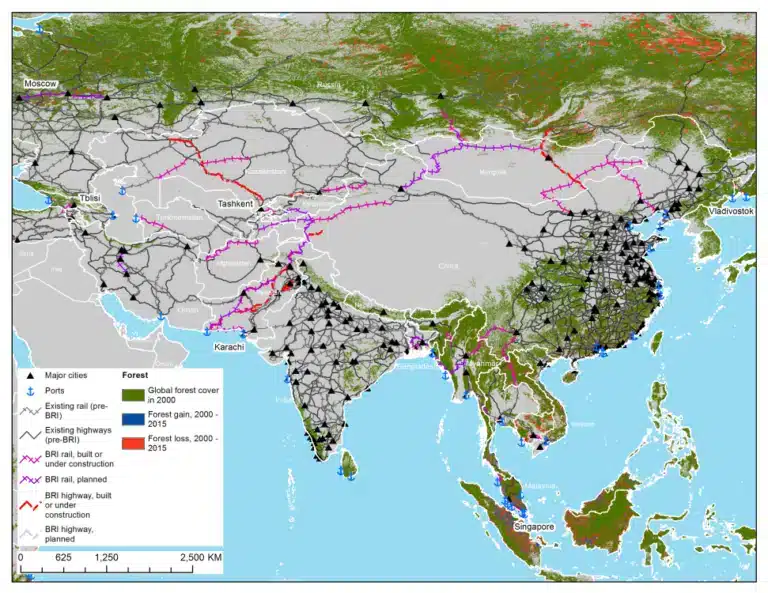

In the past, Wood Central has reported on China’s deep connections with African forestry, driven by its connection to the Belt and Road initiative.

China has invested heavily in Central Africa in recent years, with more than 4.2 tons of timber exported over the past decade, with a constant supply for China’s veneer and plywood manufacturing hubs.

That includes the Congo Basin, where Wood Central reported on the Chinese multi-million dollar conflict racket last month, and Gabon, where more than 40% of the country’s sawn wood is exported to China and manufactured and sold into western markets, including the US.

However, with log exports expected to cease in the Congo and Gabon – EIA reports, the illegal timber trade is only likely to escalate, given the surge in demand for timber windows and doors.

The complication, according to the EIA, is that whilst the US can produce or source “single-consumer of wood products” like structural pine used in house framing or from neighbouring Canada, it has much greater difficulty in sourcing wood-based cabinets, flooring, weather-resistant decks and wooden furniture.

“In many instances, these products are made of tropical wood that presents desirable colours, grains, and durability, and are in the vast majority of cases sourced outside of the country,” the report said.

This has led the US to crack down on countries like Vietnam, which imports more than 30% of the manufactured hardwood furniture in the US marketplace.

In the first quarter of 2022 alone, the US imported hardwood products from 128 countries worth AU $13 billion (or US $9.2 billion).

“While some supply chains directly connect the US to the country where the trees were harvested, a significant share of hardwood products are imported into the US through complex international supply chains.”

“After trees are cut in a tropical forest, the logs are shipped to a global processing hub – if not transshipped between several of them – and the finished or semi-finished product is exported to the US.”

To address the concerns, the EIA is now demanding the following actions:

- Home Depot: a) immediately remove all Okoume-faced doors from its shelves and stocks; b) urgently review and revise its wood purchasing policy to include unbroken traceability to the point of harvest for all wood products; c) make information about the origin of wood products easily accessible to customers;

- Jeld-Wen: suspend the import and manufacture of Okoume-faced door skins until the company has developed and implemented a compliance plan at least as thorough and detailed as the one Lumber Liquidators accepted in its guilty plea;

- US Department of Justice: investigate Jeld-Wen and other companies importing and selling products containing Okoume to determine if the Lacey Act is being violated and, if so, prosecute those responsible;

- US Animal and Plant Health Inspection Service: a) adopt and implement a robust plan to monitor and investigate Lacey Act compliance, using available data and technology to improve timely analysis of high-risk imports; b) radically improve the information available to the public regarding Lacey Act Declarations;

- Government of China: adopt regulations to implement the amended Article 65 of the national forest code, clarifying its application to imported timber;

- International shipping lines, including Maersk and CMA-CGM, stop their engagement in the corruption-enabled timber export from Equatorial Guinea and put the necessary due diligence mechanisms in place to respect national log export bans.

For more information, including a copy of the 39-page report from EIA click here.