The Netherlands has emerged as the European country most impacted by the push to establish the European Union Deforestation Regulation.

Last month, Wood Central reported that Indonesia called on the Dutch to oppose the EUDR, with trade reaching US $6.23 billion in 2022.

From the sidelines at the G20, Indonesian Trade Minister Zulkifli Hasan urged the Dutch to push back against the regulation, urging it to “minimise barriers for Indonesian products that meet sustainable standards to enter the EU.”

Indonesia is the world’s fourth-largest coffee export market and ranked sixth and eighth for global pulp and paper products – with a recent report highlighting that the world’s largest pulp and paper companies are “unprepared” for the new regulation.

Wood Central can confirm that the Netherlands imported the most goods at risk of deforestation from non-EU countries last year.

According to Statistics Netherlands, the country’s shipping ports are Europe’s busiest for timber from locations at risk of deforestation.

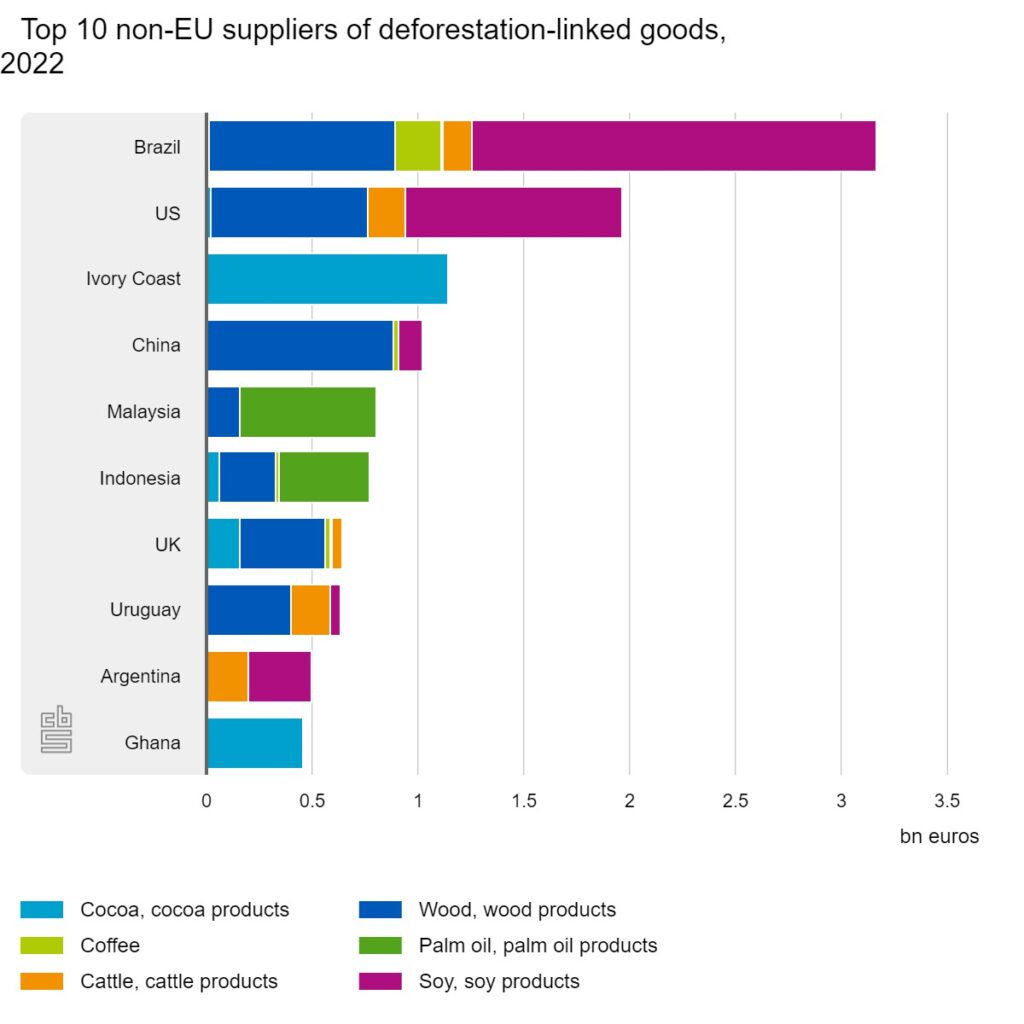

The largest share came from Brazil – with large timber and soy imports accounting for 3.2 billion Euros last year alone.

It also reveals that the Dutch are the largest importer of soy, palm oil and cocoa and, most significantly, the region’s second-largest importer of wood products.

Wood Central understands that the Dutch exposure to deforested wood and wood-based products is extreme, with the country importing more wood than soy, palm oil and cocoa combined.

As a popular trading route for European and global markets, “95% of Europe’s most lucrative markets are within 24 hours of Amsterdam or Rotterdam.“

Add to that its supportive legal and tax structures, its logistics and technology infrastructure, and it’s no wonder the country is among the top business locations according to the World Competitiveness Ranking by the Institute for Management Development.

Since 2002, the Dutch trade in wood from non-EU countries has boomed, with imports doubling over the past 20 years (125%) and is followed by cocoa (67%), beef (+53%) and palm oil (+19%).

In addition to Brazil, Chinese timber furniture is among the country’s top imports – China uses the country as a trading post to supply the European markets.

In recent years, China has invested heavily in Central African forest resources to meet global demand for furniture markets.

As reported by Wood Central last month, 4.2 million tonnes of timber leaves Central Africa, which is processed into furniture products and sold directly to North American and European markets by China or Vietnam.

The Dutch also import a significant volume of goods from within the EU that are at risk of deforestation – with wood and wood products mainly from Germany, Belgium, and Sweden traded to global markets through the Port of Rotterdam.

Of the total imports that transition through the port, 28% are re-exported abroad, 33% are traded into European markets after processing, and 39% remain in the country for direct consumption or secondary processing.

In May, the European Parliament approved the EUDR, which mandates that companies prove their products do not originate from deforested or forest-degraded lands, or they may face substantial penalties.

The new regulation, which comes into effect next year, will see the EU ban importing and selling products like beef, soy, palm oil, and cocoa associated with deforestation and infringing indigenous peoples’ rights.

Last year, the Netherlands Minister for Foreign Trade and Development Cooperation, Liesje Schreinemacher, outlined the country’s new green agenda, which included a reduced reliance on deforested products.

“Transitioning to a sustainable, green economy is key for my government, and we are calling on other countries to do the same,” Minister Schreinemacher said.

“We must rethink how we use scarce resources to ensure that the SDGs can be achieved in less than eight years.”

Under the new regulation, non-compliant companies may face penalties of up to 4% of their turnover in an EU member state. EU countries will conduct compliance checks to ensure adherence to the regulations.