A huge increase in standing timber (which has doubled in 45 years) and declining housing demand is to blame for persistently soft lumber prices, which are now crunching margins for timber companies in Arkansas and several swing states in the Deep South.

That is according to leading economists from the Arkansas Center for Forest Business, which reports that one of the United States’ most timber-dependent economies is grappling with an increasingly tricky lumber market – and could get worse before it get’s better.

Last week, Wood Central reported that the housing crisis – specifically in low- and middle-income detached, semi-detached, and multifamily residential areas – is poised to shape the presidential elections, with the American building and construction market now flooded with lumber.

Now Freddie Mac, one of the United States’ largest home loan mortgage government-sponsored enterprises (GSEs), has reported that “net timber growth (in the American South) continues to exceed harvests by 25 million tons annually,” with total standing timber in the state (of Arkansas) nearly doubling since 1978.

According to Nana Tian, an economist and associate professor at the University of Arkansas at Monticello, “the strong supply of timber in the South—including Arkansas—has existed for a long time. (However) the decreased timber prices—especially after the Great Economic Recession of 2008—have made many landowners hesitant to harvest.”

“The predicted housing starts decrease contributes to a relatively decreased demand in timber, so combined with a downward trend in demand and market price, the timber supply is very strong.”

For Associate Professor Tian, this “wall of wood” is exerting downward pressure on timber prices:

“Typical prices for pine pulpwood in Southeast Arkansas are less than $2 per ton. Prices often dip below $1 per ton as delivery prices tighten and logging costs are affected by inflation and unpredictable limits on mills accepting timber. Compared to the last decade, that price has decreased,” Tian said, adding that capacity at Arkansas sawmills has fallen to about 85%, primarily driven by a huge reduction in demand.

Wood Central understands that the Arkansas economy is the most forestry-dependent of all the southern states (and second only to Wisconsin across the US), with more than 4.1% of the state’s gross domestic product—or about $7 billion—connected to timberlands.

“With uncertain economic conditions, global unrest in major energy and fertilizer producing regions, an election year, and a decline in predicted US housing starts, the Arkansas forest industry will see little to no growth in 2024,” according to the Arkansas Center for Forest Business.

For Tian, the factors that could help strengthen the industry include:

- Embracing climate-resilient solutions, such as creating a wood product-friendly consumer base.

- Contributing to bioenergy projects such as biomass-to-electricity.

- Combined-heat-and-power generation.

- Wood pellet segments.

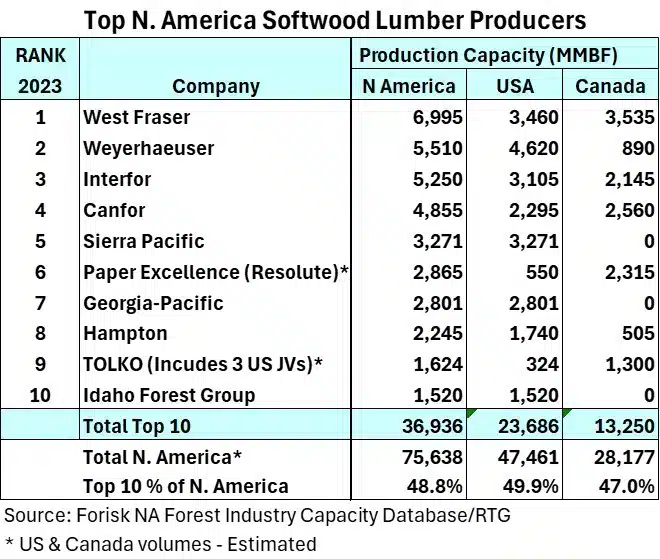

The new concerns come after Wood Central reported that the North American market (namely the United States and Canada) remains global timber’s safest bet despite “having a few headwinds” – with demand fuelled by an uptake in single-family houses that use three times more lumber than multifamily units.

That is according to Russ Taylor Consulting, one of the world’s top forest consultants who has analysed US, Canadian, Russian, Chinese, and European timber markets for the past 30 years.

According to Mr Taylor, this has created an environment where “a flood of sawmill expansions and new greenfield mills over the last six to seven years (which) have added large amounts of lumber capacity, mainly in the US South.”

“As lumber prices moved below breakeven in some regions in 2023, higher-cost mills were closed, sometimes to rationalise timber supplies around multiple company sawmill sites. Nine sawmills were permanently closed in 2023. So far in 2024, 3 new sawmills have started operating in the US South while nine more sawmills—in all regions of North America, except Eastern Canada—have announced closures.”

These changes have created an environment where Southern Yellow Pine, produced from mills in the American South, trades at significant discounts: “Many Southern Yellow Pine sawmills are now below cash costs, resulting in some temporary and permanent sawmill curtailments in the South—something not seen since the housing market collapse 15 years ago,” he said, adding that “mill capacity curtailments are expected to allow prices to move higher over the next few months.”

- To read the complete analysis of global wood markets, visit the Russ Taylor Consulting website.