The North American market remains global timber’s safest bet despite “having a few headwinds” – with demand fuelled by an uptake in single-family houses that use three times more lumber than multi-family units.

That is according to Russ Taylor Consulting – one of the world’s top forest consultants who, for the past 30 years, has analysed US, Canadian, Russian, Chinese and European timber markets.

Mr Taylor, who will present at the Global Wood Summit in Vancouver later this year, said lumber demand and prices in Europe, China, and Japan remain weak, “negatively impacted by oversupply, high-interest rates, and a lack of consumer confidence.”

“Essentially, the global lumber markets are not doing too well, as there is still too much supply chasing weak to perhaps stable demand,” Mr Taylor said, adding that “the global outlook for 2024 is for flat to perhaps some increase in demand in a few areas.” However, he said, “stable markets will still require a constrained supply – which could be a challenge in some markets.”

Yesterday, Wood Central reported that Europe’s major timber-producing economies, reeling from massive biomass shortages, have led to a significant contraction in European lumber entering Chinese ports – with Russia and Belarus now responsible for up to 70% of all Chinese imports.

According to Chinese Customs, published yesterday, lumber production from Finland (down 25%), Germany (38%), and Sweden (42%), has created a “pricing disconnect” between the price of raw materials and the price of lumber produced – causing the cost of raw materials to spike as volumes sank.

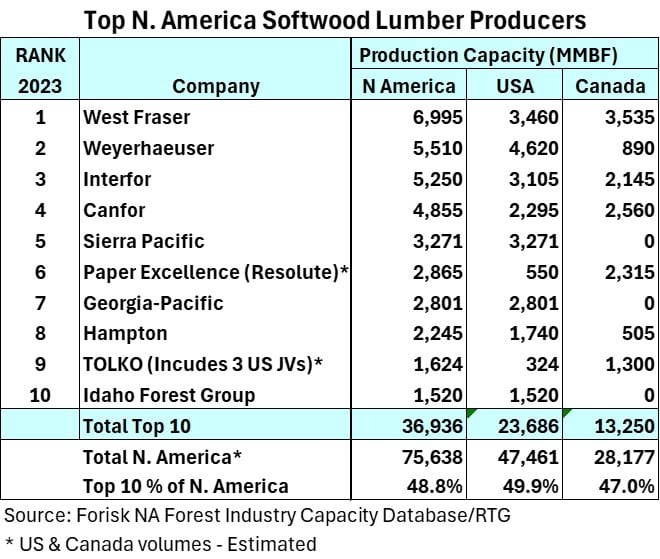

In North America, where the top softwood manufacturers account for 49% of the total production (or 36.9 billion feet of lumber), sawmill capacity dipped by 2% last year amid a shift in production from the Pacific West and British Columbia to the American South.

According to Mr Taylor, this has created an environment where “a flood of sawmill expansions and new greenfield mills over the last six to seven years (which) have added large amounts of lumber capacity, mainly in the US South.”

“As lumber prices moved below breakeven prices in some regions in 2023, higher-cost mills were closed, sometimes to rationalise timber supplies around multiple company sawmill sites. Nine sawmills were permanently closed in 2023. So far in 2024, 3 new sawmills have started operating in the US South while nine more sawmills—in all regions of North America, except Eastern Canada—have announced closures.”

These changes have created an environment where Southern Yellow Pine, produced from mills in the American South, trades at significant discounts.

“Many Southern Yellow Pine sawmills are now below cash costs, resulting in some temporary and permanent sawmill curtailments in the South—something not seen since the housing market collapse 15 years ago,” he said, adding that “mill capacity curtailments are expected to allow prices to move higher over the next few months.”

As for the future, Mr Taylor is confident that the second half of the year will be better than the first half for global timber markets, saying that “early signs indicate that this could be very possible.”

- To read the complete analysis of global wood markets, visit the Russ Taylor Consulting website.