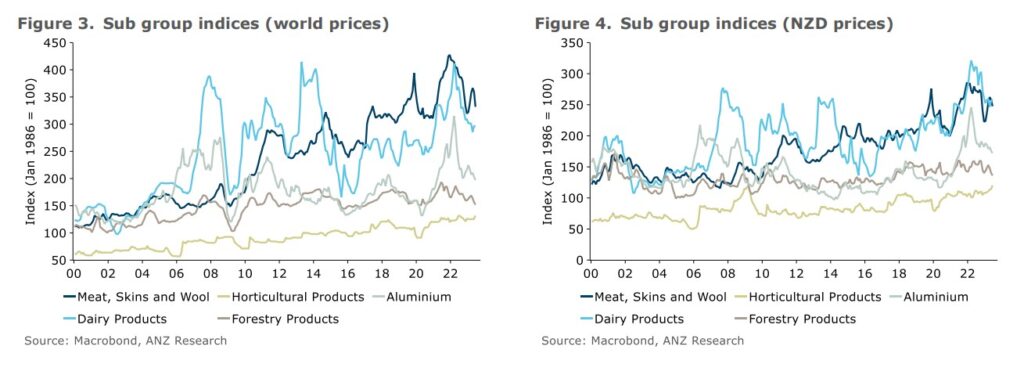

New Zealand’s log export prices continue to tumble, with slower-than-expected Chinese economic growth to blame for prices dropping 21% over the past 12 months.

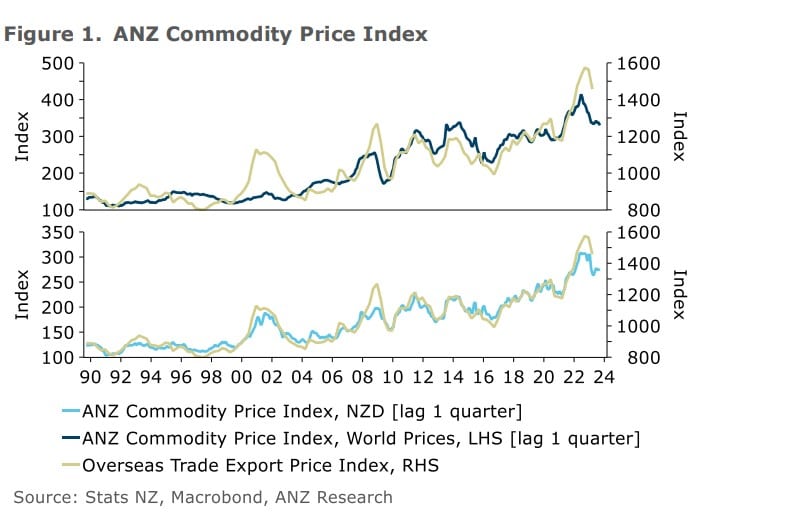

The data published by ANZ Research reports that the ANZ Wood Commodity Price Index fell 2.3% to June 2023.

According to ANZ agricultural economist Susan Kilsby, the forestry index dropped 3% with “demand from China for log weak, there are few alternatives for raw logs.”

The latest index supports data compiled by Scion with A-grade log prices to March 2023 dropping from NZD 130 to 133 to NZD 112.

According to Scion, up to 55% of New Zealand’s log exports are connected to China, with log prices riding high in 2021 amid the Chinese construction boom.

Last month, Wood Central reported that ASB Bank predicts a “timber tantrum” with slower export demand and softening local demand due to higher interest rates, low population rates and a less acute housing market.

The ASB Bank reports that NZ’s reliance on China as an exporter market is stronger than the Scion data (from June 2022), with more than 60% of sawn timber exported to China.

The one consolation prize, according to Economist Nathaniel Keall, is that freight costs have eased substantially.

According to ANZ Research, shipping costs have softened due to tightening global economic conditions reducing demand for goods.

PF Olsen’s latest report, which looks at Wharf Gate (AWG) prices for logs in May 2023, also points to a steep decline in average month-by-month average prices that exporters can sell timbers for at the port, including freight costs.

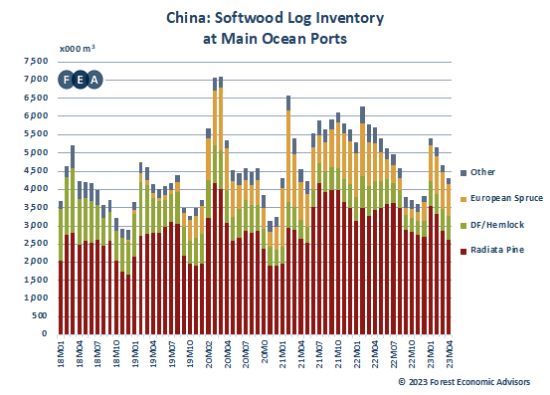

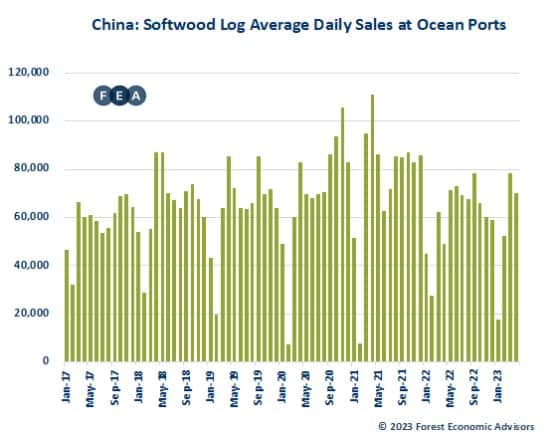

The latest data provided by Forest Economic Advisors (FEA), as reported by Wood Central last month, points to an 8% decrease in the cubic stockpile of softwood log inventories held at Chinese key ports.

The problem for New Zealand exporters is that China’s construction market – fuelling demand for softwood – continues to soften.

As China enters its summer months – a period associated with reduced construction activity – the likelihood of a significant increase diminishes.

Cashflow constraints remain a significant issue for log buyers and construction companies in China.

PF Olsen reports that the construction sector experienced its longest average payment delay, averaging 96 days.

A notable drop in factory activity, reflected in April’s China Caixin Purchasing Managers’ Index (PMI) falling to 49.5, adds to market uncertainty.

The PMI is a trusted tool used internationally to monitor macroeconomic trends.

A PMI below 50 indicates a contraction in the manufacturing economy, heightening fears of a global slowdown and underperformance in the property market compared to prior forecasts.

So where does this leave the NZ market?

As reported in May 2023, local contractors are pushing for new markets.

Allan Laurie, Managing Director of Laurie Forestry, identified India as a potential market.

Demand for timber is surging in India, with the country emerging as a key market for Australia amid the China log export ban.

According to data provided last week, India accounted for 91% of Australian softwood exports for April 2023 – marking a 23-month highpoint for the country’s log exports.

However, Europe presents the greatest opportunity for NZ’s radiate pine.

“Europe is a standout. We’re seeing significant reductions in harvest across Europe of the softwood species, and that must be destined to continue. So we should be looking for opportunities in Europe also,” Mr Laurie said.

According to Hakan Ekstrom, publisher of US-based Wood Resources Quarterly, Australia could also provide an important Trans Tasman market for the county’s structural timbers.

“However, with the outlook of softwood lumber prices increasing worldwide, the importation of lumber from Europe could become costlier,” Mr Ekstrom told Wood Central last week.

“This scenario could open opportunities for shipments of logs and lumber from New Zealand to Australia in the coming decade (this would require higher timber qualities than for logs shipped to China).”

Latest commodity data sparks fears of a double-dip recession

As reported by the NZ Herald, the commodity price downturn will put added pressure on the New Zealand economy, which is already navigating the recessionary headwinds of high-interest rates in tandem with sticky inflation pressures.

Broadly though, falling global prices are expected to be a disinflationary force and should ultimately flow through to lower domestic retail prices.

Many economists are forecasting a double-dip recession, with the economy bouncing briefly out of technical recession in the June quarter but another downturn later this year.

A report published today by Kiwibank economists said they expected to see another dip from the third quarter to the first quarter of 2024, with growth through 2024 remaining weak.

Kiwibank lifted its growth outlook marginally on expectations that higher net migration will offset pressure from interest rates and export prices.