After rising to record highs in 2021, NZ forestry prices have experienced a subdued past 18 months with no significant rebound on the horizon, according to new data released by NZ-based ASB bank over the weekend.

Economist Nathaniel Keall said of all New Zealand’s major exports, the forestry sector is the most dependent on the Chinese market; hence the “timber tantrum” has suffered the most from the Chinese slowdown.

Almost 60% of NZ forestry exports are China-bound, compared to about 40% of dairy exports, 40% of meat exports, and 20% of horticulture exports.

Meanwhile, local demand has also been progressively slowing, with higher interest rates, low population growth, and a less acute housing shortage all cooling the local property market.

“If there is one consolation prize for exporters, freight costs have eased substantially over the same period,” Keall said.

With the Chinese economy projected to rebound after its dismal 2022 performance, some exporters will be hopeful that strengthening property market activity boosts forestry demand and supports global log prices.

“For our part, we expect any price gains to be modest.

On the domestic front, support for the forestry market from the local property market also looks “fairly precarious”.

While the strong near-term pipeline of building work has kept construction activity looking pretty resilient, high-interest rates and cooling house prices are increasingly weighing, with business surveys showing construction expectations are deeply in the red.

“That dynamic is set to remain a feature over the remainder of 2023 and the beginning of 2024.

“The good news is that with net migration proving much stronger than anticipated and the Reserve Bank getting closer to the end of the hiking cycle, the housing market will eventually turn, but probably not until next year,” Keall said.

Data from PF Olsen and FEA ‘China Bulletin’ support the ASB projections

New Zealand’s export log prices are in decline, reaching their lowest point since July last year, according to a new report from PF Olsen.

The report highlights a drop of $22 per JASm3 at Wharf Gate (AWG) pricing for logs in May after a $20-25 decline per JASm3 in April.

JASm3 is the Japanese Agricultural Standard (JAS) and is an industry metric used to measure small-end diameter logs – largely structural timber for export. The Wharf Gate (AWG) is the price exporters can sell timbers, including additional freight costs.

The price drop is attributed to several factors.

Earlier this month, Wood Central reported that the price for A-grade log exports dropped from $78-80 (USD) to $68-70 (USD) per JASm3. Managing Director of Laurie Forestry, Allan Laurie, said “prices must be north of $120” for harvesters to break even.

When accounting for the additional cost of freight (CFR), log prices have dropped too $111 -$113 (USD), marking the lowest prices since July 2022 and $10 below the five-year average for log exports to China.

As China enters its summer months – a period associated with reduced construction activity – the likelihood of a significant increase in the near future is diminishing.

Latest Data from Chinese Ports

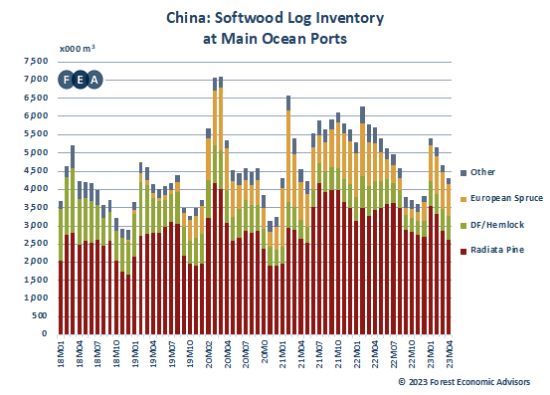

In a report published in Friday Offcuts, Forest Economic Advisors (FEA) has identified several important trends in softwood log inventories at China’s key ocean ports. FEA reports that the stockpile of softwood logs stood at 4.31 million cubic meters as of April 22, 2023, an 8% decrease from the past month.

The FEA’s monthly China Bulletin monitors forest products trade data. The bulletin issued on Friday identified some key trends:

- Radiata pine log inventory volumes sourced from New Zealand and South America amounted to 2.62 million cubic meters. This figure represents an 8% decline from the previous month, making up 61% of the total log inventories.

- Log volumes of North American Douglas-fir and hemlock stood at 647,000 cubic meters. This figure represents an 8% increase from the previous month and accounts for 15% of the total log inventories, up from 13% in late March.

- European spruce log volumes stood at 886,000 cubic meters, a decrease of 12% from the previous month, making up 21% of the overall log stocks.

- Softwood log inventories from other countries (including Japanese sugi and European red pine logs) amounted to 157,000 cubic meters, a decrease of 25%.

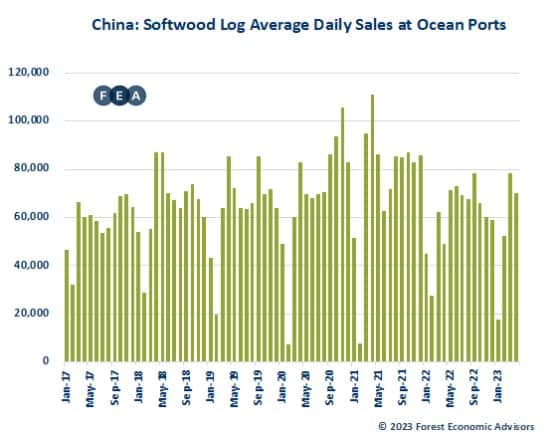

In the first three weeks of April, average daily sales at ocean ports were estimated to be 70,000 cubic meters. This is higher than the 49,075 cubic meters in the lockdown impacted April 2022 but lower than the 110,875 cubic meters in April 2021.

The continuous downward trend of log wholesale market prices was also highlighted, with a 40–60% drop in pricing observed at Taicang and Lanshan, compared to values from late March.

With high stock levels of older European spruce logs still posing the largest risk factor that could trigger a further price decline, FEA concludes that traders and distributors may need to lower prices.

FEA predicts a decline in the arrival of new spruce logs post-May, given that the orders confirmed during December and January have now been completely dispatched. This development might result in a sizeable reduction in the stockpile of spruce logs.

Worrying data emerging about the Chinese economy

Cashflow constraints remain a significant issue for log buyers and construction companies in China.

PF Olsen reports that the construction sector experienced its longest average payment delay, averaging 96 days.

A notable drop in factory activity, reflected in April’s China Caixin Purchasing Managers’ Index (PMI) dipping to 49.5, adds to market uncertainty. The PMI is a trusted tool used internationally to monitor macroeconomic trends. A PMI below 50 indicates a contraction in the manufacturing economy, heightening fears of a global slowdown and underperformance in the property market compared to prior forecasts.

View China’s latest PMI index here.

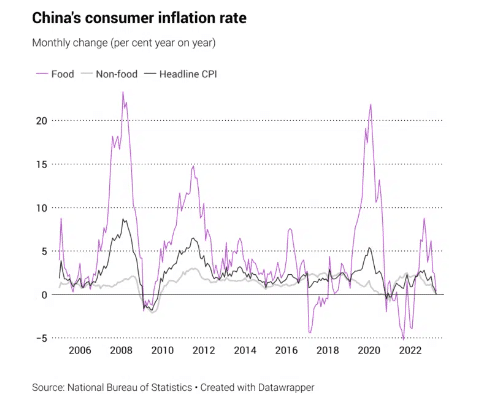

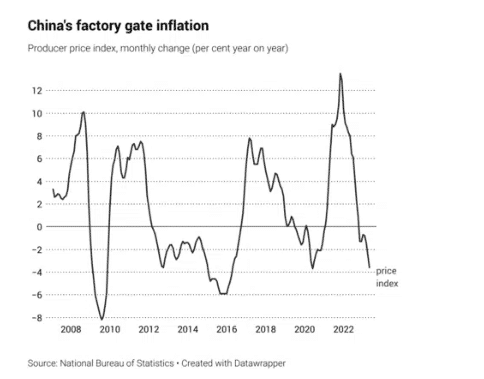

Last week, Wood Central reported on China’s worrying Consumer Price Index (CPI) and Producer Price Index (PPI) – which tracks the prices that factories charge wholesalers.

“Producer price deflation deepened last month to a 35-month low, and consumer price inflation dropped to its smallest point in more than two years. Although reopening pushed up services inflation, this was more than offset by lower food and energy inflation, driven largely by base effects,” said Capital Economics.

Despite the 2020 ban on Australian logs and timber imports being revoked, Chinese log buyers are not forecasting a significant increase in supply from Australia, especially in light of the prevailing price levels.

New Zealand Domestic Market

PF Olsen also reported a slowdown in New Zealand’s domestic log market, leading many mills to scale back orders.

Even though prices held steady over the second quarter, New Zealand has an excess supply of local structural timber products. The lockdown measures during the Covid-19 pandemic sparked a surge in DIY projects, such as home renovations and deck-building, reducing the available household discretionary spending.

With rising interest rates and new laws making it more difficult to acquire residential investment properties, New Zealand is in the middle of a market correction. While there are ongoing projects related to logistical warehousing, these require less timber than residential projects.