Australia has enough capacity and supply to meet local demand for mass timber projects, and whilst imported cross-laminated timber, glulam, and laminated veneer lumber still occurs from time to time, the reasons are commercial rather than lack of supply from the country’s growing number of manufacturers.

That is according to two of Australia’s largest mass timber manufacturers – Australian Sustainable Hardwoods (ASH) and Xlam, certified by Responsible Wood and PEFC – who spoke exclusively to Wood Central about the impact of the Red Sea Crisis on the Australian building and construction industry.

“Australia has more capacity and supply locally than what is required,” according to Daniel Wright, Director and National Business Development Manager for ASH, who is “aware of most, if not all mass timber projects Australia-wide, and have an idea about their collective scale,” adding that “availability, per se, is not the problem.”

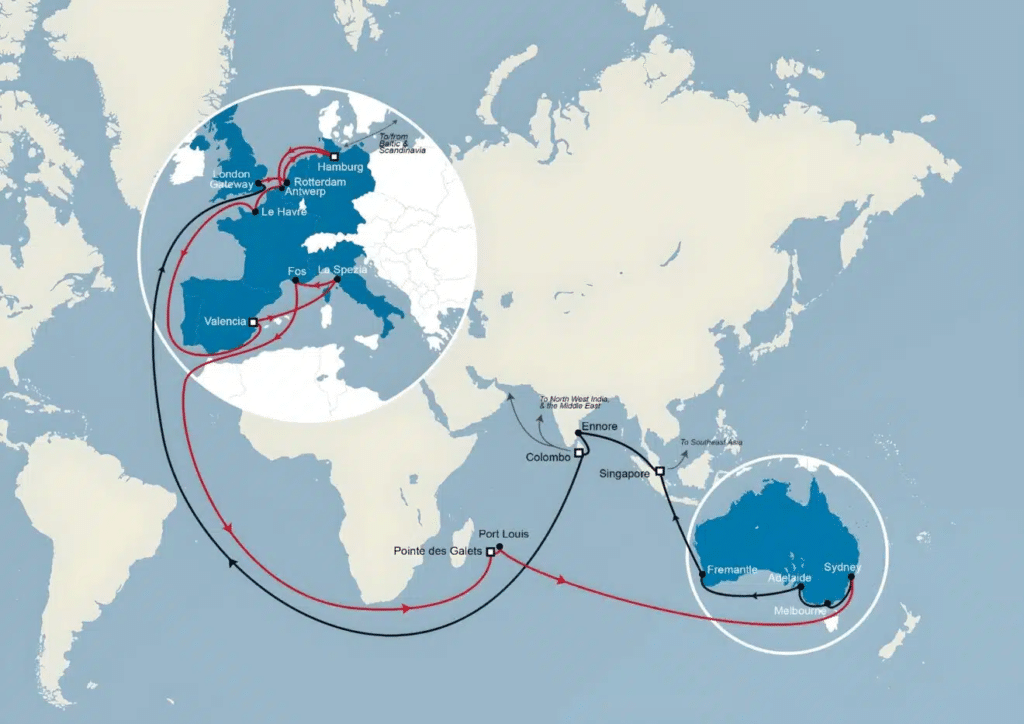

It comes as Wood Central revealed last week that more than 30% of timber imported through Australia’s busiest seaport is at risk of being tied up in the Red Sea conflict – with a Port of Melbourne spokesperson revealing that cross-laminated panels and glulam beams from Central Europe were now circling Cape of Good Hope to avoid the Suez Canal.

The redirection has already seen industries – like furniture – feel the pinch from supply shortages and rocketing freight costs, with Greenlit Brands (which owns Fantastic Furniture and Freedom) warning that consumers could soon be slugged with increased prices due to the conflict.

However, fears, at least in the short term, of a surge in imported mass timber prices due to the crisis appear overstated, with “merchants keeping enough to make up for any short-term supply delays,” according to Mr Wright.

“Experienced installers and builders understand a major benefit of mass timber is in the speed of installation,” he said, before adding that “if mass timber delivery is delayed, it impacts the building’s critical path – so importers have to warehouse timber to overcome this. When you warehouse timber, you must consider all overheads associated with that.”

Nonetheless, importing timber can be a tricky business with several hidden costs and risks (including different priorities, unreliable lead times, damage in freight, commercial risk, as well as location and reaction times) adding to the risks borne by importers “unless you find the right partner,” Mr Wright said, with ASH working with key partners to meet demand.

In recent years, thanks to COVID-19 and the 2021 “Ever Given” crisis, experienced importers have been working on contingencies to reduce global reliance on the Suez Canal for global trade.

“These include diversifying supply sources, being prepared to use alternative shipping routes and onshoring critical manufacturing,” according to Sydney-based UTS Associate Professor Sanjoy Paul, who spoke to SBS News Australia last month.

Meanwhile, Xlam – the first local cross-laminated timber supplier into the Australian and New Zealand markets told Wood Central that the “The freight of CLT from Europe, which often includes the components of an entire prefabricated building, has understandably always been a point of risk from a supply, insurance and emissions perspective.”

Before adding that, this “is one of the reasons XLam was established in Australia to meet the Australian market needs.”

The spokesperson said the company prides itself on being Australian grown from local pine plantations, manufactured in regional Victoria, “employing locals and keeping freight to a minimum,” before adding, “Our design experts are solutions-focused, here on the ground, to provide all the support the client needs to deliver their carbon sequestering building.”

- For more information about the implications of the Red Sea Crisis on Global Timber Supply Chains, including increased shipping times and freight costs, read Wood Central’s special feature.