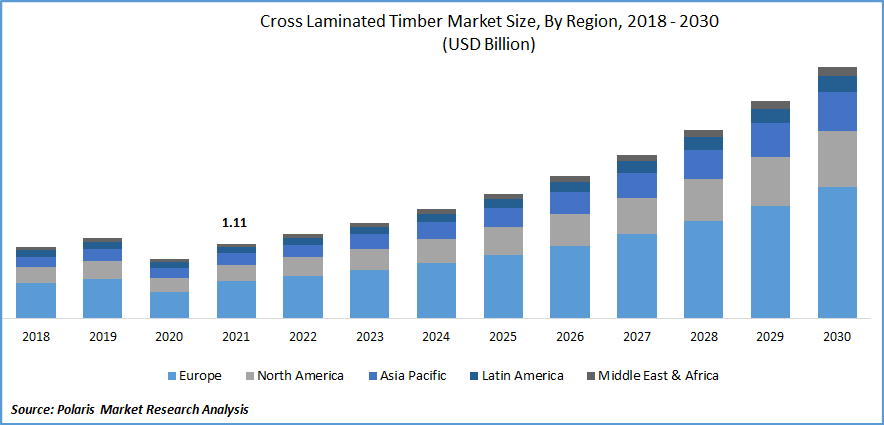

The global cross-laminated timber market (CLT) is expected triple over the next 7 years reaching USD 4.24 billion by 2030 from USD 1.66 billion, according to a new report published by Quince Market Insights.

The report, which uses data from 12 leading CLT manufacturers, forecasts an acceleration in global demand by North America and Europe, with growing demand in the Asia Pacific region fuelled by Australia, Japan, China, and India.

The market is expected to grow at 14.3%, compounding annually, with capital investment in new production plants driving increased production.

In a report published in November 2022, Europe was responsible for 50% of all CLT for 2021, with North America – and the USA more specifically – a trending market due to favourable green building codes.

In the DACH region alone – which includes Germany (D), Austria (A) and Switzerland (CH) – the overall capacity of CLT is expected to reach 2 million cubic metres by the end of this year – an increase from 1.2 million cubic metres in 2021 with the establishment of eight new production plants driving the increase.

By the numbers, Austria has seven CLT manufacturing sites, Germany has three, and Switzerland has two.

Smaller manufacturing sites exist in Finland, Italy, Norway, Spain, and Sweden, with new CLT plants built in Finland, France, Sweden, and the United Kingdom.

Earlier this month, Wood Central reported on the newly inaugurated Sodra CLT plant in Värö, Sweden, one of the world’s newest plants described as “the world’s greenest mass timber facility.”

The new plant can process 100,000 cubic metres of timber annually, which according to Sodra, will result in a ten-fold increase in the company’s CLT production.

In Australia, Timberlink is building a new CLT and Glulam facility, which it expects to be fully operational in October 2023.

The $63 million investment, which follows a $100 million investment in upgrading its sawmill processing facilities, “will increase our productive capacity by about 20 per cent,” Timberlink CEO Ian Tyson told ABC News last year.

“Then the material that is the shorter links will be finger jointed and fed into the new CLT plant.”

In March, Wood Central reported that NeXTimber by Timberlink, along with domestic suppliers Xlam and Cusp, add to more than 20 importers who have serviced the market in recent years – with the Australia and NZ market expecting to exceed 800,000 cubic metres by 2026 according to a report published by imarc last year.

The market in China is also predicted to develop with emerging research looking to integrate locally produced bamboo into the product’s manufacture, making it cheaper than conventional construction materials.

In late 2022, Chinese researchers published new research concluding that Cross-Laminated Bamboo and Timber (CLBT) – a timber and bamboo composite could successfully bind with further research on commercialising CLBT-engineered panels.

According to the report, the residential segment continues to dominate the global market.

Last month, Wood Central reported about Freres Lumber’s mass plywood panels – a veneer-based cross-laminated timber product which oWOW hopes to use in 600 global projects.

Non-residential building applications are also substantial, owing to the widespread use of CLT in constructing office buildings in North America and the Asia Pacific – including Atlassian Central Tower in Sydney, a 39-storey hybrid timber combining steel frames and cross-laminated timber panels.

The use of CLT in commercial construction is also growing throughout Europe, contributing to the rise of the non-residential building market.

For more information, download the report here.