The global supply chain for timber products is being crunched, with sluggish lumber prices, reduced log supply, and rising costs leading Europe and North America’s largest manufacturers to cut back on production. And that’s even before traders grapple with rising fuel costs, a byproduct of the Red Sea Crisis, which is now entering its ninth month, causing merchants and end-users to feel the pinch.

That is according to Lesprom, a B2B marketplace for global wood products, which reports that EU, North American, and even Russian mills are being squeezed out – as stagnant lumber prices continue to erode profit margins across the value chain.

In recent months, experts have reported that the United States is the world’s “best bet for global lumber.” However, despite hopes that a long-awaited housing rebound, which has resulted in massive spikes in plywood entering ports, would stimulate a sluggish global market, the “stop-start” North American construction markets remain soft, with sawmill closures failing to curb the drop to pre-pandemic levels.

“Lumber prices have dropped during the building season, indicating trouble in residential construction and home-improvement markets due to high borrowing costs,” according to Lesprom’s Lumber Industry Insights, echoing Skansa USA’s quarterly report, showing that the American market for wood-based building materials (including lumber, MDF, and engineered wood products) remains sluggish due to the Fed Reserve’s expected rate cuts failing to materialise.

Prices for two-by-fours, a key housing indicator, now flashes alarm!

Two-by-four prices, which skyrocketed during the pandemic, have become a reliable leading indicator of the housing market. However, lately, it has been flashing caution.

According to Lesprom, “lumber futures fell 3% (last week) to $452.50 per thousand board feet, down 27% since mid-March,” whilst at the same time, “cash prices are even lower, with Random Lengths’ framing-lumber composite price dropping to $366, the lowest since May 2020.”

In addition, “Southern yellow pine prices hit lows not seen since the Covid crash, with the Southern pine composite price falling to $335 last week.”

“Two-by-fours were one of the initial assets to decline from their pandemic peaks when the Federal Reserve initiated interest rate hikes in March 2022,” Lesprom said, with “the central bank aiming to cool down the overheated housing market and curb the spending associated with rising property values.”

However, despite hopes that rate easing would help stimulate the industry, persistently sky-high interest rates have left developers struggling to cover the borrowing costs of development, leaving the market to be propped up by government projects and big tech.

Expenses have risen sharply since 2020

At the same time that demand and pricing have stagnated, production costs, from labour to logs, have risen sharply, causing many mills to operate at a loss.

Earlier this year, Russ Taylor Consulting, one of the world’s top forest consultants who, for the past 30 years, has analysed US, Canadian, Russian, Chinese and European timber markets, said the industry is in a state of correction:

“As lumber prices moved below breakeven in some regions in 2023, higher-cost mills were closed, sometimes to rationalise timber supplies around multiple company sawmill sites. Nine sawmills were permanently closed in 2023. So far in 2024 (up to March), three new sawmills have started operating in the US South while nine more sawmills—in all regions of North America, except Eastern Canada—have announced closures.”

Russ Taylor Consulting said US sawmill capacity fell 2% in 2023 due to closures outweighing openings and expansions. Despite Russ Taylor Consulting’s hopes that US housing would rebound, Lesprom reports that new starts fell by 17% between February and May, while building permits for residential units fell to their lowest level since June 2020 in May.

Major sawmills are up for sale, but who is buying?

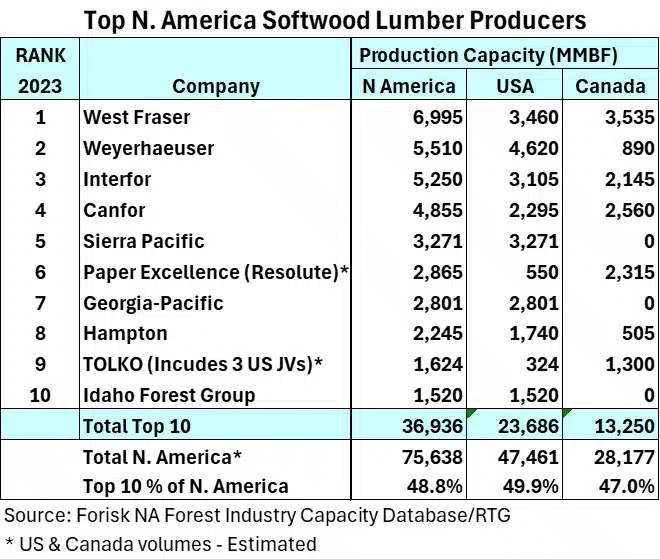

West Fraser—North America’s largest lumber producer—has been exiting high-volume, low-value pulp and lumber assets, including British Columbia and Florida, as well as curtailing production in Arkansas

Whilst the Wall Street Journal (WSJ) reported that Teal-Jones Group, a Canadian firm, filed for bankruptcy protection due to high costs and low lumber prices, putting its assets, including multiple mills, up for sale.

And whilst forest product executives expect prices to rebound once more mills close and supply aligns with reduced demand. They also anticipate that lower interest rates will help revive the repair and remodelling market, which consumes about 40% of lumber.

Speaking to the WSJ, Devin Stockfish, the CEO of Weyerhaeuser, said that many producers operating below cash flow breakeven and cannot sustain this indefinitely.

- To learn more about the global shift from low-value, high-volume products to more flexible, higher-value production, click on Wood Central’s special feature.