“Who would buy a sawmill?” That was the question posed in Wood Central’s article last week, which reported that lumber producers are struggling amid a global slowdown in residential construction.

However, while much of the attention has centred around the sluggish North American market, dubbed the world’s “best bet” for global lumber, and the Chinese market—where thousands of unsold dwellings now remain vacant—India is seen as a growing market for manufacturers and exporters, with a seemingly endless hunger for timber.

That is, until it wasn’t!

However, the rivers of gold could be ending – with Wood Central revealing that India is now cutting back on lumber, signalling a potential false dawn for exporters eying the Indian market as a pivot from China.

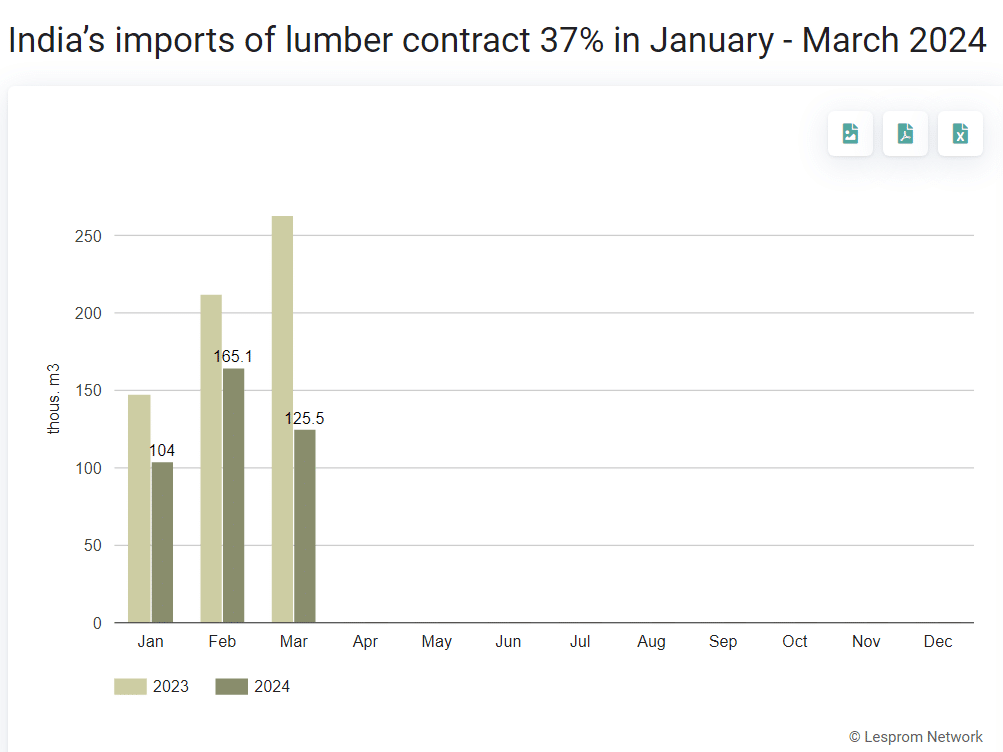

According to data from the Indian Ministry of Commerce and Industry, imports for the first quarter of 2024 were down 37% over the same period last year. Whilst more recent data from April and May (considered off-peak for construction) shows that declining imports continue.

And it’s not just lumber—used in framing, flooring, wall panelling, and window framing, with imports of timber furniture and log imports sinking…and fast!

In essence, traders are taking less timber during the busy construction months (September to March) than in the previous year, which is a massive reversal of the 137% increase between 2022 and 2023.

India—as one of the world’s top 10 importers of wood products—has been flagged as a major growth market producer of roundwood, lumber, and furniture, with the ITTO reporting that roundwood will grow 70%, from 57 million cubic metres in 2020 to 98 million cubic metres in 2030, fueled to a large degree by a surge in construction activity.

According to the Indian Centre for Science and Environment, the country’s 2022 demand for lumber was 63 million cubic metres – 30 million cubic metres for domestic production and 33 million cubic metres from imported sources.

Turning to Australia, New Zealand, Canada, the United States, Brazil, and even Uruguay, Indian importers have been aggressive in the market, dominating export orders. Last year, Wood Central reported that 91% of softwood leaving Australian shores arrived at Indian ports.

India’s housing market is finally showing signs of fatigue.

However, like all good things, India’s hunger for lumber has hit a roadblock – just as its booming real estate market, “its tiger economy” has slowed:

“After steady growth in home sales in India’s top seven markets for over three years, sales of new homes declined for the first time in the April-June quarter,” according to an article in India’s Business Today last week.

According to data from Anarock Property Research, sales in the June quarter fell by 8%—120,340 housing units were sold last quarter, compared to 130,170 in the previous quarter.

Among the key markets, Hyderabad reported the steepest decline – down 23% quarter-on-quarter; this is followed by Kolkata (-18%), Chennai (-9%), Bengaluru (-8%) and Pune (-8%). In the Mumbai Metro Region, the largest real estate market in the country, sales declined 3%.

“This drop is also due to the significant hike in property prices over the last year, which has prompted many investors to take a breather,” said Anuj Puri, Chairman of Anarock Group, who said developers are now pivoting to social and affordable housing.

- To learn more about the Indian economy and its hunger for timber, visit Wood Central’s special feature.