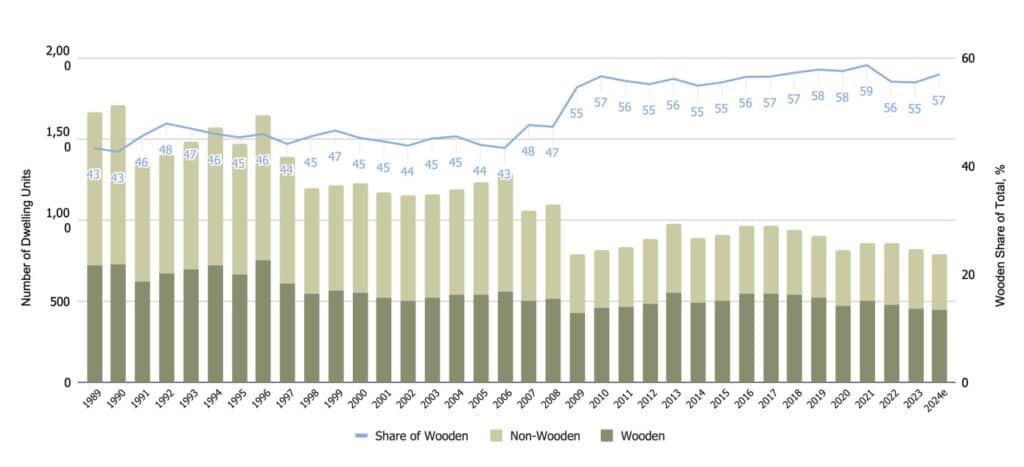

More than 59% of Japanese new houses are now built out of timber, a significant increase over the past two decades (including just 43% of new builds in 2006). However, despite a rise in the percentage of new builds, Japanese house starts are in free fall. The total number of houses almost halved from 1,540,000 in 1994 to just 818,514 last year—and it is expected to dip further again in 2024.

That is according to new data from the Japanese Ministry of Land, Infrastructure, Transportation and Tourism, which reports that new starts fell 0.2% year-over-year to 68,014 units for July, with timber-based construction increasing by 0.7% to 40,420 units.

“Despite a 2.6% increase in housing from June to July 2024, and a 5.4% rise in wooden housing starts, the year-to-date figures show a decline,” according to Lesprom Analytics, which presents global trade data:

“From January to July 2024, total housing starts decreased by 3.9%, all the while wooden housing declined by 1.6%. In effect, the annualised rate of housing starts for the period stood at 787,033 units, a 4% decrease from 2023 and a 12% drop from the 10-year average.”

The latest data comes after Wood Central last month reported that China’s housing market was collapsing, with concerns that the world’s largest economy (by GDP size) could follow Japan (which last year conceded its position as the third-largest global GDP to Germany) into a multi-decade economic malaise.

“This should be a wake-up call for Chinese economic policymakers. It should be viewed as confirmation that the Chinese economy is in deep trouble and that its economic growth model is now well past its sell-by date,” according to Desmond Lachman, an expert in macroeconomic policy.

“Unless the Chinese government introduces major structural economic reforms that encourage domestic consumer spending, China could experience a Japanese-style lost economic decade,” Mr Lachman wrote in the equity markets publication Seeking Alpha in June.

Japan’s woes come after new calculations show that long-abandoned homes in Japan are lowering the values of surrounding properties, with losses reaching $ US24.7 billion over the five years to 2023.

Wood Central understands that the number of abandoned homes not for sale or available for rent increased by 360,000 units between 2018 and 2023 to about 3.85 million units, with 70% of the dwellings being detached, single-level family homes.

“Our estimate was limited to the impact of abandoned single-family houses on land prices,” said Teppei Kawaguchi, CEO of Crassone, who has led a consortium calculating the value of the abandoned homes. “The actual negative impact may be even greater.”

The decline comes as the Japanese government has introduced a suite of new reforms and policies aimed at rapidly increasing the amount of timber from local cedar trees to help stimulate its housing industry.

Pushed by Japanese Prime Minister Fumio Kishida, the policies include cutting pollen-producing cedar trees near major urban centres and widening “Specified Skilled Worker 1” visa requirements to include “forestry” and “timber workers.”

Under the new changes, which came into effect in May, foreigners will be eligible for a skilled worker visa, thus facilitating their pathway to full-time worker migration rights, which are notoriously difficult in the country.

Encouraging, but at the same time not a problem fix for its woes is a surge in demand for Japanese high-rise timber buildings. Late last year, Wood Central reported that planning officials received 36 applications for mid-rise or high-rise timber structures for 2022/23, more than double the previous year.