Australia’s second-largest hardware retailer is muscling in on the timber frame and truss market after Metcash acquired Alpine Truss, one of the country’s largest manufacturers, as part of a $558m mega buyout of Superior Foods and South Australia-based Bianco Construction Supplies.

The latest acquisition now elevates Metcash, as it competes with Coles, Woolworths and Wesfarmers’s Bunnings chain to create a conglomerate across food, liquor and hardware – as part of greater network expansion.

It comes after Wood Central reported in December that Metcash, through its Independent Hardware Division (IHG), was expanding its footprint in timber supplies and hardware to compete with Bunnings.

The push comes at a time when Bunnings, which has a more than 50% total market share of the Australian hardware and DIY market, has invested heavily in the frame and truss to capture an even greater share of the commercial “wholesale” market.

Bunnings makes up 50% of Wesfarmers’ $45.6 billion revenue, with a new 5-year plan implemented earlier this year as part of a push to grow its commercial business to offset fluctuations in the retail market.

According to Metcash Group CEO Doug Jones, the acquisitions were strategically aligned, synergistic and financially compelling, with Metcash expecting them to create cost savings of $19 million annually.

“The acquisitions unlock substantial shareholder value and build on our track record of disciplined and accretive capital allocation,” he said overnight, adding that “they also deliver further diversification and resilience to the group and provide Metcash with an even stronger growth trajectory.”

The Bianco Construction Supplies ($82 million) and Alpine Truss ($64 million) bolster the business’s growing footprint in the timber-based building supplies market.

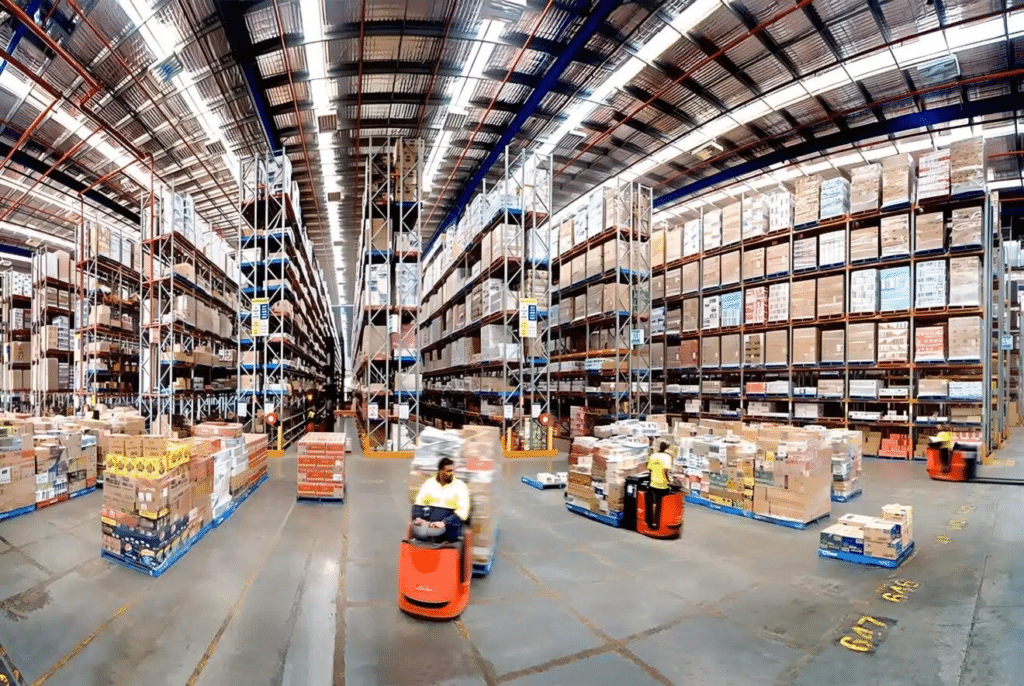

Already, Metcash operates 1500 brick-and-mortar stores under its Mitre 10, Home Timber & Hardware and Total Tools brands and is circulating a buyout of HBT and its 940 “proudly independent” retail stores nationwide.

Hardware is an opportunity for Metcash, providing the conglomerate with a hedge against food (through IGA, Foodland and now Superior Food) and liquor (including Celebrations, IGA liquor and Bottle-O).

In September, Wood Central reported that Bunnings – Metcash’s greatest rival in the Australian timber supplies market, was investing up to $75 million in developing “mega” timber fabrication facilities in Victoria, NSW and QLD, which will see it become Australia’s largest truss manufacturer.

The new facilities will use robots to assemble and nail-plate the A-frame trusses, which IndustryEdge Managing Director Tim Woods said represents a “massive rationalisation” in the residential construction industry.

“The largest participants in the market are making the next logical step, and it could be that some of their thinking is getting ahead of a global trend toward entire houses being built inside factories,” Mr Woods said.

Alpine Truss manufactures and supplies roof trusses, wall frames, and flooring systems to buildings across Victoria and NSW. Bianco Construction Supplies has a network of stores supplying door frames, doors, fasteners and sawn timber from 8 stores across South Australia and the NT.

According to Mr Jones, both align “align completely” and are “highly complementary” to Metcash’s broader hardware strategy, which includes broader customer offerings, higher market share and greater network expansion.