New Zealand’s timber manufacturers are feeling the pinch, with mils reporting “very low forward orders, indeed worse than last year,” with demand from Australia “also very low.” And despite sales of sawn wood picking up in Asian markets – namely China and India, New Zealand cannot sustain a sawmill industry without a solid domestic market.

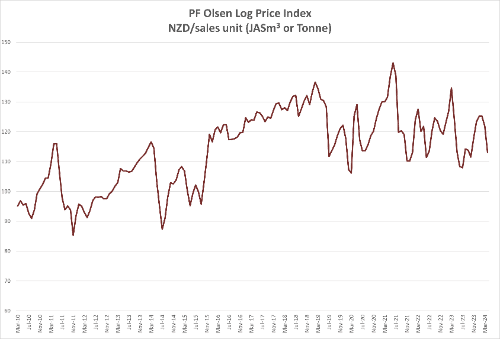

That is according to Scott Downs, PF Olsen’s Director of Sales and Marketing, who said, “NZ saw millers predict that 2024 will be tougher than 2023.” This is reflected in the latest PF Olsen Log Price Index, which dropped $9 to $113 for April—”this is $6 below the two-year average and $8 below the three- and five-year average.”

Last month, Mr Downs reported that more than 85% of logs jamming Chinese ports were NZ radiata pine – and while daily take-off has now increased from 60,000 to a healthy 75,000 per day, “market sentiment, however, remains weak with virtually everyone in the supply chain in China still struggling to consistently make a profitable margin.”

“This increase in log buying seems to be more of a reaction to wholesalers dropping prices rather than a fundamental increase in demand.”

For April, log volumes from NZ to China dropped 25%, with volumes expected to drop even more in May—with prices bottoming out in the US $110-116 range. The volume drop is due to a combination of factors: ” wetter Autumn weather slowing down harvest, harvest jobs stopping or slowing due to price levels, volumes now being sold in India, and less volume from windthrow.”

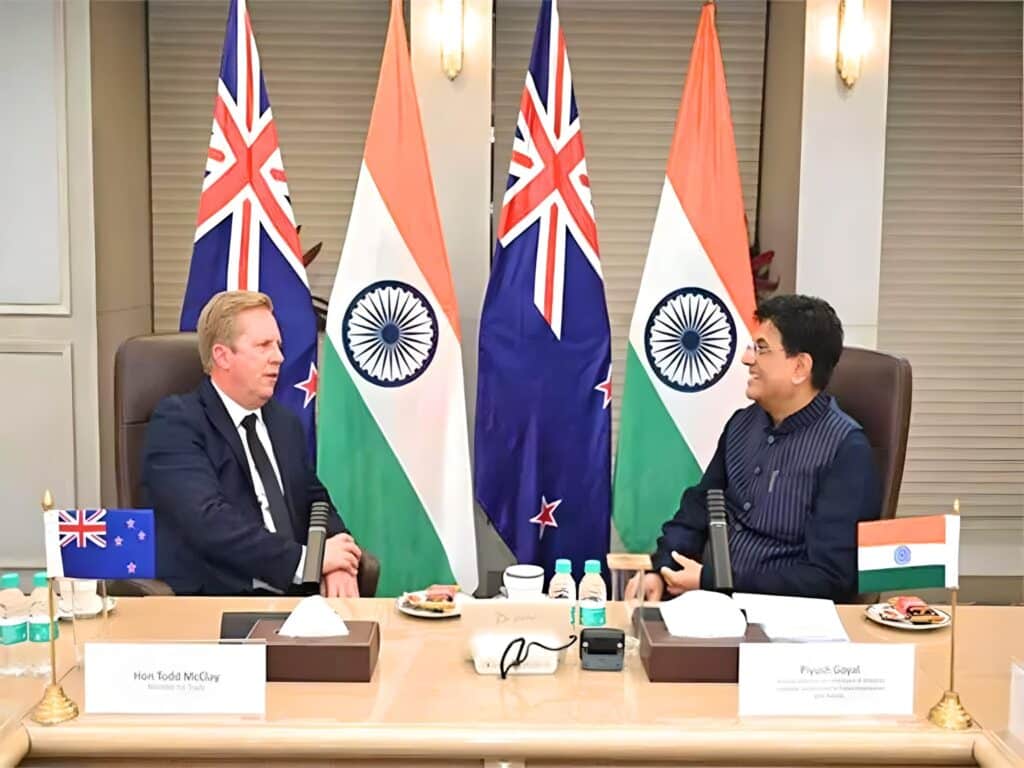

According to Mr Downs, NZ exports to India – restored after both countries tackled the long-running Methyl Bromide dispute – will grow as India (and Australia) capitalise on fumigation issues in South Africa, freight price disputes in South America, supply chain disruptions in the US and increased log prices in European markets.

“Indian demand for pine logs is expected to increase in Quarter 3, as the Parliamentary election results will be declared on June 4, and the new Central Ministry will be formed after that,” Mr Downs said, adding that “Labourers will return to sawmills from villages after voting, so production improves.”

Adding to costs for NZ exporters, “shipping costs from the North Island (of NZ) to China is now in the high 30’s USD per JASm3, with Supramax cargoes above 40 USD.” And whilst the Baltic Dry Index (BDI) has trended downwards, “this is heavily influenced by a reduction in demand for the larger vessels.” “The costs for smaller vessels such as Supramax have increased against the trend.”

- To learn more about the NZ market, download the latest “Log Market” from the PF Olsen website.