A Hong Kong court has ordered the world’s most indebted property developer, Evergrande, to liquidate in a decision that will test the mettle of the Chinese property industry – long considered the engine room of the world’s second-largest economy.

The move could send shockwaves through fragile Chinese capital and property markets – responsible for more than 25% of China’s GDP. Given the many authorities involved, such a process could also be complicated, with potential political considerations.

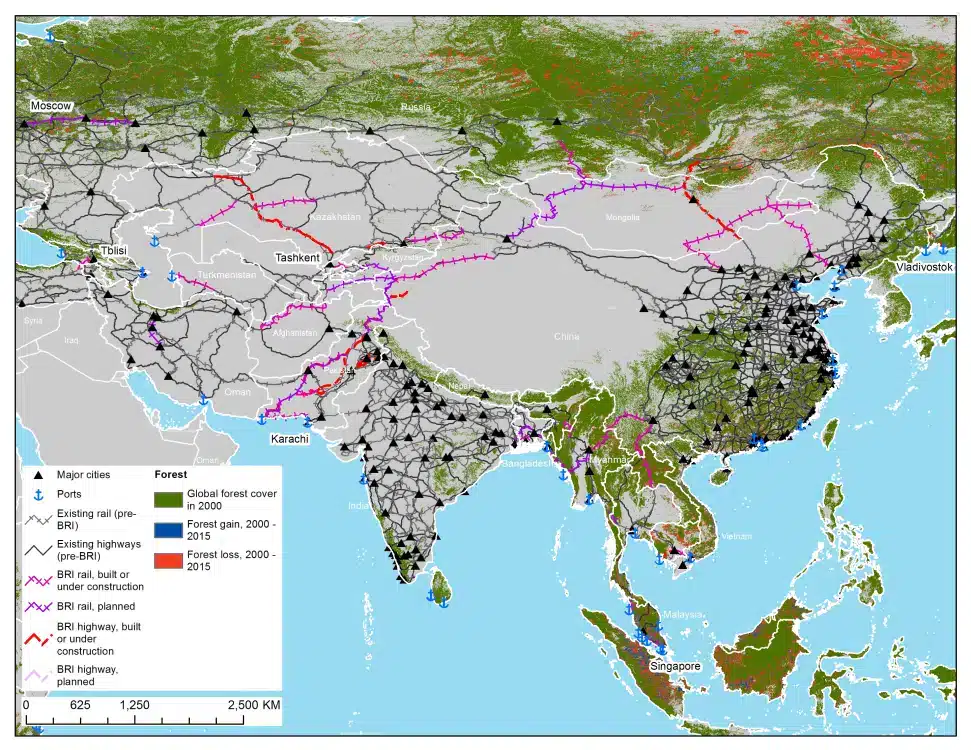

It comes as Wood Central reported in November that a slump in the country’s real estate market, which has played havoc in global log export markets, may spill over into the $3 trillion “shadow banking” sector – now bankrolling its controversial belt and road projects.

The decision, which has yet to be recognised by Chinese courts, comes just months after the company entered into talks to restructure more than US $300 billion (or AU $455 billion) in liabilities, including more than the US $25 billion owed to overseas investors.

Yesterday, Hong Kong High Court Judge Linda Chan issued the liquidation order after the company failed to develop a restructuring plan to satisfy its international creditors.

“It would be a situation where the court says enough is enough,” Judge Chan said before adding, “I consider that it is appropriate for the court to make a winding-up order against the company, and I so order.”

According to CNN, the court has appointed Alvarez and Marsal, who will now manage the Hong Kong affairs of the real estate conglomerate – once considered the poster child for new China.

It will now have powers to seize Evergrande assets in Hong Kong — such as the group’s office tower located in the commercial district of Wan Chai — and sell them to raise funds. Still, the implications for the company’s vast business in mainland China are unclear.

According to Evergrande’s CEO Xiao En, the liquidation order would not affect the operations of subsidies that are “independent legal entities,” including its main property development business, Hengda Real Estate Group, based on the Chinese mainland.

“At present, the management and operation systems of Hengda Real Estate Group and other domestic and overseas subsidiaries as independent legal entities remain unchanged,” he told 21st Century Business Herald.

That’s because the legal systems of Hong Kong and China remain distinct despite Beijing’s growing control over the former British colony in recent years.

“Today’s liquidation order will have minimal immediate impact on Evergrande’s onshore operations or assets,” according to Brock Silvers, chief investment officer for Hong Kong-based Kaiyuan Capital.

And whilst Hong Kong and the mainland city of Shenzhen — where Evergrande is based — have a mutual insolvency recognition agreement, it’s “effectively inoperative”, and courts in the town are “extremely unlikely” to recognise the offshore liquidator.

“To do so would threaten the availability of Evergrande’s onshore assets to resolve its onshore obligations. Onshore, tomorrow will be much like Evergrande yesterday,” Mr Silvers said.

Nonetheless, many have speculated that the ongoing instability and uncertainty around the real estate market could wreak havoc on global supply chains for building products – including timber, which have fuelled the country’s real estate boom.

Already, the Reserve Bank of Australia has warned that problems stemming from the “sharp deterioration” in China’s property sector could lead to a global slowdown, weaker commodity prices and “reduced Chinese imports of Australian goods and services”.

Last year, the Chinese government introduced new policies, capitalising on its position in the global supply chain of timber products to stimulate the real estate industry. The rise in demand for timber, according to the Chinese government, “can be attributed to the increased construction activity in China’s real estate sector.”

“Whilst Evergrande’s offshore liquidation was expected, it’s still a significant setback for an already troubled onshore real estate sector, which will further decay investor sentiment,” Mr Silvers said.

Chinese developers face $100 billion in maturing obligations this year, and local governments’ financing arms also have $650 billion worth of debt due.

Already, Country Garden – China’s largest real estate developer has run into trouble, whilst Zhongzhi Enterprise Group, a wealth management conglomerate with interests in timber, healthcare, new energy vehicles and finance, collapsed late last year.

“Given these impending solvency issues, Evergrande’s creditors will likely face a near wipe-out. All of which contributes to the current crisis of confidence in China’s capital markets,” Mr Silvers added.

- For more information, visit Wood Central’s special features on China’s Belt and Road Initiative, the $3 trillion shadow banking industry now fuelling global supply chains and the lessons learned from the $100 billion “Forest City” disaster.