Sweden is the latest casualty of the Red Sea crisis, with the fourth largest exporter of pulp, paper, and sawn wood warning that Asia-Pacific consumers should brace for shortages, delays and inevitable price hikes.

Wood Central revealed last month that the global timber supply chain is one of the most impacted by the conflict, with “bulky” containers filled to the brim with timber driving trade between Europe and Asia-Pacific through the Suez Canal passage.

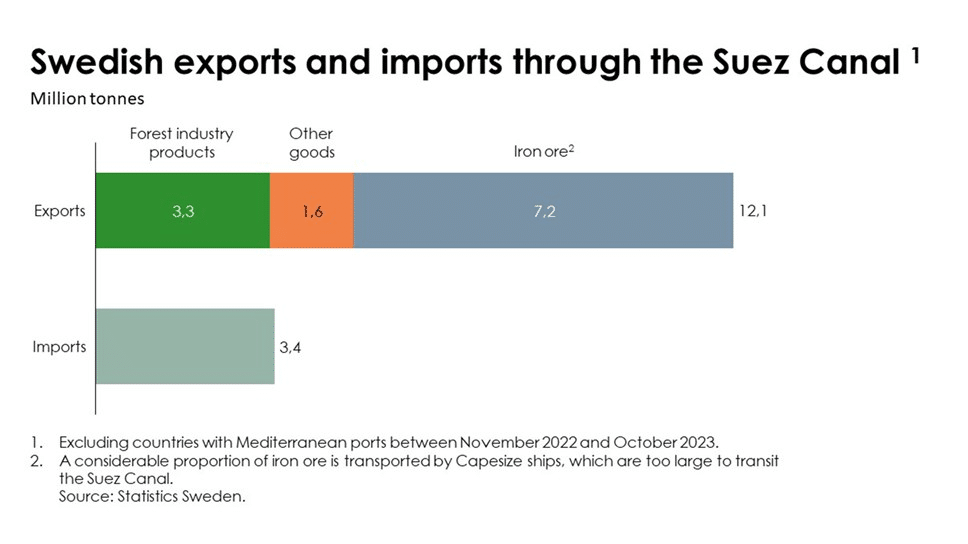

By the numbers, Sweden exports more than 80% of its forest products to international markets (with more than US $16.8 billion in sawn timber exports alone). Christian Nielson from Swedish Forest Industries warned that the conflict will take a toll on the besieged industry.

“Our industry is the single largest transport buyer of container freight from Sweden via the Suez Canal. With costs surging by 100-200% (243% as reported by Wood Central last week), we are bracing for potential container shortages, delays, and disruptions,” Mr Nielsen said before adding that alternative shipping routes via the Cope of Good Hope will only exacerbate inflationary concerns.

And despite the overcapacity of containers and vessels, which to date have kept freight costs at “unusually low levels”, Mr Nielson is wary that the longer the conflict continues, the more significant the impact on supply and pricing at the end of the shipping line.

“The situation may lead to cost increases and heightened uncertainty, not just for our industry but also for our customers.”

He said producers are now busy negotiating with customers to share increased shipping costs, which has already seen the world’s second-largest freight company by volume, CMA CGM, announce that it would double its rates for shipping from Asia to Europe due to the conflict.

Further impacting Swedish imports are deteriorating economic conditions, leading to falling European product prices and higher production costs.

“Margins are under more pressure than usual, which could severely impact individual deliveries during this period,” Mr Neilson said before adding that the conflict could benefit European paper suppliers competing against low-cost Asian producers.

Already, one of Australia’s largest furniture outlets – Greenlit Brands – has warned that customers should prepare for supply shortages and price increases as producers and shipping companies look to recover costs due to the conflict.

As it stands, more than 40% of Asia-Europe trade travels through the passage, with ships shunning the passage adding up to $1 million in fuel and up to 30 days to round trips.

In Australia and New Zealand, more than 20% of bulk imports and exports connect to Europe, and blockages in the global shipping system are already impacting food, clothing, and furniture.