A decrease in dwelling consents has resulted in a slowdown in residential construction activities and price growth in New Zealand, according to the latest Cordell Construction Cost Index (CCI), as reported by NZ Advisor.

According to the report, construction costs rose 0.6% in the June quarter, aligning with the figures from the previous quarter.

However, these numbers were significantly lower than the average quarterly increases of 2% recorded in both 2021 and 2022.

The annual rate of change in the Consumer Price Index (CPI) declined to 6.4%, still above the decade average of 4.5%, but an improvement compared to the peak of 10.4% observed in late 2022.

This year, dwelling consents fell by 10% to less than 46,000, according to the CCCI June report.

Kelvin Davidson, the top property economist at CoreLogic, noted that the current consent remained substantially higher than the post-GFC numbers – 14,000.

“Although we’re also seeing the actual volume of building work start to drop, the construction industry is still busy as it works through the pipeline of previously approved consents,” Mr Davidson said.

“The widely anticipated slowdown in consents has alleviated some pressure on the construction materials supply chain in recent months while also slightly reduced workloads for builders, which means that the cost growth isn’t as intense as it was in 2022.”

Throughout 2023, the quarterly rate of increase has averaged around 0.6%, a drop from the 2.5% average experienced last year.

In terms of materials, Davidson said timber prices had stabilised in 2023, with structural timber costs declining.

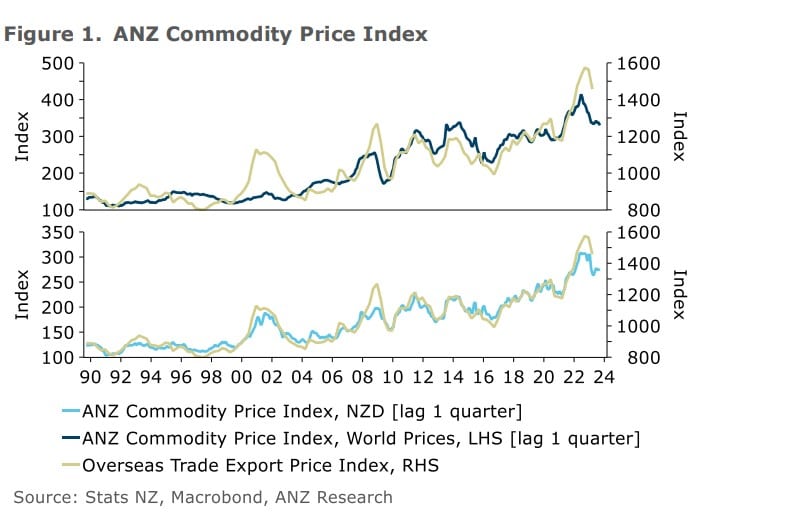

This supports data published by ANZ last week showing weak structural timber prices owing to a softening Chinese export market.

Whilst ASB Bank last month predicted a “timber tantrum” with slower export demand and softening local demand due to higher interest rates, low population rates and a less acute housing market.

Meanwhile, metal prices also experienced a decline in pricing, with recent drops in structural steel costs.

However, implementing the H1 energy efficiency and insulation standards in May could increase the overall cost of a standard build by approximately 3% to 5%, Davidson said.

“It’s possible that the overall CI may have slowed even further in Q2 had it not been for the new roof, window, wall, and underfloor insulation building code changes,” he said.

Davidson projected a further decline in the number of new dwelling consents, resulting in ongoing moderation of workloads over the next two to three years as construction projects in the pipeline reached completion.

He added that the ease in demand and increased builder capacity would help restrain construction costs. However, the impact of migration flows on labour supply requires close monitoring.

“The expectation is the quarterly rate of change in the CI will continue to grow around 0.5% for the rest of 2023, taking the annual change to less than 3% by the end of the year,” Davidson said.

“That’s not going to mean the cost to build a new home is going to be cheaper, but it does reassure buyers that costs won’t increase at the same rapid rate we’ve experienced in the past two years.”

- Download the latest Cordell Construction Cost Index (CCI) report from CoreLogic.