China’s demand for unprocessed timber is in structural decline, with new data from China Customs revealing that the world’s largest timber market took just 3.63 million cubic metres of logs in May— continuing a long-term drop in imports over 18 months.

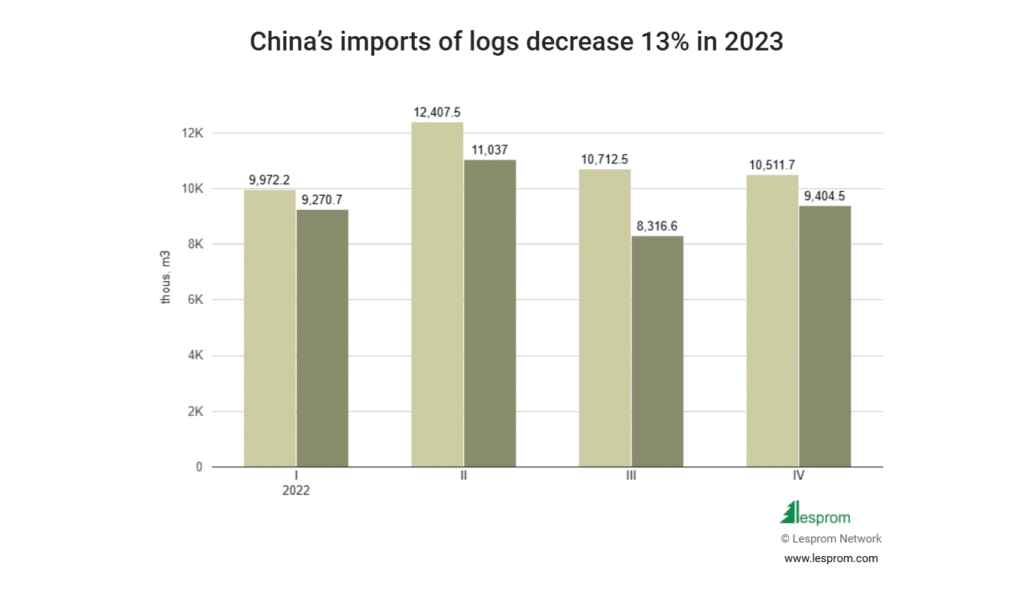

It comes as China’s take-up of logs is down 6% (from 9.404 million cubic metres to 8.851 million cubic metres) for the December to March quarters, with log demand down 13% – from 42.97 million to 38.03 million cubic metres – for the 2022 and 2023 calendar years.

At the same time that log imports soften, “China’s log inventory (at its mega ports) continues to reduce slowly, and daily port off-take remains around 70,000 per day,” according to Scott Downs, Sales and Marketing Director for PF Olsen, who said that exporters are continuing to be stung from increased freight costs, amid ongoing congestion in the global shipping network.

Why is China taking fewer logs?

According to Rudolf van Rensburg, the co-author of China – Forest, Log & Lumber Outlook,” a 197-page report produced by Russ Taylor Global and Margules Groome Consulting, it’s unlikely that the volume of Chinese log imports will return to past levels, “with China pivoting from logs to lumber amid a global scramble for a declining amount of global logs.”

“We expect that Chinese lumber exports will grow, offsetting the decline in log exports amid a ban on log exports from Ukraine and Russia, bark beetle infestations in Europe, and a slowdown in NZ harvesting,” he said.

As it stands, China is New Zealand’s (as well as Australia’s) most important log market, with more than 89.2% of radiata pine logs (in April) that left NZ processed through China’s ports—ahead of South Korea at 4.7%, India at 3.5%, and Japan at 1.2%.

At the same time, New Zealand is also China’s most crucial import market, with China Customs data showing that more than half of all logs processed at ports were from New Zealand (51.1%), ahead of PNG (6.5%), the United States (5.7%), Russia (5.3%) and the Solomons (4.7%).

In March, Wood Central reported that China is now addressing its “supply gap” (at least in hardwoods) and, thanks to more than 40 years of policy development, is rapidly boosting plantation establishment to attain its long-term goal of “wood product self-sufficiency.”

At the same time, it is investing massively in Oriented Strand Board (OSB) and particleboard, with Wood Central last week revealing that more than 50 new plants are under construction.

Whilst log exports remain low, China Customs reports that timber furniture exports grew 27% year-on-year in May to 41.4 million pieces, with the export value rising 9.8% to US $2.12 billion. Plywood exports also increased by 9.5% year-on-year to 993,000 m3, with a 4.6% rise in value to US $441 million.

Steel exports also reached 9.6 million tonnes, the highest monthly total since 2016, with China’s extremely soft housing market leading steel exporters to seek overseas markets to make up for collapsing local demand.

- Download the report to learn more about the Chinese forest economy and its impact on the global supply chain for timber and forest products.