Russia and Belarus are ramping up timber exports to Uzbekistan amid fears the former soviet state could act as a new trading post for conflict timber entering global timber supply chains.

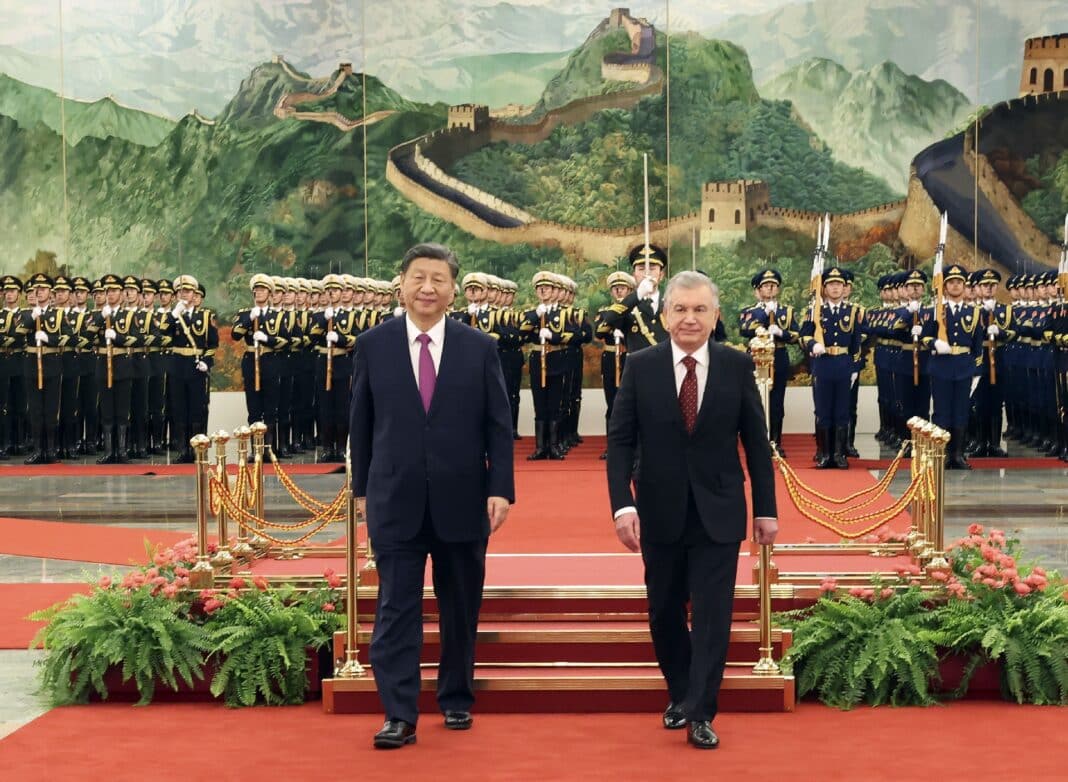

It comes as Uzbekistan is spending billions on new rail, road and sea infrastructure, funded by China’s Belt and Road Initiative, forging new pathways for timber to infiltrate global supply chains.

Already, Uzbekistan is Russia’s second-largest importer of softwoods, with 480,000 cubic metres of timber (or 11% of its total imports) imported into the country every quarter – in what is a significant escalation in trade since the start of the Russian invasion of Ukraine.

It comes as Wood Central reported in July that a block of ten countries – including Uzbekistan as well as China, Kazakhstan, Belarus, Iran, Kyrgyzstan, the United Arab Emirates, Azerbaijan, and Tajikistan – is fueling a booming trade of conflict timber bypassing western sanctions.

Now, Uzbekistan is strengthening ties with Belarussian timber, pulp and paper suppliers, with the government building on a trade that doubled last year.

In recent years, Uzbekistan has ploughed billions into constructing the Angren-Pop railway – 169km, which includes the longest tunnel in Central Asia, with the country looking to develop trading corridors and, in time, direct sea roots throughout the region.

The infrastructure is critical, according to Sodiq Safoyev, the country’s former First Deputy Chair of the Senate, with rail providing the most economical mode of transportation to grow the trade routes.

“It’s no coincidence that over US $7 billion have been spent,” he said.

One of just two double-landlocked countries, Uzbekistan has built a railway to Mazar-e-Sharif in Afghanistan and is cooperating with other countries to extend this to the Persian Gulf and the Indian Ocean.

A byproduct of heavy sanctions imposed by Western Countries, Russia and Belarus are turning to China, South Korea and the Middle East to replace relationships with “unfriendly economies.”

Since March 2022, trade between Russia and the EU – once the bloc’s fifth largest trading partner has slowed to a crawl, creating a $3 billion hole in Russia’s timber trade.

At the same time, FSC and PEFC – the world’s two largest forest certification schemes, suspended certificates, making it impossible to trade certified Russian (and Belarussian) products in global markets.

And whilst trade has slowed by more than 33% over the past year, conflict timber is still finding a way into global markets despite sanctions to curb timber revenue – making up at least some of the difference in supply.

One of the world’s largest exporters of cotton and gas to liquid energy, Uzbekistan has, for more than 30 years, cultivated an export market for plywood, sawn wood, woodfuel, round wood and paper – traded into China, Azerbaijan and Singapore.

The push into Uzbekistan comes as Russia and Belarus look at strengthening already strong ties with Eurasian partners, more specifically China (which takes 85% of Russian-sawn wood) and Turkey,

In November, Wood Central revealed that Russia’s Komi region – home to the largest virgin forest in Europe was working with Shanghai trading companies to boost the region’s trade with China – which now stands at 85% of all Russian sawn-wood exports.